Low cost South Dakota automotive insurance coverage is an important consideration for drivers within the state. Navigating the marketplace for inexpensive protection requires understanding the nuances of the South Dakota auto insurance coverage panorama, together with components influencing charges, coverage sorts, and out there reductions. This information dives deep into methods for locating the perfect offers, inspecting the impression of driving data, car sorts, and even credit score scores on premiums.

We’ll additionally discover important tricks to handle your prices and assets for acquiring additional info.

South Dakota’s insurance coverage market, whereas providing choices, may be complicated. This information empowers you to make knowledgeable choices, making certain you discover probably the most appropriate protection on the best worth.

Understanding South Dakota Automotive Insurance coverage Market

South Dakota’s automotive insurance coverage market operates inside a framework influenced by components like state laws, driver demographics, and the aggressive panorama of insurance coverage suppliers. Understanding these parts is essential for shoppers searching for inexpensive and complete protection. Navigating the complexities of the market can result in higher knowledgeable choices when selecting a coverage.The South Dakota auto insurance coverage panorama is characterised by a mixture of aggressive pricing and controlled requirements.

The general price of insurance coverage is impacted by quite a lot of components that affect premiums. Shoppers want to pay attention to these influences to know their insurance coverage choices and select the perfect plan for his or her particular person wants.

Components Influencing Automotive Insurance coverage Charges in South Dakota

A number of key components contribute to the price of automotive insurance coverage in South Dakota. These components may be broadly categorized to achieve a greater understanding of how they have an effect on pricing. These components aren’t remoted and might work together in complicated methods to find out the ultimate premium.

- Driving Historical past: A driver’s historical past, together with previous accidents, claims, and violations, performs a big function in figuring out their insurance coverage premium. A clear driving report typically ends in decrease charges, whereas a historical past of incidents can result in larger premiums. For example, a driver with a number of dashing tickets would possibly face larger premiums in comparison with a driver with a clear report.

- Demographics: Age, gender, location, and car sort can even have an effect on insurance coverage charges. Youthful drivers typically pay larger premiums than older drivers attributable to statistically larger accident charges. Geographic location can even impression charges relying on the realm’s accident frequency. For instance, rural areas may need totally different charges than city areas. Moreover, the kind of car, comparable to a sports activities automotive versus a sedan, can affect the premium attributable to potential restore prices and danger evaluation.

- Protection Choices: The chosen stage of protection, together with legal responsibility, collision, and complete, impacts the general premium. Larger protection ranges typically lead to larger premiums. This relationship is necessary to think about as a way to select the perfect protection stage for the motive force’s wants.

- Insurance coverage Firm: Completely different insurance coverage corporations in South Dakota could have various pricing methods and monetary stability, which influences the premium. Shoppers ought to evaluate quotes from numerous corporations to seek out the perfect worth.

Sorts of Automotive Insurance coverage Obtainable in South Dakota, Low cost south dakota automotive insurance coverage

South Dakota’s auto insurance coverage market presents numerous forms of protection. Understanding these sorts is essential to creating knowledgeable choices.

- Legal responsibility Protection: That is the minimal protection required by South Dakota legislation, defending the insured in opposition to claims of bodily damage or property harm precipitated to others in an accident. It does not cowl the insured’s personal damages.

- Collision Protection: The sort of protection pays for damages to your car no matter who’s at fault in an accident. It’s typically a further choice to legal responsibility insurance coverage.

- Complete Protection: This protection protects in opposition to harm to your car attributable to components past accidents, comparable to climate occasions, vandalism, or theft. It supplies further safety in opposition to surprising damages.

- Uninsured/Underinsured Motorist Protection: This protects the insured in case of an accident involving a driver with inadequate or no insurance coverage. It supplies monetary help if the opposite driver’s insurance coverage is inadequate to cowl all damages.

Driving Historical past and Demographics in Insurance coverage Pricing

South Dakota insurance coverage corporations use driving historical past and demographic info to evaluate danger and set premiums. This info is crucial to calculate the chance of an accident and the potential severity of the damages. Youthful drivers and people with a historical past of accidents, violations, or claims are normally assigned a better danger issue.

- Driving Historical past: A driver’s previous report, together with accidents, violations, and claims, considerably influences the insurance coverage premium. A clear report typically ends in decrease charges, whereas a historical past of incidents can result in larger charges.

- Demographics: Age, gender, and site are additionally necessary components in danger evaluation. Youthful drivers are statistically extra prone to be concerned in accidents and due to this fact face larger premiums. This displays an accepted correlation within the insurance coverage business.

Laws Governing Auto Insurance coverage in South Dakota

South Dakota has particular laws relating to the forms of protection required and the minimal limits. Understanding these laws is crucial for compliance and to keep away from penalties.

- Minimal Protection Necessities: South Dakota mandates particular minimal protection limits for legal responsibility insurance coverage, offering a baseline for monetary safety.

- Insurance coverage Firm Licensing: The state licenses and regulates insurance coverage corporations working inside its borders to make sure client safety.

Common Prices of Automotive Insurance coverage in South Dakota

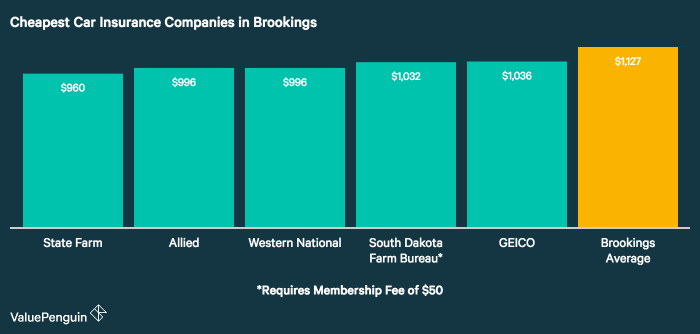

The common price of automotive insurance coverage in South Dakota varies throughout demographics and components like driving historical past and protection choices. There isn’t any single definitive determine, however numerous reviews present traits in pricing primarily based on the precise particulars.

Potential Reductions for South Dakota Automotive Insurance coverage Insurance policies

A number of reductions can be found for South Dakota automotive insurance coverage insurance policies, which might considerably cut back premiums. Profiting from these reductions can result in appreciable financial savings.

- Protected Driving Reductions: Corporations typically provide reductions to drivers with a clear driving report, demonstrating secure driving practices.

- Multi-Coverage Reductions: Acquiring a number of insurance coverage insurance policies (comparable to automotive and residential insurance coverage) from the identical firm may end up in a reduction.

- Bundled Companies Reductions: Bundling different providers, like roadside help, can even yield reductions.

Insurance coverage Corporations Working in South Dakota

The desk under lists some insurance coverage corporations working in South Dakota, together with their rankings, buyer critiques, and protection choices.

| Insurance coverage Firm | Ranking | Buyer Opinions | Protection Choices |

|---|---|---|---|

| Instance Firm 1 | Glorious | Optimistic | Complete |

| Instance Firm 2 | Good | Blended | Legal responsibility, Collision, Complete |

| Instance Firm 3 | Glorious | Optimistic | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist |

Figuring out Low cost Insurance coverage Choices

Navigating the South Dakota automotive insurance coverage market may be daunting, however discovering inexpensive protection is achievable with strategic planning. Understanding the assorted components influencing premiums and using sensible comparability strategies can result in substantial financial savings. This part delves into sensible methods for securing low-cost insurance coverage.South Dakota’s insurance coverage market, like others, is influenced by components comparable to driving data, car sort, and site.

Shoppers can take proactive steps to scale back their insurance coverage prices by understanding these influences and making use of the methods Artikeld on this part.

Comparability Web sites and Instruments

On-line comparability instruments streamline the method of discovering probably the most aggressive charges. These platforms combination quotes from a number of insurers, permitting you to shortly assess totally different choices.A number of in style web sites provide free quotes from a number of suppliers. These websites act as intermediaries, saving you effort and time in accumulating info from numerous insurance coverage corporations. Examples embody Insurify, Policygenius, and others.

Utilizing these instruments, you may instantly evaluate insurance policies from totally different corporations in South Dakota and discover the best option.

Negotiating Insurance coverage Charges

Negotiating your automotive insurance coverage charges is a viable technique. Insurance coverage corporations typically provide reductions or alter premiums primarily based on particular circumstances. Contacting your present insurer and inquiring about potential charge reductions is a proactive step.A proactive method can yield advantages. Demonstrating accountable driving habits, like a clear driving report or a secure driving course completion, can enhance your negotiating energy.

Keep in mind to be ready to debate your scenario and current supporting documentation to again your case.

Bundling Insurance policies

Bundling a number of insurance coverage insurance policies, comparable to house and auto insurance coverage, can ceaselessly result in vital financial savings. Insurance coverage corporations typically provide reductions for patrons who mix their insurance policies. This bundling technique can considerably cut back the general price of insurance coverage.Bundling insurance policies with the identical insurance coverage supplier can unlock substantial financial savings. It’s because insurers typically view bundling as a approach to retain clients and encourage long-term relationships.

Impression of Protection Ranges

The extent of protection chosen instantly impacts your premium. Primary protection insurance policies sometimes price lower than complete or collision insurance policies. Understanding the various kinds of protection is crucial for selecting the best stage of safety and balancing price with satisfactory safety.Primary protection, whereas extra inexpensive, won’t totally defend you within the occasion of an accident or harm.

Complete protection protects in opposition to harm from perils like climate or vandalism. Collision protection protects in opposition to harm attributable to an accident. The premium will replicate the added protection.

Insurance coverage Firm Comparability

Completely different insurance coverage corporations have various pricing fashions and approaches. Evaluating their insurance policies, specializing in components like customer support rankings, monetary stability, and claims dealing with processes can assist you discover a appropriate insurer.Evaluating numerous insurance coverage corporations can reveal disparities in pricing. For example, an organization would possibly provide decrease premiums for primary protection however larger premiums for complete protection. Contemplate the steadiness between worth and the protection wanted.

Use a comparability desk to judge totally different insurance policies from numerous suppliers.

Surprising Worth Will increase

Varied components can result in surprising will increase in your automotive insurance coverage premiums. Modifications in your driving report, comparable to a site visitors ticket or accident, or alterations to your car, like putting in costly upgrades, can affect your premium.Accidents and transferring to a higher-risk space can result in surprising worth will increase. For instance, transferring to a area with a better accident charge or a better variety of site visitors incidents would possibly impression your premium.

Insurance coverage Supplier Comparability Desk

| Insurance coverage Firm | Primary Protection | Complete Protection | Premium (Instance) |

|---|---|---|---|

| Firm A | $500 | $750 | $120/month |

| Firm B | $600 | $800 | $115/month |

| Firm C | $450 | $650 | $105/month |

This desk supplies a simplified instance. Premiums can fluctuate primarily based on particular person circumstances. At all times get quotes instantly from the insurance coverage corporations for correct pricing.

Components Affecting Automotive Insurance coverage Premiums in South Dakota

South Dakota’s automotive insurance coverage market, like others, is influenced by a fancy interaction of things. Understanding these parts is essential for securing inexpensive protection. This evaluation delves into the important thing determinants of insurance coverage prices within the state.

Driving Document Impression

A driver’s historical past considerably impacts their insurance coverage premium. A clear driving report, free from accidents and violations, sometimes ends in decrease premiums. Conversely, drivers with a historical past of site visitors violations, particularly transferring violations or accidents, face larger insurance coverage prices. The severity of the violations and the frequency of occurrences instantly affect the premium enhance. For example, a driver with a number of dashing tickets or an at-fault accident will seemingly expertise a better premium than a driver with no such incidents.

Insurance coverage corporations use statistical fashions to evaluate danger primarily based on driving data.

Automobile Kind and Worth Affect

The sort and worth of the car play a vital function in figuring out insurance coverage premiums. Excessive-performance automobiles like sports activities vehicles typically carry a better premium because of the perceived danger of harm or theft. Equally, the worth of the car impacts the fee. A high-value car will sometimes require a better premium, because the potential loss is larger.

For instance, a luxurious sports activities automotive insured for $100,000 may have a considerably larger premium than a regular sedan insured for $20,000, reflecting the distinction in potential losses. SUVs, whereas typically perceived as extra sturdy, may also carry larger premiums than sedans relying on the precise mannequin and options.

Location and Demographics Impact

Geographic location and demographic components additionally have an effect on automotive insurance coverage premiums in South Dakota. Areas with larger crime charges or a higher focus of accidents are likely to have larger insurance coverage prices. Demographic components, comparable to age and gender, can even impression premiums. Youthful drivers, as an illustration, typically pay larger premiums than older drivers attributable to a statistically larger accident charge.

Moreover, the realm’s historic accident traits and the variety of insured drivers in a particular geographic space affect the insurance coverage charges.

Claims Historical past Impact

A driver’s claims historical past is a key determinant of insurance coverage prices. Drivers with a historical past of submitting claims, whether or not for accidents or harm, sometimes face larger premiums. The frequency and severity of claims considerably impression the calculated danger. Insurance coverage corporations analyze the main points of previous claims to evaluate the chance of future claims. A driver who has filed a number of claims for property harm or bodily damage would possibly see a considerable enhance of their premiums.

Comparability of Automobile Sorts

The price of insurance coverage varies significantly between totally different car sorts. For example, a sports activities automotive will sometimes have a better premium than a compact sedan attributable to its larger potential worth and perceived danger. SUVs typically have premiums larger than comparable sedans because of the elevated danger of harm and damage. The precise mannequin, options, and security rankings of every car can even have an effect on the premium.

Insurance coverage corporations use information evaluation to find out the typical danger related to totally different car sorts.

Credit score Rating Affect

Credit score scores can surprisingly affect automotive insurance coverage premiums. Drivers with larger credit score scores typically obtain decrease premiums, as they’re perceived as much less prone to interact in dangerous behaviors. That is typically attributed to the correlation between monetary duty and secure driving. A robust credit score rating demonstrates monetary stability, which insurance coverage corporations contemplate a constructive issue.

Automobile Security Options Affect

Automobiles outfitted with superior security options, comparable to airbags, anti-lock brakes, and digital stability management, typically qualify for decrease insurance coverage premiums. These options cut back the chance of accidents and accidents, making them a good issue for insurance coverage corporations. Insurance coverage corporations typically use car security rankings from organizations just like the Insurance coverage Institute for Freeway Security (IIHS) to find out the impression of security options on premiums.

Impression of Varied Components on Insurance coverage Premiums

| Issue | Description | Impression on Premium |

|---|---|---|

| Driving Document | