South Dakota automobile insurance coverage quotes can range considerably relying on quite a few elements. Understanding the South Dakota automobile insurance coverage market, the weather influencing premiums, and the out there suppliers is essential for securing the very best deal. This information delves into the specifics, offering insights into evaluating quotes, discovering financial savings, and understanding coverage particulars.

Navigating the complexities of South Dakota’s insurance coverage panorama might be daunting. This useful resource simplifies the method, offering a transparent and complete overview of the elements impacting your insurance coverage prices and the steps to take to safe probably the most favorable quotes.

Overview of South Dakota Automotive Insurance coverage

South Dakota’s automobile insurance coverage market is characterised by a aggressive panorama, with varied insurers vying for patrons. Premiums are typically influenced by elements similar to driving historical past, automobile kind, and site throughout the state. Understanding these elements may also help customers make knowledgeable selections when choosing a coverage.South Dakota’s insurance coverage market operates inside a regulatory framework, which impacts pricing and protection choices.

This framework, whereas striving for a balanced strategy, might be influenced by the state’s demographics and financial circumstances. The state’s comparatively low inhabitants density, in comparison with different states, would possibly contribute to the precise dynamics of its insurance coverage market.

Elements Influencing Automotive Insurance coverage Premiums in South Dakota

A number of key elements sometimes affect automobile insurance coverage premiums in South Dakota, just like many different states. These elements are evaluated by insurers to find out the chance related to insuring a selected driver or automobile.

- Driving document: A clear driving document, with no accidents or site visitors violations, sometimes leads to decrease premiums. For instance, a driver with a historical past of dashing tickets or at-fault accidents is prone to face greater premiums.

- Car kind: The worth and sort of auto play a job. Luxurious automobiles and high-performance vehicles usually have greater premiums as a result of potential for greater restore prices. As an example, insuring a sports activities automobile may cost greater than insuring a compact sedan.

- Location: Completely different areas inside South Dakota may need various charges. Areas with greater crime charges or accident concentrations usually expertise greater premiums. This displays the potential for extra claims and elevated threat in these areas.

- Age and gender: Age and gender are elements in figuring out premiums. Youthful drivers are typically seen as higher-risk drivers, resulting in greater premiums. This can be a widespread issue throughout varied insurance coverage markets, and is commonly as a result of greater probability of accidents amongst younger drivers.

- Protection choices: The extent of protection chosen immediately impacts the premium. Complete protection, which protects towards damages aside from collisions, often incurs greater premiums than liability-only insurance policies. As an example, including complete protection for a automobile with a better restore worth will sometimes end in a better premium in comparison with a primary legal responsibility coverage.

Comparability of South Dakota’s Automotive Insurance coverage Panorama to Different States, South dakota automobile insurance coverage quotes

South Dakota’s automobile insurance coverage panorama, whereas influenced by nationwide developments, displays some distinctive traits. Evaluating it to different states reveals sure distinctions.South Dakota, just like different states, has a mixture of insurance coverage firms catering to totally different wants and budgets. Nonetheless, the precise market share of every firm and the vary of obtainable reductions would possibly range from state to state.

Frequent Sorts of Automotive Insurance coverage Protection in South Dakota

The usual protection choices out there in South Dakota are corresponding to these present in different states. This can be a key part of understanding the state’s insurance coverage market.

- Legal responsibility protection: This protects you for those who trigger an accident and are legally answerable for damages to a different particular person’s automobile or accidents. That is the minimal protection sometimes required by regulation.

- Collision protection: This protects you in case your automobile is broken in an accident, no matter who’s at fault. This protection pays for repairs or substitute.

- Complete protection: This protects your automobile towards damages aside from collisions, similar to vandalism, theft, or climate occasions. It covers the restore or substitute prices.

- Uninsured/Underinsured Motorist Protection: Protects you if you’re concerned in an accident with an at-fault driver who does not have insurance coverage or does not have sufficient protection to compensate to your damages.

