AAA vs State Farm automotive insurance coverage: Choosing the proper protection is essential for peace of thoughts. This in-depth comparability explores the important thing variations between these two main suppliers, inspecting protection choices, pricing methods, customer support, and monetary stability. We’ll delve into the specifics that will help you make an knowledgeable choice.

Navigating the complicated world of auto insurance coverage can really feel overwhelming. Understanding the nuances of every supplier is important for securing the absolute best coverage. This evaluation gives a transparent and concise comparability, equipping you with the information to decide on the optimum match to your wants.

Introduction to Automotive Insurance coverage Comparability

The automotive insurance coverage market is a jungle, full of complicated phrases and much more complicated quotes. It is a maze of choices, designed to make your head spin. However worry not, intrepid driver! This information will aid you navigate the complexities and select the right coverage to your wants. Understanding the nuances of various suppliers is essential to discovering one of the best worth to your hard-earned money.Evaluating completely different insurance coverage suppliers is essential.

Similar to evaluating costs at completely different grocery shops, you will typically discover vital variations in premiums and protection. Discovering the best match to your driving habits and car sort is paramount. This comparability focuses on AAA and State Farm, two titans within the insurance coverage world, offering a transparent image of their choices.

Elements to Take into account When Selecting a Automotive Insurance coverage Coverage

Selecting a automotive insurance coverage coverage entails contemplating a number of elements. Your driving report, car sort, and placement all play a task in figuring out your premium. Moreover, particular add-ons like roadside help or rental automotive protection can affect your closing price.

- Driving File: A clear driving report usually interprets to decrease premiums. Accidents and site visitors violations will enhance your charges. Consider it as a mirrored image of your danger profile to the insurance coverage firm. A historical past of accountable driving, like constant protected driving habits, earns a reduction in your premiums.

- Car Sort: The worth and sort of your car instantly affect your premiums. Luxurious sports activities automobiles, for instance, typically include increased insurance coverage prices because of their elevated restore prices.

- Location: Areas with increased charges of accidents or theft might have increased insurance coverage premiums. City areas typically have increased premiums than rural areas.

- Protection Wants: Take into account the extent of protection you require. Complete protection, which protects towards injury from occasions like hail or vandalism, is usually a worthwhile funding.

AAA and State Farm Automotive Insurance coverage Comparability

This desk Artikels a simplified comparability of AAA and State Farm automotive insurance coverage choices. Pricing and particular options might range based mostly on particular person circumstances and placement.

| Characteristic | AAA | State Farm |

|---|---|---|

| Legal responsibility Protection | Commonplace protection, typically contains bodily damage and property injury. | Commonplace protection, typically contains bodily damage and property injury. |

| Collision Protection | Covers injury to your car from a collision, no matter who’s at fault. | Covers injury to your car from a collision, no matter who’s at fault. |

| Complete Protection | Protects towards injury from non-collision occasions like vandalism, hearth, or climate. | Protects towards injury from non-collision occasions like vandalism, hearth, or climate. |

| Roadside Help | Usually included as a regular profit. | Usually included as a regular profit. |

| Pricing | Variable, typically aggressive in particular markets. | Variable, typically aggressive in particular markets. |

| Buyer Service | Usually praised for its in depth community of brokers. | Usually praised for its in depth community of brokers. |

Protection Comparability

So, you’ve got obtained your coronary heart set on both AAA or State Farm? Nice! Now let’s dive into the nitty-gritty of their protection choices. We’ll examine their customary insurance policies, discover add-ons, and spotlight any potential potholes within the highway. As a result of let’s face it, automotive insurance coverage is sort of a sophisticated treasure hunt – you need one of the best protection with out breaking the financial institution.Understanding the completely different protection ranges is essential to creating an knowledgeable choice.

This is not nearly numbers; it is about safeguarding your funding (your automotive!) and your peace of thoughts. We’ll present you the variations in legal responsibility, collision, and complete protection between the 2 giants, so you may select one of the best match to your driving habits and life-style.

