Canadian automotive insurance coverage in usa – Canadian automotive insurance coverage within the USA presents a posh panorama for drivers crossing the border. Navigating the intricacies of US rules alongside Canadian insurance coverage insurance policies calls for cautious consideration. Drivers want to know the nuances of protection, authorized necessities, and potential price variations. This in-depth exploration clarifies the complexities, serving to Canadians make knowledgeable choices when insuring their autos to be used in the US.

From evaluating protection ranges and premiums to understanding accident claims procedures, this complete information empowers Canadians to confidently navigate the method. This information examines the various choices, from using Canadian suppliers to choosing US insurers, to make sure seamless and cost-effective protection whereas on American roads.

Overview of Canadian Automotive Insurance coverage within the USA

Yo, you Canucks lookin’ to cruise stateside? Sorted insurance coverage in your trip is vital, ‘trigger the US ain’t precisely a pleasant zone for overseas plates. Navigating the insurance coverage panorama can get a bit murky, so let’s break it down.Driving a Canadian-registered automobile within the USA is a little bit of a hoops recreation. Completely different states have completely different guidelines, however usually, you will want proof of monetary accountability, like a US-issued insurance coverage coverage.

Failing to conform can land you with hefty fines and a possible boot in your automotive. You are not simply by yourself, you gotta ensure you’re coated.

Authorized Necessities for Driving within the USA

The authorized hoops for driving a Canadian automotive within the US contain demonstrating proof of monetary accountability, typically a US-based insurance coverage coverage. Which means in case you trigger an accident, you are coated and you are not leaving the state with an unpaid invoice. It is the legislation, and it is best to be on the fitting facet of it.

Challenges in Buying Insurance coverage

Canadians typically face challenges discovering insurance coverage for his or her automobiles pushed within the US. The insurance policies in Canada typically do not prolong to US territory, that means you are uncovered. Completely different protection ranges and insurance policies, to not point out various charges, make the choice course of a bit extra of a maze. US insurers might need completely different standards for assessing danger, which might have an effect on your premiums.

Sorts of Insurance coverage Choices

There are numerous insurance coverage choices tailor-made for Canadian-registered autos within the US. A normal coverage covers legal responsibility, which is essential for authorized compliance. Complete protection can be an choice, defending your automobile in opposition to injury from numerous perils, like accidents or theft. Collision protection is one other selection, paying for injury to your automobile if it is concerned in a crash, no matter fault.

Bear in mind, these choices aren’t simply in regards to the fundamentals, however in regards to the peace of thoughts that comes with figuring out your trip is protected.

Premium Comparability

| Protection Degree | Canadian Insurer Premium (Instance) | US Insurer Premium (Instance) |

|---|---|---|

| Legal responsibility Solely | CAD $500 – $1000 | USD $600 – $1200 |

| Legal responsibility + Complete | CAD $800 – $1500 | USD $1000 – $1800 |

| Legal responsibility + Collision | CAD $1000 – $2000 | USD $1200 – $2500 |

Observe: Premiums are estimates and may fluctuate considerably based mostly on elements like automobile sort, driving historical past, and site. This desk offers a normal concept of the potential worth variations.

Insurance coverage Choices for Canadian Drivers

Proper, so you are a Canuck cruising Stateside. Insurance coverage ain’t precisely a breeze if you’re on the opposite facet of the border. You gotta know the ropes to keep away from getting nicked by hidden expenses and awkward conditions. That is your information to navigating the American insurance coverage maze.This part dives deep into the assorted insurance coverage choices out there for Canadian drivers within the USA.

We’ll cowl the professionals and cons of utilizing Canadian insurers, the method of getting protection from US corporations, and the prices and advantages of every method. Plus, we’ll take a look at any potential limitations on protection.

Utilizing Canadian Insurers for US Automobiles, Canadian automotive insurance coverage in usa

Canadian insurers typically supply insurance policies that cowl autos within the USA, however it’s kind of of a minefield. They may not supply complete protection, particularly in case you’re out on the open street, and protection ranges is perhaps decrease than what US corporations supply. It is typically a less expensive choice in case you stick with the identical metropolis or state you’re accustomed to, however there is a catch.

Some insurance policies have limitations, like decrease payout quantities or exclusions for particular US states or areas.

Acquiring US Insurance coverage for Canadian Automobiles

Getting US insurance coverage for a Canadian-registered automobile is usually easy, although it would include the next premium than in case you used a Canadian firm. You may often want to supply proof of car registration, proof of possession, and doubtlessly, your driving file. Some corporations have particular necessities for autos imported into the US. A superb tip is to buy round with numerous US insurance coverage suppliers, as charges can fluctuate.

