Automotive insurance coverage by VIN quantity is a brilliant essential factor, you realize? It is like giving your automotive a particular ID that helps insurance coverage corporations know precisely which car you are speaking about. This helps them shortly and precisely course of claims, and even helps stop fraud. It is a good means to verify all the things is obvious and truthful for everybody concerned.

Understanding your VIN is like having a brilliant secret code to unlock your automotive’s insurance coverage particulars. This implies you possibly can simply discover out your coverage particulars, protection, and even declare standing, all due to that particular VIN quantity. It is tremendous handy, proper?

Understanding Car Identification Quantity (VIN)

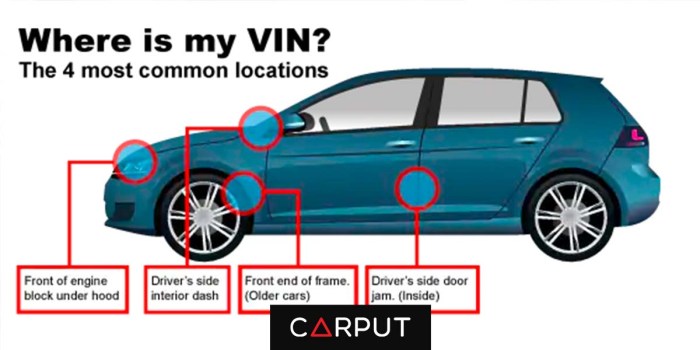

The Car Identification Quantity (VIN) is a novel alphanumeric code that serves as a car’s digital fingerprint. It is a essential piece of data, permitting authorities and insurance coverage suppliers to shortly and precisely determine a particular car, essential for all the things from verifying possession to assessing potential dangers. This complete information will discover the construction and significance of a VIN, equipping you with a deeper understanding of this important code.A VIN, typically discovered on the driving force’s facet dashboard, and typically on the car’s body or different seen components, is greater than only a string of characters.

It is a meticulously designed document containing particulars concerning the car’s make, mannequin, 12 months, and different vital specs. Understanding this code can present priceless perception right into a car’s historical past and traits.

Construction and Parts of a VIN

A VIN is a 17-character alphanumeric sequence, typically organized in a particular sample. This standardized format permits seamless identification and information retrieval throughout numerous producers. Every character performs an important function in conveying particular details about the car.

Completely different VIN Codecs for Varied Car Sorts

Completely different car sorts might need variations of their VIN format. Whereas the core construction stays constant, minor changes could also be applied to accommodate specific fashions or configurations. The variations sometimes contain the location or inclusion of particular characters or digits, designed to take care of the distinctive identification whereas adapting to design concerns. Examples embrace variations within the format for bikes, vehicles, or custom-made autos.

Significance of Every Digit Inside a VIN

Every character in a VIN holds a particular that means. The positions and kinds of characters used are standardized, offering a constant means for numerous entities to interpret the info. This meticulous design permits for environment friendly processing and correct identification of any car. The primary three characters sometimes denote the producer, whereas the remaining characters progressively determine the car’s mannequin, 12 months, engine, and different particulars.

How VINs are Used to Uniquely Determine a Particular Car

The distinctive nature of a VIN lies in its skill to unequivocally determine a selected car. No two autos share the identical VIN, making it a dependable identifier for insurance coverage corporations, regulation enforcement, and car registries. This unyielding uniqueness is essential in sustaining correct data and tracing autos in case of theft or harm. Moreover, it permits for straightforward verification of possession and ensures that insurance coverage claims are precisely related to the particular car.