Commonplace Coverages

AAA and State Farm each provide the important coverages like legal responsibility, collision, and complete. Nevertheless, the particular particulars and limits can range. Legal responsibility protection protects you in the event you trigger injury to a different particular person or their property. Collision protection kicks in when your automotive collides with one other car or an object. Complete protection handles injury to your automotive from occasions past a collision, akin to hail, theft, or hearth.

Understanding these core coverages is key to any comparability.

Variations in Protection Ranges

The important thing distinction is not all the time in regards to the presence of protection, however slightly the specifics. For instance, whereas each insurers provide legal responsibility protection, the coverage limits and deductibles may differ. Collision and complete protection may have various limits, affecting the quantity you pay out of pocket in the event you file a declare. You should definitely examine the precise quantities fastidiously.

AAA may provide a barely increased payout restrict for a comparable premium, whereas State Farm may need a decrease deductible. These subtleties could make a major distinction in the long term.

Add-on Coverages

Past the fundamentals, contemplate add-on coverages like roadside help, rental automotive reimbursement, and uninsured/underinsured motorist safety. These extras can considerably affect your peace of thoughts. Roadside help is like having a private assistant on wheels, prepared that will help you when your automotive acts up. Rental automotive reimbursement is a lifesaver in case your automotive is within the store because of an accident coated by your coverage.

Uninsured/underinsured motorist safety is essential for safeguarding you towards drivers who won’t have enough insurance coverage. They are often game-changers within the occasion of an accident.

Protection Choices Comparability Desk

| Protection Sort | AAA | State Farm | Notes |

|---|---|---|---|

| Legal responsibility | $100,000/$300,000 | $250,000/$500,000 | Coverage limits range; test particulars. |

| Collision | $1,000 deductible | $500 deductible | Decrease deductible may imply decrease premiums however increased out-of-pocket prices. |

| Complete | $1,000 deductible | $1,000 deductible | Related deductibles, examine different coverage particulars. |

| Roadside Help | Included in most plans | Included in most plans | Verify the specifics, as some options might have exclusions. |

| Rental Automotive | As much as $50/day | As much as $40/day | Protection limits and day by day allowances range. |

| Uninsured/Underinsured | $100,000/$300,000 | $500,000/$1,000,000 | Considerably increased protection ranges at State Farm. |

“Evaluating insurance policies is not simply in regards to the worth; it is in regards to the safety and peace of thoughts you get.”

Pricing and Premiums

So, you’ve got obtained your coronary heart set on the right automotive insurance coverage, however the price ticket is retaining you up at night time? Worry not, intrepid driver! We’re diving deep into the nitty-gritty of premiums, exploring the elements that inflate (or deflate!) your automotive insurance coverage invoice, and evaluating the pricing methods of AAA and State Farm. Buckle up, as a result of that is going to be a wild experience!

Elements Influencing Premiums

Your automotive insurance coverage premium is not simply plucked from skinny air; it is a fastidiously calculated reflection of your driving habits, the car you drive, and your location. Consider it as a personalised danger evaluation – the upper the danger, the upper the worth.

- Driving File: A clear driving report, free from accidents and violations, is a significant factor. Consider it as a gold star for accountable driving – the extra gold stars, the decrease the premium.

- Car Sort: A classic sports activities automotive with a penchant for high-speed chases will doubtless price extra to insure than a household sedan. The car’s make, mannequin, and even its engine dimension contribute to the perceived danger.

- Location: Residing in a high-accident space or a spot liable to extreme climate can considerably enhance your premiums. Insurance coverage firms consider native accident statistics and claims knowledge.

Pricing Fashions of AAA and State Farm

AAA and State Farm, whereas each aiming for profitability, strategy pricing in a different way. AAA, typically seen as extra consumer-centric, may regulate premiums based mostly in your particular wants, whereas State Farm may take a broader strategy, contemplating elements like regional averages. This is not all the time a clear-cut distinction, and it is dependent upon the particular coverage and particular person driver.