Price Comparability: US vs. Canadian Insurance coverage

US insurers typically cost increased premiums than Canadian insurers for Canadian-registered autos, however they may supply extra complete protection, particularly for autos used within the US. Think about the overall price, together with premiums, deductibles, and potential claims. Canadian insurance coverage may appear cheaper initially, however the next declare might eat into your financial savings in case you’re not cautious. It is all about discovering the candy spot.

Protection Limitations of Canadian Insurance coverage within the USA

Canadian insurance policies would possibly exclude sure states or areas, have limits on legal responsibility protection for US accidents, or have decrease protection limits in comparison with US insurance policies. At all times verify the advantageous print, and do not assume protection is identical throughout all US states. Be sure to perceive the boundaries and exclusions earlier than hitting the street.

Desk of US Insurers Catering to Canadian Drivers

| Insurer | Execs | Cons |

|---|---|---|

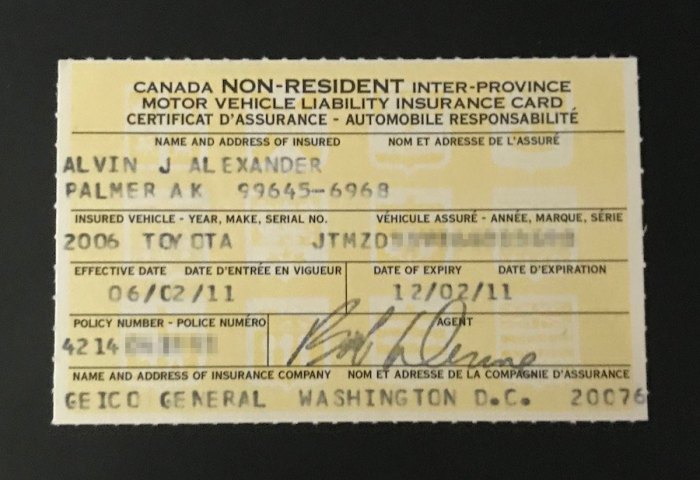

| Geico | Well known, typically aggressive charges. | Might have increased premiums for non-US residents. |

| State Farm | Robust native presence, recognized for customer support. | Charges would possibly fluctuate based mostly on the particular automobile and driver profile. |

| Progressive | Digital platform, user-friendly on-line providers. | Potential for increased premiums in comparison with different insurers, particularly for particular autos. |

| Allstate | Intensive community of brokers and declare facilities. | May have much less aggressive charges in comparison with different insurers. |

| Liberty Mutual | Good buyer opinions, versatile insurance policies. | Would possibly require further documentation to verify driver standing. |

Elements Affecting Insurance coverage Prices

Insurance coverage in your trip throughout the pond could be a proper ache within the neck. Understanding the elements that inflate these premiums is vital to getting the perfect deal. Understanding what’s driving up the price will enable you navigate the murky waters of US automotive insurance coverage, particularly in case you’re coming over from Canada.

Automobile Sort and Worth

The kind and worth of your motor are a significant component within the price ticket. A souped-up sports activities automotive, or a traditional classic trip, often comes with the next insurance coverage premium in comparison with a primary household hatchback. That is typically as a result of perceived danger of harm or theft, in addition to the potential restore prices. Insurance coverage corporations assess the automobile’s market worth, its make, mannequin, and 12 months of manufacture to estimate potential restore prices.

Driving Historical past

A clear driving file is a large plus. When you’ve received a historical past of accidents or violations, your premiums will seemingly be increased. This is not nearly US driving infractions; Canadian driving information are additionally factored in. Insurance coverage corporations take a look at each your Canadian and any potential US driving historical past when calculating your danger profile. A clear slate is your greatest guess for decrease premiums.

Location and Utilization

The place you park your trip and the way typically you employ it matter. Excessive-crime areas usually have increased premiums as a result of elevated danger of theft or injury. Insurance coverage corporations typically take into account the placement of your garaging and the frequency of use. When you primarily drive brief distances, your danger is decrease than somebody who commutes lengthy distances day by day.

Claims Historical past

A historical past of claims can dramatically enhance your premiums. Whether or not it is a fender bender or a complete loss, earlier claims sign the next chance of future claims. A declare historical past can stick with you for years, even after the accident is settled. So, a clear historical past is important.

Cost Methodology and Reductions

Insurance coverage corporations typically supply reductions for paying premiums on time and in full, for instance, via automated funds. These reductions can fluctuate relying on the supplier. Reductions are additionally out there for secure driving habits, anti-theft gadgets, and even for sure memberships. It is price investigating these reductions to see in the event that they apply to you.