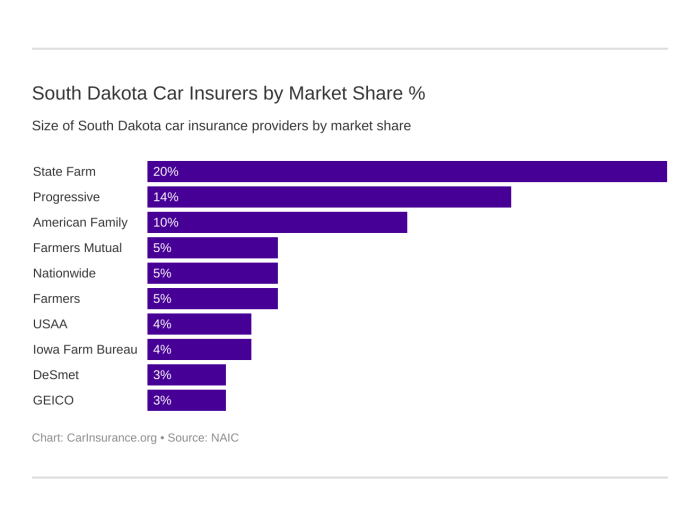

Insurance coverage Firms Working in South Dakota

A number of insurance coverage firms function in South Dakota, offering quite a lot of choices for customers. These firms provide totally different merchandise and pricing constructions.

- State Farm

- Geico

- Progressive

- Allstate

- Farmers Insurance coverage

Elements Affecting Quotes

South Dakota automobile insurance coverage charges are influenced by quite a lot of elements, making it essential to grasp these components to get probably the most aggressive quote. Figuring out these influences means that you can proactively alter facets of your scenario to probably decrease your premium. This part particulars the important thing elements affecting your automobile insurance coverage prices in South Dakota.A complete understanding of those elements empowers you to make knowledgeable selections about your protection, probably resulting in important financial savings.

The extra you understand in regards to the specifics of how your private scenario impacts your charges, the higher you’ll be able to store for the correct coverage.

Driving Historical past

Driving historical past is a serious determinant of automobile insurance coverage premiums. A clear driving document, characterised by a scarcity of accidents and violations, often leads to decrease premiums. Conversely, a historical past of accidents, dashing tickets, or different violations sometimes results in greater charges. Insurers use driving data to evaluate threat, and a poor historical past signifies a better probability of future claims, therefore the elevated premiums.

Insurance coverage firms use subtle algorithms to research driving data and decide acceptable charges. As an example, a driver with a number of dashing tickets will possible face greater premiums in comparison with a driver with no violations.

Car Sort

The kind of automobile you drive performs a major function in your insurance coverage prices. Sure automobiles are extra liable to accidents or theft, and these higher-risk automobiles command greater premiums. Luxurious automobiles, sports activities vehicles, and high-performance fashions usually have greater premiums than extra commonplace automobiles. The worth of the automobile additionally impacts the price of insurance coverage. The next-value automobile will possible require a better premium as a result of potential for greater monetary losses in case of an accident or theft.

Location and Demographics

Location and demographics are additionally thought of in figuring out automobile insurance coverage premiums in South Dakota. Areas with greater crime charges or a larger focus of accidents are likely to have greater insurance coverage charges. Demographics, similar to age and gender, can even have an effect on premiums. Insurance coverage firms use actuarial information to find out the chance related to sure demographics and places. For instance, youthful drivers usually face greater premiums as a result of their perceived greater threat of accidents.

Claims Historical past

A historical past of insurance coverage claims considerably impacts future premiums. People with a historical past of submitting claims will typically pay greater premiums. The severity of the declare additionally influences the premium. A serious accident declare may have a a lot larger affect on future premiums than a minor fender bender. It is because insurers use claims information to foretell the probability of future claims, and a historical past of claims signifies a better threat profile.

Protection Ranges

The extent of protection you select immediately impacts your premium. Complete and collision protection, which defend towards harm from accidents and different occasions, typically end in greater premiums than liability-only protection. Legal responsibility-only protection protects you from harm to others, however not your individual automobile. The extra intensive the protection, the upper the premium, because the insurer assumes a larger monetary threat.