Reductions Provided by Every Firm

Each AAA and State Farm provide a variety of reductions to reward good driving habits and accountable selections. These reductions can considerably scale back your premiums, making them worthwhile to discover.

- AAA Reductions: AAA typically presents reductions for bundling your automotive insurance coverage with different providers like AAA membership, multi-vehicle insurance policies, and protected driving packages.

- State Farm Reductions: State Farm incessantly presents reductions for good scholar drivers, a number of automobiles on a coverage, and even for putting in security options like anti-theft gadgets.

Typical Premium Prices

A exact comparability of premiums requires particular person knowledge, however we will illustrate the overall traits.

| Coverage Sort | Driver Profile (AAA) | Driver Profile (State Farm) |

|---|---|---|

| Fundamental Legal responsibility | $1,200 – $1,500 | $1,000 – $1,300 |

| Complete | $1,500 – $2,000 | $1,300 – $1,800 |

| Full Protection | $1,800 – $2,500 | $1,500 – $2,200 |

| Younger Driver (underneath 25) | $2,000 – $3,000 | $1,800 – $2,800 |

| Mature Driver (over 65) | $800 – $1,200 | $700 – $1,100 |

Notice: These are estimated figures and will range based mostly on particular person circumstances. A clear driving report and a protected car can result in vital financial savings.

Buyer Service and Claims Course of

Navigating the world of automotive insurance coverage claims can really feel like looking for a needle in a haystack, particularly when coping with completely different firms. AAA and State Farm, two titans within the trade, boast completely different approaches to customer support and declare dealing with. Let’s dive into the specifics to see which one is perhaps the higher match to your wants.

AAA Buyer Service Method

AAA typically prides itself on its complete strategy to customer support, emphasizing member advantages and a wide selection of assist channels. Their customer support representatives are typically well-trained and educated, typically with in depth expertise within the trade. They perceive the complexities of auto insurance coverage claims, permitting for a clean course of.

State Farm Buyer Service Method

State Farm, recognized for its in depth community of brokers and its sturdy emphasis on customized service, presents a barely completely different expertise. Their brokers are sometimes extremely approachable, offering tailor-made help for policyholders, which might be helpful for these in search of individualized assist.

Declare Submitting Procedures

Submitting a declare is a important a part of any insurance coverage course of. Each AAA and State Farm provide numerous methods to provoke a declare, from on-line portals to cellphone calls to in-person interactions. Understanding these procedures is important to making sure a swift and environment friendly decision.

AAA Declare Submitting

AAA’s declare submitting course of is designed to be easy and environment friendly. Their on-line portal gives a handy option to report accidents and provoke the claims course of. Moreover, members can attain out to a devoted claims division through cellphone. For extra complicated conditions, in-person help could also be out there at choose areas.

State Farm Declare Submitting

State Farm’s declare submitting procedures are equally well-structured. Their web site presents a user-friendly on-line portal for submitting claims. A devoted claims cellphone line permits for speedy help, whereas native brokers can deal with extra complicated claims. This presents a stability between on-line comfort and customized assist.

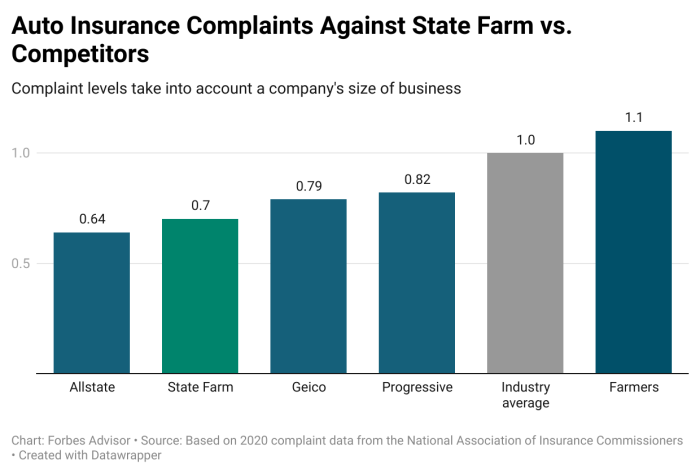

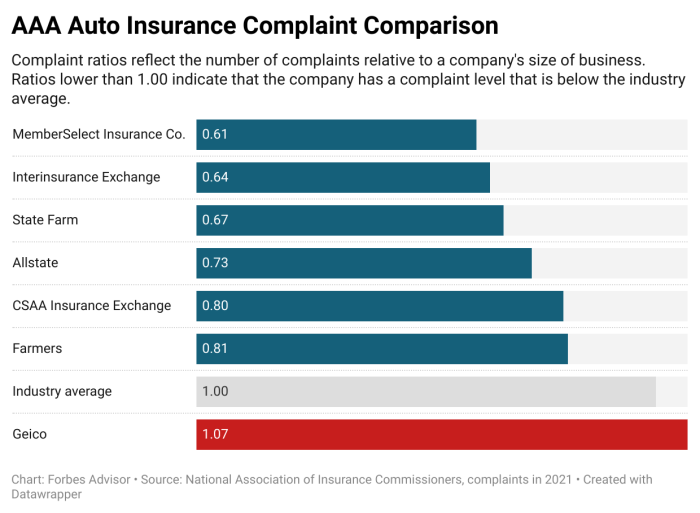

Comparability of Responsiveness and Effectivity

Figuring out which firm handles claims extra effectively requires inspecting a number of elements. Whereas each firms goal for well timed decision, particular experiences can range. Usually, each AAA and State Farm try for fast turnaround occasions, although particular person circumstances can affect the declare dealing with course of. Elements just like the severity of the accident, the complexity of the declare, and the provision of sources all affect the velocity of decision.

Buyer Service and Declare Submitting Channels

| Firm | Cellphone | On-line Portal | In-Individual |

|---|---|---|---|

| AAA | Devoted claims line, out there 24/7 | Person-friendly on-line portal for reporting accidents and initiating claims | Help out there at choose areas |

| State Farm | Devoted claims line, out there 24/7 | Person-friendly on-line portal for submitting claims | Native brokers out there for complicated claims |

Monetary Energy and Status: Aaa Vs State Farm Automotive Insurance coverage

Choosing a automotive insurance coverage firm is not simply in regards to the worth; it is about peace of thoughts. Think about your automotive getting totaled, or worse, needing a hefty restore. You need an organization that is financially sound, capable of deal with your declare with out disappearing. This part dives into the monetary stability and status of AAA and State Farm, essential elements to contemplate when selecting your insurer.

Insurer Monetary Energy: Why It Issues

Monetary power is a important facet of any insurance coverage firm. An organization with a robust monetary place is extra doubtless to have the ability to pay out claims, even in giant or complicated conditions. Consider it like a financial institution—you wish to understand it has sufficient reserves to deal with your withdrawals, proper? The identical precept applies to insurance coverage.

A financially wholesome insurer can climate storms and nonetheless be there for you while you want them most. A financially weak firm may battle to pay claims, resulting in delays and even full insolvency. This might go away you with a hefty invoice and no protection while you want it most.

Impartial Scores and Evaluation

Insurers are usually evaluated by impartial score businesses. These businesses analyze numerous elements, together with the corporate’s profitability, funding methods, and claims-paying skill, to evaluate their monetary power. These scores present a useful benchmark for customers, providing perception into the insurer’s stability and reliability. Excessive scores from these businesses normally sign a reliable and steady firm.

Monetary Energy Scores Comparability

| Score Company | AAA | State Farm |

|---|---|---|

| A.M. Greatest | Wonderful (A++) | Wonderful (A++) |

| Moody’s | Robust (Aa2) | Robust (Aa2) |

| Commonplace & Poor’s | Wonderful (AA+) | Wonderful (AA+) |

The desk above showcases the monetary power scores for each AAA and State Farm from distinguished score businesses. Discover the constant glorious scores throughout numerous businesses. This constant sturdy exhibiting highlights the dedication each firms have in the direction of monetary stability.