Comparability of Canadian and US Accident Claims Processes

The declare course of within the US and Canada can differ considerably. Canadian accident claims are often extra easy, with clear processes and procedures. Within the US, the method can generally be extra complicated, with a wider vary of things to contemplate, from authorized illustration to third-party involvement. A Canadian driver could need to familiarize themselves with the US claims course of.

| Automobile Sort | Estimated Premium Affect |

|---|---|

| Luxurious Sports activities Automotive | Excessive |

| Compact Sedan | Medium |

| Small SUV | Medium-Low |

| Traditional Automotive | Excessive |

| Truck | Medium-Low |

Claims and Dispute Decision

Navigating the maze of cross-border automotive insurance coverage claims could be a proper ache, particularly when your wheels are spinning in a special nation. Understanding the ropes for submitting a declare and resolving disputes when your Canadian trip will get right into a jam on US soil is essential. This part will break down the method for you, so you are not left stranded with a hefty restore invoice and a mountain of paperwork.

Accident Procedures for Canadian-Registered Automobiles within the USA

Understanding the procedures for accidents involving Canadian-registered autos within the US is vital to getting issues sorted out rapidly and effectively. Firstly, instantly following the accident, you might want to gather all needed info: police report particulars, witness statements, and images of the injury. Then, contacting your Canadian insurer and US insurer (if relevant) is essential. Your insurer might need particular directions for reporting accidents overseas, and the US insurer would possibly require a declare report.

Submitting a Declare with a US Insurer

Submitting a declare with a US insurer when your automobile is registered in Canada requires cautious consideration to element. The insurer wants proof of the accident, together with the police report, medical information, and injury assessments. It’s best to all the time retain all documentation associated to the declare. Offering correct and complete info to the insurer is important to make sure a clean declare course of.

Furthermore, figuring out the particular insurance policies and procedures of the US insurer concerned is vital for avoiding any delays or problems.

Frequent Disputes in Cross-Border Insurance coverage Claims

Disputes typically come up as a consequence of differing interpretations of insurance coverage insurance policies throughout borders. Language obstacles, cultural misunderstandings, and ranging authorized techniques also can contribute to those conflicts. Misunderstandings about protection limits, obligations, and accident reporting procedures are frequent causes of dispute. For instance, a Canadian driver may not pay attention to the particular necessities for reporting an accident within the US, resulting in problems afterward.

Likewise, US insurers may not totally perceive Canadian insurance coverage practices. These complexities can typically result in delays and problems in resolving the declare.

Comparability of Declare Dealing with Procedures

| Facet | Canadian Insurer | US Insurer |

|---|---|---|

| Accident Reporting | Normally requires reporting the accident to the Canadian insurer inside a particular timeframe. | Reporting the accident to the US authorities and your insurer is essential. Usually requires a police report. |

| Declare Evaluation | Evaluation typically includes Canadian requirements for repairs and valuations. | Evaluation adheres to US requirements for repairs and valuations. |

| Legal responsibility Willpower | The method for figuring out legal responsibility usually follows Canadian legal guidelines. | The method adheres to US legal guidelines and rules. |

| Cost Course of | Repairs and settlements typically comply with Canadian cost buildings. | Funds typically comply with US cost buildings. |

| Dispute Decision | Canadian dispute decision procedures could apply, together with mediation or arbitration. | US dispute decision mechanisms could embrace mediation or litigation. |

This desk offers a simplified overview of the declare dealing with procedures. The precise procedures and necessities can fluctuate based mostly on the circumstances of the accident and the particular insurance policies of every insurer.

Authorized Issues

Navigating the authorized panorama of US automotive insurance coverage if you’re a Canadian driver could be a proper ache. It is not simply in regards to the premiums; figuring out the principles is essential to keep away from hefty fines or worse. Understanding the legalities ensures you are not simply coated, however you are additionally enjoying by the US gamebook.The US has particular rules for insuring autos, even these registered in different international locations.

This part dives into the authorized necessities, potential penalties of non-compliance, and the way completely different states method cross-border insurance coverage. It is all about avoiding these nasty surprises that would go away you stranded or worse.

Insurance coverage Necessities for Canadian-Registered Automobiles

US states require proof of monetary accountability for all autos working inside their borders. This often means having legal responsibility insurance coverage, a particular minimal quantity of protection. This is not only a matter of politeness; it is the legislation. For Canadian drivers, this typically includes acquiring a US insurance coverage coverage or demonstrating equal protection via a acknowledged reciprocal settlement. Failure to conform might end in hefty penalties.