Affect of Elements on Insurance coverage Charges

| Issue | Description | Impression on Charges | Instance |

|---|---|---|---|

| Driving Report | Quantity and severity of previous violations | Increased violations, greater charges | A number of dashing tickets |

| Car Sort | Make, mannequin, and worth of the automobile | Excessive-performance or luxurious automobiles, greater charges | Excessive-performance sports activities automobile |

| Location | Crime price and accident frequency within the space | Excessive-crime areas, greater charges | City areas with excessive accident frequency |

| Demographics | Age, gender, and driving historical past of the motive force | Youthful drivers, greater charges | 18-year-old driver with no driving historical past |

| Claims Historical past | Earlier claims filed | Extra claims, greater charges | A number of claims for accidents or harm |

| Protection Degree | Sort and extent of protection chosen | Increased protection, greater charges | Complete and collision protection |

Evaluating Insurance coverage Suppliers

Choosing the proper automobile insurance coverage supplier in South Dakota is essential for securing reasonably priced protection and wonderful service. Understanding the strengths and weaknesses of various firms empowers you to make an knowledgeable determination that aligns together with your wants and finances. This part delves into the comparative evaluation of distinguished insurance coverage suppliers, contemplating their charges, protection choices, buyer evaluations, monetary stability, and customer support.

Insurance coverage Supplier Comparisons

A radical comparability of insurance coverage suppliers includes analyzing varied elements. This contains evaluating their monetary power, customer support high quality, protection choices, and pricing methods. An important side of this comparability is evaluating buyer evaluations and satisfaction scores to gauge the general expertise.

| Insurance coverage Firm | Strengths | Weaknesses | Buyer Opinions & Satisfaction | Monetary Stability | Buyer Service High quality |

|---|---|---|---|---|---|

| Progressive | Aggressive charges, user-friendly on-line platform, wide selection of reductions, and cellular app for managing insurance policies | Restricted protection choices for particular automobile sorts, often sluggish declare processing instances. | Usually optimistic, with many shoppers praising the convenience of on-line instruments and the promptness of claims decision. Some reported problem reaching customer support representatives. | Glorious monetary stability, persistently ranked amongst high insurance coverage firms in monetary power scores. | Good total; whereas some clients report problem reaching brokers, the web instruments and cellular app provide comfort. |

| State Farm | In depth community of brokers, robust repute for customer support, complete protection choices, and established monitor document. | Usually greater premiums in comparison with some rivals, probably restricted on-line instruments and digital platforms in comparison with different firms. | Excessive buyer satisfaction, with many highlighting the supply of native brokers and customized service. Some evaluations point out lengthy wait instances for claims decision. | Glorious monetary stability; persistently ranks extremely in monetary power reviews. | Sturdy customer support repute, however some clients report longer wait instances for responses and help. |

| Geico | Aggressive charges, particularly for youthful drivers and people with good driving data, user-friendly web site, and varied reductions. | Restricted availability of specialised protection choices, probably much less customized service in comparison with firms with intensive agent networks. | Usually optimistic, with clients appreciating the low charges and ease of on-line entry. Some unfavourable evaluations point out sluggish response instances or difficulties in getting particular questions answered. | Stable monetary stability, persistently rating throughout the top-tier insurance coverage firms. | Good customer support by means of digital channels, however some clients have reported challenges reaching brokers for complicated points. |

| Allstate | Big selection of protection choices, together with specialised insurance policies for particular wants. Sturdy declare dealing with processes. | Probably greater premiums than rivals, restricted availability of reductions in comparison with different suppliers. | Buyer evaluations are combined, with some praising the intensive protection and responsive declare dealing with, whereas others report points with pricing and customer support accessibility. | Stable monetary standing; persistently among the many top-tier insurance coverage firms. | Usually optimistic customer support evaluations, significantly in declare dealing with. Some clients have famous challenges in getting quick help with inquiries. |

Monetary Stability Evaluation

Evaluating the monetary stability of an insurance coverage supplier is vital. Insurers with robust monetary scores usually tend to meet their obligations, making certain policyholders obtain the required compensation in case of claims. Insurance coverage firms are rated by impartial organizations, and these scores provide perception into their monetary well being and capability to pay claims. Sturdy monetary stability is a key indicator of a dependable insurance coverage supplier.