VIN Breakdown Desk

This desk illustrates the totally different sections and data discovered inside a VIN. Understanding this format permits for a extra detailed comprehension of the data encoded inside the car’s identification code.

| Part | Data |

|---|---|

| World Producer Identifier (WMI) | Signifies the producer (e.g., GM, Ford, Toyota). |

| Car Descriptor Sequence | Specifies the car’s kind, mannequin, and physique type. |

| Car Identification Quantity (VIN) | Uniquely identifies the car. |

| Verify Digit | A calculated digit used to validate the accuracy of the VIN. |

Automotive Insurance coverage and VIN Quantity Relationship

A car identification quantity (VIN) is greater than only a string of numbers and letters; it is the distinctive fingerprint of your vehicle. Insurance coverage corporations leverage this distinctive identifier to meticulously handle their insurance policies and claims. This vital connection ensures correct protection and protects each the policyholder and the insurer from fraudulent actions. Understanding this relationship is vital to navigating the world of automotive insurance coverage.Insurance coverage corporations use VIN numbers to confirm the car’s id.

This verification is essential for a number of causes. Firstly, it ensures the policyholder is insured for the right car. Secondly, it helps stop fraudulent claims. Thirdly, it permits insurers to shortly determine and observe autos in case of theft or harm. This course of streamlines claims and helps decide the validity of any given declare.

VIN Verification in Insurance coverage Claims

VIN verification is a cornerstone of insurance coverage declare processing. It ensures that the reported harm corresponds to the car insured. This course of is crucial in minimizing fraudulent claims and sustaining accuracy in coverage administration. With out a exact VIN match, claims could be rejected or delayed, doubtlessly resulting in monetary hardship for the policyholder.

VIN Verification in Coverage Administration

Insurance coverage corporations use VINs to take care of correct data of insured autos. This consists of updating particulars reminiscent of modifications, accidents, and repairs. A complete database of VIN info permits insurers to trace autos all through their lifespan, offering an in depth historical past for every car. This detailed document is significant for evaluating danger and adjusting premiums accordingly.

Comparability of VIN Utilization in Completely different Declare Situations

The significance of VINs varies throughout totally different declare situations. For instance, in a collision declare, a exact VIN match is crucial to make sure that the harm corresponds to the insured car. If a car is stolen, the VIN is vital for reporting the theft and initiating the restoration course of. In a case of a complete loss, the VIN is required to confirm the car’s id and provoke the payout course of.

Examples of Essential VIN Utilization

Contemplate a state of affairs the place a car has been concerned in an accident. With out the VIN, the insurance coverage firm can’t verify that the car in query is the one insured. This results in a major delay in processing the declare and doubtlessly denies the declare completely. One other instance includes a stolen car. The VIN is essential for reporting the theft to the authorities and for the insurance coverage firm to provoke the declare course of.

With out the VIN, the insurance coverage firm cannot decide if the declare is authentic.

Desk Evaluating Declare Sorts

| Customary Declare | VIN-Based mostly Declare |

|---|---|

| Policyholder’s title, tackle, and get in touch with info | Policyholder’s title, tackle, contact info, and the VIN of the insured car |

| Description of the harm or loss | Description of the harm or loss, and the exact VIN of the broken/stolen car |

| Supporting documentation (e.g., police report, photographs) | Supporting documentation (e.g., police report, photographs, and any further paperwork which will embrace the VIN) |

Accessing Insurance coverage Data by VIN

Unraveling the mysteries of your car’s insurance coverage coverage can really feel like deciphering historic hieroglyphics. Thankfully, the Car Identification Quantity (VIN) acts as a key to unlock this info, offering a simple pathway to your coverage particulars. This part will discover the assorted strategies for acquiring this very important information, making certain you are armed with the information to navigate the insurance coverage labyrinth with confidence.

Strategies for Acquiring Insurance coverage Data

Understanding the best way to get hold of your automotive insurance coverage info by VIN is essential for numerous causes, together with coverage verification, claims administration, and even easy record-keeping. The strategies out there vary from easy on-line portals to doubtlessly extra concerned interactions together with your insurer.

- On-line Portals: Many insurance coverage corporations provide safe on-line portals the place policyholders can entry their coverage particulars. These portals sometimes require login credentials for verification. For instance, some corporations use a novel login ID and password for safe entry, enabling policyholders to view protection particulars, cost historical past, and declare info. Accessing your coverage particulars on-line typically permits for swift and handy retrieval of the data you want, eliminating the necessity for telephone calls or in-person visits.