Further Providers and Advantages

Need greater than only a coverage? AAA and State Farm provide a smorgasbord of additional providers, from towing you out of a sticky scenario to serving to you intend your subsequent nice escape. Let’s dive into the juicy particulars and see which one’s the final word journey companion.

Roadside Help

AAA and State Farm each present roadside help, however the satan, as they are saying, is within the particulars. This is not nearly a flat tire; it is about the complete spectrum of automotive emergencies. Think about a lifeless battery in the course of nowhere, or a automotive that simply will not begin. These providers might be lifesavers.

- AAA usually presents a broader vary of roadside help, together with jump-starts, lockouts, gasoline supply, and even tire modifications, and sometimes have a quicker response time.

- State Farm’s roadside help is usually dependable, however it could not cowl as many providers as AAA, and the response time may range.

Journey Providers

Planning a visit? Each firms provide some journey perks, although they range significantly in scope. AAA typically boasts complete journey sources, together with journey planning instruments, emergency roadside help, and reductions on inns and sights. State Farm, alternatively, may present a extra restricted collection of journey advantages.

- AAA presents a extra in depth suite of journey providers, together with journey planning, route ideas, and reductions on inns, rental automobiles, and sights. This will prevent vital quantities of cash and stress throughout journey.

- State Farm might provide journey help like emergency roadside help, however its choices are typically much less complete in comparison with AAA’s journey providers.

Evaluating Further Providers

The worth proposition of further providers relies upon completely in your wants. In the event you’re a frequent traveler who values peace of thoughts, AAA is perhaps the extra enticing possibility. In the event you primarily want primary roadside help and do not plan in depth journeys, State Farm might suffice.

| Service | AAA | State Farm |

|---|---|---|

| Roadside Help (Towing, jump-start, and so on.) | Usually complete, typically quicker response time. | Dependable, however doubtlessly much less in depth providers. |

| Journey Providers (Journey planning, reductions) | Intensive journey sources and reductions. | Restricted journey help, doubtlessly with reductions on choose providers. |

| Estimated Value | Variable, typically included with membership charges | Variable, typically included with coverage, however might have limits or restrictions. |

AAA’s membership charges typically cowl these providers, whereas State Farm usually bundles them with their insurance coverage insurance policies, however might have limits or restrictions.

Coverage Sorts and Choices

Selecting the correct automotive insurance coverage coverage is like selecting your good pair of footwear—you need one thing that matches your wants and your finances. This part dives into the several types of insurance policies out there, inspecting the varied choices AAA and State Farm provide. Understanding these variations can prevent a bundle and make sure you’re adequately protected on the highway.Figuring out your choices helps you make knowledgeable selections, avoiding the “purchaser’s regret” that comes with a poorly chosen coverage.

We’ll dissect the professionals and cons of every, plus provide a useful comparability desk to make your selection a breeze.

Legal responsibility Protection

Legal responsibility protection is like having a security internet for when issues go sideways. It protects you financially in the event you’re at fault in an accident, protecting the opposite driver’s medical bills and car injury. It is a basic element of any insurance coverage package deal, and sometimes required by regulation. Totally different ranges of legal responsibility protection exist, starting from primary safety to extra complete plans, every with various worth tags.

This important protection gives a important layer of monetary safety.

Collision Protection

Collision protection is triggered when your car collides with one other object, no matter who’s at fault. Consider it as insurance coverage to your personal automotive, even when it is your fault. This protection pays for the injury to your car, providing peace of thoughts within the occasion of a fender bender or a extra critical collision. It is typically a clever addition, notably for newer automobiles.

Complete Protection

Complete protection extends past collisions, protecting injury attributable to issues like vandalism, theft, hail, hearth, and even falling objects. It is the final word safety, guaranteeing you are coated in a wider vary of unlucky circumstances. Whereas it provides to your premium, it is a worthwhile funding for automobiles which might be useful belongings.