Buyer Service High quality Analysis

Customer support high quality considerably impacts the general insurance coverage expertise. Responsive and useful customer support can resolve points shortly and supply readability on coverage issues. Assessing customer support includes wanting on the firm’s response time, the supply of brokers, and the general effectivity of their processes. Firms that prioritize customer support are higher outfitted to deal with issues and construct belief.

Acquiring Quotes and Saving Cash

Securing probably the most advantageous automobile insurance coverage coverage in South Dakota requires proactive analysis and comparability. Understanding the varied quote acquisition strategies, out there reductions, and techniques for value discount empowers you to make knowledgeable selections and optimize your protection. This course of includes cautious consideration of things like your driving historical past, automobile kind, and desired protection ranges.Efficient comparability of quotes from a number of suppliers is essential to establish probably the most appropriate plan to your wants and finances.

This includes extra than simply glancing at numbers; it requires a complete understanding of the protection specifics and related prices.

Strategies for Acquiring Quotes

Varied avenues facilitate acquiring South Dakota automobile insurance coverage quotes. On-line comparability instruments streamline the method by permitting you to enter your data and obtain quotes from a number of insurers concurrently. Direct contact with insurance coverage firms by means of their web sites or cellphone traces offers customized service and probably tailor-made quotes based mostly on particular person circumstances. Visiting native insurance coverage businesses provides face-to-face interplay, permitting for clarification of particular protection wants and the exploration of customized choices.

Evaluating Quotes Successfully

Complete comparability includes scrutinizing not solely the premium quantity but in addition the protection particulars. A comparative evaluation ought to think about the deductibles, coverage limits, and sorts of protection supplied. A desk format permits for a transparent presentation of the important thing options and related prices from totally different insurers.

| Insurance coverage Supplier | Premium Quantity | Protection Limits | Deductible | Further Advantages |

|---|---|---|---|---|

| Insurer A | $1,200 | $100,000/300,000 | $500 | Accident Forgiveness, Roadside Help |

| Insurer B | $1,000 | $250,000/500,000 | $1,000 | Rental Reimbursement |

Frequent Reductions Obtainable in South Dakota

Quite a few reductions can be found in South Dakota, probably lowering your premium considerably. Understanding these alternatives can result in substantial financial savings.

- Secure Driver Reductions: Insurers usually reward drivers with clear driving data, lowering premiums for these with a historical past of secure driving habits. A clear driving document, devoid of accidents or violations, regularly interprets to a diminished premium.

- Multi-Coverage Reductions: Having a number of insurance coverage insurance policies with the identical supplier can usually end in bundled reductions, which might considerably decrease the general value of insurance coverage. This low cost is regularly supplied to clients with varied insurance coverage merchandise, similar to auto, house, and life insurance coverage, underneath the identical supplier.

- Bundling Reductions: Combining your auto insurance coverage with different sorts of insurance coverage, similar to house or life insurance coverage, from the identical supplier, usually earns you a bundled low cost. This low cost displays the benefit of getting a number of insurance policies with the identical insurer.

- Reductions for Good College students: Insurers regularly present reductions for college students with good tutorial data. A great tutorial document demonstrates duty and maturity, which insurers regularly affiliate with diminished threat.

Steps to Guarantee Correct Quote Comparisons

Correct comparability of quotes includes exact information entry and cautious assessment of coverage specifics. Making certain that every one related data is supplied precisely through the quote course of is important for an correct evaluation of your insurance coverage wants. Double-checking particulars like automobile data, driving historical past, and desired protection choices prevents errors and ensures a exact comparability.

Methods for Saving Cash on Automotive Insurance coverage

Methods for saving cash on automobile insurance coverage embrace sustaining a clear driving document, bundling insurance policies, and contemplating totally different protection choices. Sustaining a clear driving document is commonly an important consider acquiring decrease premiums. Combining varied insurance coverage insurance policies from the identical supplier usually qualifies you for important reductions. Adjusting protection choices to satisfy your particular wants with out compromising important safety may end up in value financial savings.

Step-by-Step Information for Acquiring Quotes

- Collect Data: Accumulate your automobile particulars, driving historical past, and desired protection choices.