- Buyer Service Representatives: Direct interplay with insurance coverage firm representatives stays a viable possibility. By contacting customer support and offering the VIN, you possibly can achieve entry to your coverage particulars. Insurance coverage brokers can present details about your coverage phrases, protection quantities, and cost schedules. This strategy could be significantly useful for advanced conditions or when searching for clarification on particular elements of your coverage.

- Insurance coverage Paperwork: In some cases, the insurance coverage coverage itself or supporting paperwork might comprise the required details about your coverage. For instance, the insurance coverage paperwork would possibly embrace particulars on protection quantities, coverage phrases, or cost schedule, and the VIN quantity may be included in these paperwork.

Procedures for Discovering Insurance coverage Coverage Particulars

Finding your coverage particulars utilizing the VIN includes a scientific strategy. It typically includes verifying the VIN’s accuracy, offering the right info to the insurance coverage firm, and understanding the corporate’s course of.

- Verification of VIN: Make sure the VIN you present is correct. Double-check the VIN towards your car registration paperwork for affirmation. A easy error can derail your efforts and trigger delays.

- Contacting Insurance coverage Firm: Attain out to your insurance coverage supplier. Use the suitable channels, reminiscent of on-line portals, telephone help, or the insurance coverage firm’s web site. Present the VIN to the consultant or enter it into the system.

- Acquiring Coverage Particulars: As soon as your id and the VIN are verified, the insurance coverage firm ought to present the requested info. Count on particulars about your protection, coverage phrases, and any related updates.

Authorized Facets of Accessing Insurance coverage Data

Accessing insurance coverage info through a VIN is ruled by particular authorized laws. These laws typically give attention to defending the privateness and safety of non-public information. Moreover, insurance coverage corporations are legally obligated to make sure correct information dealing with.

How Insurance coverage Firms Confirm VIN Data

Making certain the accuracy of VIN info is an important side of the insurance coverage course of. Insurance coverage corporations use numerous strategies to confirm the data, sustaining information integrity and stopping fraudulent actions. They sometimes cross-reference the VIN with car registration databases and different authoritative sources.

| Methodology | Process | Benefits | Disadvantages |

|---|---|---|---|

| On-line Portal | Entry the insurer’s on-line portal, log in, and enter the VIN. | Comfort, effectivity, self-service. | Requires account entry and is probably not out there for all insurance policies. |

| Buyer Service | Name the insurer’s customer support line and supply the VIN. | Help for advanced points or clarifications. | Potential wait occasions, much less handy for easy inquiries. |

| Insurance coverage Paperwork | Assessment your insurance coverage coverage paperwork for VIN info. | Easy and direct entry if the paperwork are available. | Requires having the paperwork readily accessible. |

Insurance coverage Coverage Particulars by VIN

Unveiling the secrets and techniques of your automotive’s insurance coverage coverage, one VIN at a time! Understanding your coverage particulars is essential, particularly when surprising mishaps happen. This part delves into the specifics, revealing how your VIN unlocks a treasure trove of details about your protection.The Car Identification Quantity (VIN) acts as a novel identifier on your automotive, intrinsically linked to its insurance coverage coverage.

This connection permits approved events to entry vital coverage info, making certain fast and environment friendly claims processing and offering transparency all through the insurance coverage course of.

Particular Coverage Particulars Accessible by VIN

Insurance coverage insurance policies comprise a wealth of data. By means of the VIN, you possibly can entry important particulars just like the policyholder’s title, the coverage’s efficient dates, and the kinds of protection included. This detailed info is significant for understanding your safety.

Forms of Protection Related to a Explicit VIN

The VIN straight correlates with the particular coverages related together with your automotive. This consists of legal responsibility protection, collision protection, complete protection, and doubtlessly extra specialised choices, relying on the insurer. Understanding these protection sorts helps you respect the breadth of your safety.

Discovering Protection Limits, Deductibles, and Premiums Associated to a Particular VIN

Coverage particulars embrace protection limits, deductibles, and premiums, all uniquely tied to your VIN. The protection restrict specifies the utmost quantity the insurer pays for a selected declare. Deductibles are the quantities you have to pay out-of-pocket earlier than the insurer begins masking your bills. Premiums are the periodic funds you make on your insurance coverage coverage. All these figures could be accessed by the VIN.

As an illustration, a coverage with a excessive protection restrict for collision might need the next premium.

Limitations of Accessing Particular Coverage Data through VIN

Whereas the VIN offers important entry to coverage particulars, limitations exist. Not all coverage info is available by the VIN alone. Some information, reminiscent of claims historical past, may be restricted for privateness causes or as a result of it is solely accessible by a devoted buyer portal. This can be a essential level to recollect.

Desk of Accessible Coverage Particulars by VIN

| Coverage Element | Instance |

|---|---|

| Policyholder’s Title | John Smith |

| Coverage Efficient Dates | 01/01/2024 – 12/31/2024 |

| Forms of Protection | Legal responsibility, Collision, Complete |

| Protection Limits | $100,000 for bodily damage legal responsibility |

| Deductibles | $500 for collision |

| Premiums | $150 per 30 days |

Notice: The particular particulars accessible might differ relying on the insurance coverage supplier and the extent of entry granted.

VIN-Based mostly Insurance coverage Declare Course of

Submitting an insurance coverage declare, particularly after a fender-bender or a extra severe incident, can really feel like navigating a bureaucratic maze. Thankfully, the VIN, that distinctive identifier on your car, can streamline the method, making it much less of a headache and extra of a manageable process. Consider the VIN as your car’s passport, immediately verifying its id and historical past to the insurance coverage firm.The VIN performs a vital function in validating the car’s particulars and making certain correct declare processing.

It serves as a key component in confirming the car’s possession, mannequin, and any pre-existing harm, serving to insurance coverage adjusters to evaluate the declare promptly and pretty. This streamlined strategy typically results in quicker declare decision.

Steps Concerned in Submitting a Declare

The declare course of, although typically a aggravating expertise, is surprisingly easy when the VIN is used as a information. First, promptly notify your insurance coverage firm concerning the accident or harm. A transparent description of the incident, together with the date, time, location, and any witnesses, is vital. Subsequent, collect all related documentation, together with police experiences (if relevant), restore estimates, and photographs of the harm.

Bear in mind, the extra detailed the data, the smoother the method.

Reporting an Accident or Injury Utilizing a VIN

To expedite the method, present the VIN together with all the main points. This permits the insurance coverage firm to immediately entry your coverage info and start the analysis. This verification step ensures that the declare is processed effectively and that each one needed info is available. Your VIN is your car’s distinctive identifier, appearing as a key to unlock your coverage info and expedite the declare course of.

Affect of VIN Verification on Declare Processing Time

The VIN verification course of, like a well-oiled machine, can dramatically scale back declare processing time. By immediately confirming the car’s particulars and coverage protection, the insurance coverage firm can provoke the declare settlement a lot quicker. This effectivity interprets to a faster decision for you, permitting you to get again on the highway (or not less than get the repairs achieved) sooner.

In lots of circumstances, this course of can save days and even weeks in comparison with conventional declare processing strategies.

Declare Situations and Resolutions

Contemplate these situations:* Situation 1: A driver experiences a minor scratch on their automotive. Offering the VIN together with the photographs and a short description permits the insurance coverage firm to confirm the car’s particulars and approve the declare shortly. A easy, easy course of with a constructive consequence.* Situation 2: A extra advanced accident involving a number of autos.

The VIN helps in figuring out the concerned autos, confirming their possession, and verifying protection particulars, permitting for a quicker and extra correct settlement for all events.