Implications of Violating US Insurance coverage Rules

Driving with out enough insurance coverage within the US can result in extreme penalties, starting from fines to potential license suspension and even automobile impoundment. The precise penalties fluctuate relying on the state and the severity of the violation. This may be extremely disruptive, particularly in case you’re reliant in your automobile for work or day by day life.

Particular Authorized Frameworks Governing Cross-Border Insurance coverage

A number of US states have reciprocal agreements with Canada and different international locations to simplify the method for drivers with overseas registrations. These agreements typically Artikel the particular necessities for proof of insurance coverage and the right way to navigate cross-border insurance coverage wants. Nonetheless, these agreements can fluctuate considerably, and a radical investigation is essential. When you’re not sure, consulting a authorized professional is a brilliant transfer.

Penalties of Not Having Applicable Insurance coverage Protection

Driving with out enough insurance coverage may end up in a spread of great penalties, impacting not solely your private funds but in addition your means to journey or work. This is not only a monetary headache; it is a authorized one that would affect your future. Examples embrace fines, suspension of your driving privileges, and the potential of dealing with lawsuits from concerned events.

Moreover, in case you trigger an accident, you may be held accountable for any damages, even in case you’re only a customer.

US State-Particular Rules Concerning Canadian Automotive Insurance coverage

The US does not have a single, unified system for dealing with cross-border insurance coverage. Rules differ considerably from state to state, creating a posh panorama for Canadian drivers.

| State | Particular Necessities |

|---|---|

| Instance State 1 | Proof of minimal legal responsibility protection; reciprocal settlement with Canada; particular kinds required for verification. |

| Instance State 2 | No reciprocal settlement with Canada; requires a US coverage or equal proof of protection; potential for increased premiums for overseas drivers. |

| Instance State 3 | Simplified course of for drivers with legitimate Canadian insurance coverage; restricted documentation required. |

This desk is a simplified illustration; all the time seek the advice of the particular insurance coverage division of the state you’re visiting. Rules are complicated and topic to alter.

Comparability of Protection

Navigating US insurance coverage as a Canadian driver can really feel like a maze. Understanding the completely different protection ranges between Canadian and US insurance policies is essential for avoiding nasty surprises down the road. This part breaks down the important thing variations, serving to you make the fitting selections in your wheels.US insurance coverage insurance policies, in contrast to their Canadian counterparts, typically have completely different protection ranges tailor-made for driving within the US.

This implies a coverage legitimate in Canada may not totally defend you within the States.

Typical Protection Ranges

Canadian insurance policies typically deal with the necessities, whereas US insurance policies have a tendency to supply extra complete choices. This distinction in method is straight tied to the various authorized frameworks and accident charges between the 2 international locations. Canadian protection tends to be extra targeted on legal responsibility and primary protections. US insurance policies, then again, would possibly supply a broader vary of protection to accommodate the upper chance of accidents, collisions, and property injury.

Legal responsibility Protection

Legal responsibility protection within the US is often extra substantial than in Canada. It’s because US legal guidelines typically maintain drivers extra accountable for damages brought about in accidents. Canadian legal responsibility insurance policies usually cowl damages to different events’ autos and accidents sustained by others. Nonetheless, US insurance policies incessantly prolong legal responsibility protection to cowl further damages or medical bills. Understanding the specifics of every coverage is essential for making certain you are adequately protected.

Collision and Complete Protection

Collision protection within the US is usually extra sturdy, because it typically covers damages to your individual automobile no matter fault in an accident. Canadian insurance policies could have various ranges of collision protection, typically specializing in the monetary affect of harm to your automobile. Complete protection within the US is often extra inclusive, encompassing injury from occasions past accidents, reminiscent of theft, vandalism, or pure disasters.

Canadian insurance policies may not embrace the identical breadth of complete protection.

Sorts of Insurance coverage Protection

Insurance coverage insurance policies supply a spread of coverages, every enjoying a particular position in defending your pursuits. Legal responsibility protection is important for safeguarding your self from claims associated to accidents or injury to different events. Collision protection is designed to deal with the monetary accountability for injury to your individual automobile in a collision. Complete protection offers safety in opposition to numerous dangers past collisions, reminiscent of theft, fireplace, or vandalism.

- Legal responsibility Protection: Protects you from monetary accountability for injury to others’ property or accidents brought about in an accident.

- Collision Protection: Covers injury to your automobile in a collision, no matter who’s at fault.

- Complete Protection: Protects in opposition to damages to your automobile from occasions like theft, vandalism, fireplace, or hail.

- Uninsured/Underinsured Motorist Protection: Gives safety in case you’re concerned in an accident with an uninsured or underinsured driver.