Evaluating Coverage Sorts and Prices (Instance)

| Coverage Sort | AAA Estimated Value (per yr) | State Farm Estimated Value (per yr) |

|---|---|---|

| Legal responsibility Solely | $500 | $450 |

| Legal responsibility + Collision | $800 | $750 |

| Legal responsibility + Collision + Complete | $1200 | $1100 |

Notice: These are instance prices and will range based mostly on elements like your driving report, car sort, and placement.

Coverage Choices Provided by AAA and State Farm

Each AAA and State Farm provide quite a lot of coverage choices tailor-made to completely different wants and budgets. These firms perceive {that a} one-size-fits-all strategy is not sensible, so they supply numerous choices. From primary legal responsibility safety to complete packages, drivers can discover the right match for his or her particular circumstances.

- AAA: Presents a variety of protection choices, together with tailor-made packages for particular car sorts (like traditional automobiles) and high-value automobiles. In addition they typically present reductions for good drivers and for bundling different providers like roadside help.

- State Farm: Gives a strong collection of coverage choices, recognized for its aggressive pricing and huge availability throughout completely different states. They incessantly provide reductions for a number of insurance policies and different elements, making them a lovely possibility for a lot of drivers.

Execs and Cons of Every Coverage Sort

Understanding the benefits and drawbacks of every coverage sort is essential. It helps you weigh the fee towards the safety you want.

- Legal responsibility: Execs: Reasonably priced. Cons: Gives restricted safety in case of accidents. It solely covers injury to others, not your individual car.

- Collision: Execs: Covers your car no matter fault. Cons: Can enhance your premiums. Will not be obligatory if you have already got a complete coverage.

- Complete: Execs: Gives broad safety towards numerous perils. Cons: The costliest possibility. You won’t want all points of complete protection relying in your life-style and car.

Buyer Opinions and Testimonials

Unveiling the real-world experiences of AAA and State Farm automotive insurance coverage clients is like getting a sneak peek behind the velvet ropes. These opinions, each candy and bitter, give us an interesting glimpse into the precise buyer journey, permitting us to see how these giants stack up towards one another.

Buyer Experiences: A Blended Bag

Buyer opinions, a goldmine of suggestions, paint a vivid image of the insurance coverage panorama. Constructive experiences typically spotlight the graceful claims course of and pleasant customer support representatives, whereas adverse opinions incessantly level to irritating delays or unhelpful interactions. In the end, the expertise varies considerably, reflecting the nuances of particular person conditions and interactions.

AAA Buyer Suggestions

AAA typically receives reward for its in depth roadside help. Clients incessantly point out feeling valued and supported in occasions of bother. Nevertheless, some opinions specific issues in regards to the complexity of their insurance policies or the issue in navigating their on-line platforms.

State Farm Buyer Suggestions

State Farm’s status typically facilities round its affordability and widespread community. Many shoppers reward their user-friendly on-line portals and fast claims processing. Nevertheless, some testimonials recommend a disconnect between claims representatives and clients, typically resulting in misunderstandings or delays.

Claims Dealing with: A Nearer Look

Claims dealing with is a vital facet of any insurance coverage firm. A fast and environment friendly course of is usually a large aid for policyholders throughout a tough time. Nevertheless, sluggish processing or unhelpful representatives might be extremely irritating. Buyer opinions provide useful insights into the velocity and effectivity of each firms’ claims dealing with procedures.

“AAA’s roadside help is incredible! I used to be stranded in the course of nowhere, they usually obtained me again on the highway very quickly. The customer support was top-notch.”

Buyer Assessment (Constructive)

“State Farm’s on-line portal is superb, tremendous straightforward to make use of. However once I filed a declare, it took endlessly to get it resolved, and the representatives weren’t very useful.”

Buyer Assessment (Detrimental)

“I have been with AAA for years and I am all the time impressed with their customer support. They’re so responsive and useful.”

Buyer Assessment (Constructive)

“State Farm’s premiums are surprisingly low, however the claims course of was unnecessarily sophisticated. It took weeks to get my declare accepted.”

Buyer Assessment (Detrimental)

General Buyer Expertise Abstract

The general buyer expertise with each firms is a blended bag. AAA excels in roadside help, however some clients discover their insurance policies and on-line portals cumbersome. State Farm, alternatively, typically receives reward for affordability and user-friendly on-line platforms, however some clients report irritating claims processing experiences. In the end, one of the best firm for you is dependent upon your particular wants and priorities.

Geographic Availability

Crossing state traces for automotive insurance coverage can really feel like navigating a maze, but it surely would not should be a headache. Understanding the place your insurance coverage choices are available is essential to discovering one of the best match. We’ll examine the geographic attain of AAA and State Farm, exploring how location impacts pricing and protection choices.

Protection Areas

AAA and State Farm, whereas each giants within the insurance coverage world, boast completely different geographic footprints. AAA, with its roots in roadside help, usually has a robust presence within the US, notably in areas with excessive AAA membership. State Farm, a nationwide powerhouse, has a near-ubiquitous presence throughout the nation, providing protection in most states.

Regional Variations in Pricing

Location performs a major position in insurance coverage premiums. Elements like accident charges, pure disasters, and even native site visitors patterns affect the price of protection. A coastal space with increased storm exercise may see a better premium than a rural space, and a metropolis with heavy site visitors congestion might even have increased charges.

Availability Map (Illustrative), Aaa vs state farm automotive insurance coverage

Think about a map of the US, shaded in several colours to signify protection areas. AAA’s protection could be closely concentrated in sure areas, maybe with a deep orange/crimson hue, indicating a robust presence in these areas. State Farm’s protection, alternatively, could be depicted with a extra uniform, lighter yellow/tan shade throughout most states, representing widespread availability.

Variations in depth of the colours may mirror the density of protection inside every area. This might be an illustrative map; it would not mirror actual protection areas.

Influence on Protection Choices

Whereas each firms provide a regular set of coverages, native rules and particular wants might affect the particular choices out there in several areas. For instance, flood insurance coverage is perhaps a extra important consideration in areas liable to flooding, and protection for particular automobiles (like traditional automobiles) might range based mostly on regional legal guidelines and demand.

Pricing and Protection Examples

| Area | Insurance coverage Supplier | Estimated Premium | Instance Protection Influence |

|---|---|---|---|

| Coastal California | State Farm | $2000 | Increased premiums because of earthquake danger |

| Rural Nebraska | AAA | $1500 | Decrease premiums because of decrease accident charges |

These are illustrative examples and never a exact illustration of precise prices. The precise premiums will range based mostly on particular person elements.

Remaining Ideas

In the end, one of the best automotive insurance coverage supplier is dependent upon particular person wants and priorities. Whereas each AAA and State Farm provide strong protection, this comparability highlights the important thing distinctions. By fastidiously contemplating elements like protection ranges, pricing, and customer support, you may confidently choose the coverage that aligns together with your finances and preferences. Make an knowledgeable choice at this time!

High FAQs

What are some widespread reductions provided by these firms?

Each AAA and State Farm provide numerous reductions, together with reductions for good scholar drivers, protected driving packages, and bundling insurance policies (combining auto and residential insurance coverage). Particular reductions might range based mostly on particular person circumstances.

How does the geographic location have an effect on the insurance coverage premium?

Your location considerably impacts your premium. Excessive-risk areas, akin to these with excessive accident charges, usually lead to increased premiums. AAA and State Farm regulate their pricing fashions accordingly.

What’s the typical declare submitting course of for each firms?

Each firms have on-line portals and phone-based techniques for submitting claims. The method usually entails reporting the incident, offering obligatory documentation, and cooperating with investigators.

What are some examples of add-on coverages?

Examples embody roadside help, rental automotive protection in case of car injury, and uninsured/underinsured motorist safety. These add-on coverages can considerably improve your coverage’s complete safety.