VIN-Based mostly Insurance coverage Declare Course of Levels, Automotive insurance coverage by vin quantity

| Stage | Motion |

|---|---|

| Reporting | Notify insurance coverage firm of incident, present VIN. |

| Verification | Insurance coverage firm verifies VIN, coverage particulars. |

| Evaluation | Insurance coverage adjuster assesses harm, gathers proof. |

| Approval/Denial | Insurance coverage firm approves or denies the declare. |

| Settlement | Fee for repairs, or different compensation. |

VIN and Insurance coverage Fraud

The Car Identification Quantity (VIN) is an important instrument for insurers, appearing as a novel fingerprint for every car. Sadly, unscrupulous people typically try to use the system, resulting in fraudulent insurance coverage claims. Understanding how VINs are utilized in these schemes is crucial for each policyholders and insurance coverage corporations to guard towards these fraudulent actions.VINs are meticulously built-in into insurance coverage databases, making a complete document of auto possession and historical past.

This permits insurers to immediately confirm a car’s id and historical past, which is essential in stopping fraudulent claims. The usage of VIN verification techniques considerably reduces the probabilities of claims being made on stolen or broken autos.

The Position of VINs in Stopping Insurance coverage Fraud

VINs function a vital element in combating insurance coverage fraud. Their distinctive nature and traceable historical past are key to verifying a car’s id, historical past, and present standing. This helps to determine fraudulent claims making an attempt to misuse or manipulate VINs for insurance coverage fraud. Insurers leverage VIN info to confirm the legitimacy of claims, mitigating the chance of payouts on fictitious occasions.

Strategies Used to Detect Fraudulent Claims Involving VIN Manipulation

Insurers make use of refined strategies to detect fraudulent claims involving VIN manipulation. These strategies typically mix information evaluation, historic data checks, and direct investigation. A mixture of those strategies considerably reduces the prospect of fraud being profitable.

- Information Evaluation: Insurance coverage corporations analyze claims information, searching for patterns or anomalies that would point out fraudulent exercise. For instance, a sudden surge in claims for a particular mannequin 12 months of a car would possibly set off an investigation. Uncommon declare frequency, coupled with comparable descriptions, might be a pink flag.

- Historic Data Checks: Insurers totally examine the car’s historical past utilizing databases that document car titles, registrations, and prior harm claims. Discrepancies on this information can reveal inconsistencies and alert investigators to potential fraud.

- Direct Investigation: Insurance coverage corporations might straight contact car house owners, dealerships, and restore retailers to confirm the main points of a declare. This course of ensures that the declare particulars align with the car’s documented historical past.

Penalties for Insurance coverage Fraud Involving VINs

Insurance coverage fraud, particularly that involving VIN manipulation, is a severe offense with extreme penalties. These penalties differ by jurisdiction however typically contain hefty fines and potential imprisonment. These sanctions deter people from participating in such fraudulent actions.

Penalties for insurance coverage fraud involving VIN manipulation are important and differ primarily based on the particular laws in every jurisdiction.

Examples of Actual-World Circumstances The place VINs Had been Utilized in Insurance coverage Fraud Schemes

A number of real-world circumstances display how VINs could be manipulated in insurance coverage fraud schemes. These examples spotlight the significance of sturdy verification processes to forestall fraudulent actions.

- Car Cloning: In a single occasion, a felony gang cloned a VIN, making a stolen car seem as if it belonged to an harmless get together. This allowed them to file fraudulent claims for harm to the car, making the most of the insurance coverage system.

- Fictitious Injury Claims: One other case concerned submitting false claims for harm to a car utilizing a manipulated VIN. By altering the VIN to match a special car, they efficiently collected insurance coverage payouts.

Desk of Insurance coverage Fraud Schemes and VIN Involvement

The desk beneath illustrates how VINs are concerned in numerous insurance coverage fraud schemes.

| Scheme | Position of VIN |

|---|---|

| Car Cloning | The VIN is altered to make a stolen car seem authentic, permitting fraudulent claims. |

| Fictitious Injury Claims | The VIN is used to create false data of harm, permitting claims for repairs that didn’t happen. |

| Stolen Car Claims | A stolen car’s VIN is used to file a declare for harm or theft, whereas the precise car stays stolen. |

Future Developments in VIN and Insurance coverage

The way forward for automotive insurance coverage is trying extra like a high-tech, data-driven detective company than a easy paperwork train. VIN numbers, these seemingly innocuous alphanumeric strings, are poised to play a pivotal function on this transformation, providing a glimpse right into a world the place insurance coverage is as personalised as your favorite pair of sneakers.The intricate dance between VINs and insurance coverage is about to develop into much more intricate.

Insurance coverage corporations might be leveraging the huge trove of information related to every VIN to not solely assess danger extra exactly but in addition to tailor insurance policies to the particular wants and traits of particular person autos. This might be a game-changer for each insurers and policyholders.

Predicting Future Use of VIN Numbers

The utilization of VIN numbers in insurance coverage isn’t just a development; it is a structural shift. Insurers will probably combine VIN information into their predictive modeling, analyzing elements like car make, mannequin, 12 months, and even particular options to evaluate the chance of accidents and different claims. This proactive strategy will permit insurers to precisely predict danger and alter premiums accordingly.

Contemplate a state of affairs the place a particular mannequin of a sports activities automotive demonstrates the next fee of accidents on account of aggressive driving kinds; this information, coupled with the VIN, will allow extra focused pricing.

Affect of Know-how on VIN-Based mostly Insurance coverage Processes

Technological developments will considerably streamline VIN-based insurance coverage processes. Think about a future the place a car’s VIN routinely triggers a customized coverage upon registration. The usage of blockchain know-how will allow the safe and clear change of VIN-related information between numerous stakeholders, fostering belief and effectivity. Furthermore, AI-powered techniques will be capable of analyze huge quantities of information related to VINs, facilitating speedy declare assessments and decreasing the effort and time concerned in your complete course of.

Rising Developments in Insurance coverage Insurance policies Tied to VINs

Insurance coverage insurance policies tied to VINs might be shifting towards higher customization. This implies insurance policies will adapt to particular options of a car, just like the presence of superior driver-assistance techniques or specialised security gear. The coverage will routinely alter primarily based on the VIN, doubtlessly reducing premiums for autos outfitted with superior security options. This dynamic adaptation is a key component within the evolution of insurance coverage.

Enhancing Coverage Customization with VINs

VINs provide a strong instrument for customizing insurance coverage insurance policies. A coverage for a classic sports activities automotive might need a special premium construction than a contemporary household sedan. The VIN will permit for tailor-made protection, premium changes, and even particular add-ons, reminiscent of enhanced roadside help, tailor-made to the actual car. This personalised strategy displays a shift in the direction of extra granular danger evaluation.

Bettering Threat Evaluation Accuracy with VIN Information

Utilizing VIN information to enhance danger evaluation accuracy is an important step. Analyzing information from numerous sources, together with VIN-related accident experiences and upkeep data, will present a extra complete view of a car’s historical past. This may assist insurers make extra correct danger assessments, resulting in fairer and extra clear pricing. A car with a historical past of upkeep points, for instance, would possibly set off the next premium than a meticulously maintained car.

Final Level

In brief, utilizing VIN numbers for automotive insurance coverage makes issues a lot smoother and safer. It helps keep away from confusion, velocity up declare processes, and protects everybody concerned. So, realizing your VIN is an important step for getting the most effective automotive insurance coverage expertise doable. It is like having a super-powered good friend in your facet, ensuring all the things is dealt with completely!

Solutions to Widespread Questions: Automotive Insurance coverage By Vin Quantity

What if I haven’t got my VIN quantity?

No drawback! You may often discover it in your automotive’s title, registration, and even on the automotive itself. Simply verify round and you’ll find it!

How lengthy does it take to get insurance coverage info through VIN?

Often, it is fairly quick. Insurance coverage corporations have techniques in place to get this info shortly. You may often get your particulars inside a couple of minutes or hours.

Can I take advantage of my VIN to verify if my insurance coverage coverage is legitimate?

Sure! Your VIN helps confirm your coverage’s particulars and guarantee it is up-to-date. It is a dependable strategy to verify your protection continues to be energetic.

What if I am concerned in an accident, and have to file a declare? How can VIN be helpful?

Offering your VIN is essential for correct declare processing. It helps insurance coverage corporations determine the car and the coverage particulars linked to it, making the entire declare course of a lot quicker.