- Use Comparability Instruments: Make the most of on-line comparability web sites to acquire quotes from a number of insurers.

- Contact Insurers Immediately: Contact insurers on to discover customized quotes and potential reductions.

- Go to Native Companies: Schedule appointments with native insurance coverage brokers to debate your particular wants.

- Assessment Quotes Fastidiously: Analyze the main points of every quote, together with protection limits, deductibles, and extra advantages.

- Choose the Greatest Choice: Select the quote that aligns together with your finances and insurance coverage wants.

Understanding Coverage Particulars

Navigating the complexities of automobile insurance coverage insurance policies can really feel overwhelming. Nonetheless, understanding the important thing phrases and provisions is essential for securing the correct protection and avoiding sudden prices. This part will delve into typical coverage phrases, protection limits, and several types of protection choices, equipping you with the data to make knowledgeable selections.

Coverage Phrases Defined

Automotive insurance coverage insurance policies are contracts outlining the duties of each the insurance coverage firm and the policyholder. These insurance policies element the precise circumstances underneath which protection applies and the extent of that protection. Understanding these particulars is paramount to making sure enough safety.

Protection Limits and Deductibles

Protection limits outline the utmost quantity the insurance coverage firm pays for a lined loss. These limits range considerably, and exceeding them would possibly end result within the policyholder bearing a portion of the monetary burden. Deductibles, however, characterize the quantity the policyholder should pay out-of-pocket earlier than the insurance coverage firm steps in. The next deductible usually interprets to decrease premiums.

For instance, a $1,000 deductible on a collision declare means the policyholder pays the primary $1,000 of damages.

Completely different Sorts of Protection Choices

Understanding the varied sorts of protection choices out there is important for selecting the best coverage.

- Legal responsibility Protection: This can be a elementary a part of most insurance policies, overlaying damages you trigger to others in an accident. It is sometimes required by regulation in most states. This protection usually contains bodily damage legal responsibility, which protects you towards claims for accidents to others, and property harm legal responsibility, overlaying harm to a different particular person’s property.

- Collision Protection: This protection kicks in when your automobile is concerned in an accident, no matter who’s at fault. It pays for repairs or substitute of your automobile. As an example, for those who collide with one other automobile, even if you’re not at fault, collision protection will sometimes pay for the damages to your automobile.

- Complete Protection: This protection goes past collisions, encompassing harm to your automobile from occasions like vandalism, hearth, hail, or theft. It is vital to notice that complete protection might not cowl put on and tear or regular use-related harm.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is crucial safety within the occasion of an accident with a driver missing enough insurance coverage or no insurance coverage in any respect. This protection safeguards you towards monetary losses if the at-fault driver has inadequate insurance coverage to cowl the damages incurred.

Coverage Phrases Breakdown

| Protection Sort | Description | Significance |

|---|---|---|

| Legal responsibility | Covers damages to others in an accident, together with bodily damage and property harm. | Required by regulation in most states; protects you from monetary duty for those who trigger an accident. |

| Collision | Covers harm to your automobile in an accident, no matter fault. | Gives monetary safety to your automobile repairs or substitute in an accident, even if you’re not at fault. |

| Complete | Covers harm to your automobile from occasions aside from accidents, similar to vandalism, hearth, hail, or theft. | Gives monetary safety to your automobile if it is broken by occasions past accidents. |

| Uninsured/Underinsured Motorist | Covers damages sustained in an accident with an at-fault driver missing enough or no insurance coverage. | Protects you from monetary losses if the at-fault driver doesn’t have ample protection to compensate to your damages. |

Illustrative Eventualities: South Dakota Automotive Insurance coverage Quotes

Navigating the complexities of South Dakota automobile insurance coverage can really feel overwhelming. Understanding how varied elements affect your premium is essential for making knowledgeable selections. This part presents real-world eventualities to exhibit the affect of various components in your insurance coverage prices.Completely different drivers face various ranges of threat, and insurance coverage premiums mirror these variations. Insurance coverage firms use a fancy algorithm to evaluate threat, contemplating elements similar to driving historical past, automobile kind, and site.

By exploring these examples, you may acquire priceless insights into how these elements have an effect on your quotes.

Impression of Driving Historical past

Insurance coverage firms intently scrutinize driving data. A clear driving document, free from accidents or site visitors violations, sometimes leads to decrease premiums. Conversely, a historical past of accidents or shifting violations can result in considerably greater premiums.

- A driver with a clear document for 5 years will obtain a decrease premium in comparison with a driver with a current accident.

- A driver with a number of minor violations might face greater premiums than one with solely a single, minor infraction.

Impression of Car Sort

The kind of automobile you drive performs a job in your insurance coverage value. Increased-performance automobiles or these with a better threat of theft or harm might have greater premiums. Conversely, automobiles perceived as much less dangerous, like compact vehicles, may need decrease premiums.

- A high-performance sports activities automobile, liable to greater restore prices and potential theft, will possible have a better premium in comparison with a normal sedan.

- A basic automobile, particularly if insured for an extended interval, may need greater premiums, because the components and restore prices could also be costlier.

Case Examine: Evaluating Quotes for Completely different Drivers

Contemplate two drivers in South Dakota: Sarah, a 25-year-old with a clear driving document and a normal sedan, and Mark, a 40-year-old with a minor dashing ticket two years in the past and a high-performance SUV. Sarah’s premium is prone to be considerably decrease than Mark’s. The added threat elements related to Mark’s automobile kind and driving historical past would affect his premium.

Low cost Impression on Ultimate Price

Reductions can considerably cut back your insurance coverage premiums. Bundling insurance coverage insurance policies, sustaining a superb driving document, and utilizing anti-theft gadgets are examples of things that will result in important reductions.

- A driver who bundles their automobile insurance coverage with their house insurance coverage coverage might obtain a considerable low cost from the insurance coverage firm.

- A driver who installs an anti-theft gadget of their automobile and maintains an ideal driving document might save a whole lot of {dollars} per yr.

Significance of Complete Protection

Complete protection protects your automobile towards damages from occasions like vandalism, hearth, or hail, even when the harm is not as a result of an accident. With out this protection, you may be answerable for important out-of-pocket bills.

- A situation the place a driver’s automobile is vandalized would end in important restore prices if not lined by complete insurance coverage.

- If a automobile is broken in a storm, complete protection may also help decrease monetary burden.

Getting a Quote and Saving Cash

The method of getting a South Dakota automobile insurance coverage quote is easy. By evaluating quotes from a number of suppliers and thoroughly reviewing coverage particulars, you will discover the very best protection at a aggressive worth.

- By evaluating quotes from a number of suppliers, a driver can probably get monetary savings on their annual premiums.

- Studying the advantageous print and coverage particulars fastidiously will assist drivers keep away from surprises and guarantee they’ve enough protection.

Conclusion

In conclusion, securing aggressive South Dakota automobile insurance coverage quotes requires cautious consideration of varied elements. Evaluating suppliers, understanding coverage phrases, and using out there reductions are key steps in reaching cost-effective protection. This information equips you with the data to confidently navigate the method and discover the most effective insurance coverage answer to your wants.

FAQ

What are the most typical reductions out there for South Dakota automobile insurance coverage?

Frequent reductions embrace secure driver reductions, multi-policy reductions, bundling reductions, and reductions for good college students.

How does my driving document have an effect on my automobile insurance coverage premiums in South Dakota?

A historical past of site visitors violations, accidents, or DUIs will typically end in greater premiums. A clear driving document, conversely, often results in decrease charges.

What are the standard sorts of automobile insurance coverage protection out there in South Dakota?

Normal coverages embrace legal responsibility, collision, and complete. Understanding the nuances of every protection kind is crucial for making knowledgeable selections.

How can I evaluate quotes from totally different insurance coverage suppliers in South Dakota successfully?

Make the most of on-line comparability instruments or contact a number of suppliers immediately. Evaluate protection choices, premiums, and any relevant reductions for an intensive analysis.

What elements affect the price of automobile insurance coverage in South Dakota in addition to my driving document?

Car kind, location, demographics, and claims historical past can all affect premiums. A more recent, higher-value automobile, as an illustration, usually comes with a better insurance coverage value.