- Medical Funds Protection: Covers medical bills for you and your passengers, no matter fault.

- Private Damage Safety (PIP): Just like medical funds, however typically covers misplaced wages and different bills.

Evaluating Protection Choices

Evaluating numerous insurance coverage choices requires cautious scrutiny of coverage particulars. The precise protection ranges, deductibles, and premiums fluctuate significantly amongst completely different insurers. Completely reviewing coverage paperwork is important. It’s best to search for protection that adequately protects you within the US whereas remaining reasonably priced.

| Insurance coverage Supplier | Legal responsibility Protection | Collision Protection | Complete Protection |

|---|---|---|---|

| Insurer A | $100,000/$300,000 | $10,000 Deductible | Full Protection |

| Insurer B | $250,000/$500,000 | $5,000 Deductible | Partial Protection |

| Insurer C | $500,000/$1,000,000 | $2,500 Deductible | Full Protection with extras |

Ideas and Suggestions for Canadians

Navigating the US automotive insurance coverage panorama as a Canadian driver could be a little bit of a maze. Understanding the nuances of protection, rules, and potential pitfalls is essential to keep away from expensive surprises. This part affords sensible recommendation for Canadians trying to safe the fitting insurance coverage for his or her wheels whereas stateside.

Actionable Ideas for Canadians

Insurance coverage is not only a field to tick; it is a important a part of your journey and possession plan within the States. Do your homework and do not simply accept the primary coverage you see. Evaluate completely different suppliers, coverages, and premiums to seek out the perfect deal tailor-made to your wants.

Dependable Assets for Data

Discovering reliable information on Canadian automotive insurance coverage within the US is vital. Begin with respected insurance coverage comparability web sites and search for sources particularly catering to Canadian drivers. Do not depend on generic on-line searches; search for websites devoted to cross-border insurance coverage. Checking along with your Canadian insurer or their US associates also can present beneficial insights.

Minimizing Insurance coverage Prices

Holding your premiums down with out compromising protection is a should. Think about elements like your driving file, automobile sort, and site when selecting a coverage. A clear driving file is usually a major consider reducing premiums. Researching reductions provided by insurers also can result in substantial financial savings.

Understanding Particular Rules

Rules fluctuate by state. Be sure to completely perceive the particular rules governing your chosen state for automobile insurance coverage. Completely different states have differing necessities for minimal protection. For instance, some states would possibly require legal responsibility protection, whereas others would possibly demand complete protection.

Suggestions for Canadians

- Completely analysis insurance coverage suppliers providing protection particularly for Canadian drivers within the USA. This typically yields higher premiums and tailor-made help.

- Acquire a number of quotes from completely different insurers to match costs and protection packages. Do not simply accept the primary quote you discover.

- Be ready to show your clear driving file, as this typically results in decreased premiums.

- Perceive and adjust to all state-specific rules for automotive insurance coverage. Completely different states have various necessities for protection.

- Think about including extras like roadside help or emergency medical cowl, particularly in case you’re travelling.

Wrap-Up

In conclusion, securing the fitting automotive insurance coverage when driving a Canadian-registered automobile within the USA is essential. Understanding the distinctive challenges, choices, and elements impacting premiums empowers Canadians to make knowledgeable selections. By completely reviewing protection, evaluating insurers, and contemplating authorized implications, drivers can guarantee their automobile is satisfactorily protected and navigate the method with confidence. The information has supplied a transparent overview of the complexities, making the whole course of much less daunting.

Important Questionnaire: Canadian Automotive Insurance coverage In Usa

What are the authorized necessities for driving a Canadian-registered automobile within the USA?

Proof of insurance coverage, typically within the type of a US-compliant coverage, is usually required. Particular rules fluctuate by state. At all times confirm necessities with the state’s Division of Motor Automobiles.

How do I evaluate premiums for comparable protection ranges between Canadian and US insurers?

Evaluating quotes straight from insurers, whereas contemplating protection particulars and exclusions, is essential. Think about using on-line comparability instruments. Observe that automobile sort, driver profile, and site throughout the USA affect premiums.

What are the frequent disputes arising from cross-border insurance coverage claims?

Disputes typically focus on legal responsibility, protection limits, and declare processing procedures. Understanding the variations in declare processes between Canadian and US insurers is important.

What are the results of not having applicable insurance coverage protection whereas driving a Canadian-registered automobile within the USA?

Penalties can vary from fines to automobile impoundment. Furthermore, with out enough protection, drivers could face vital monetary liabilities in case of accidents. At all times make sure the automobile is roofed.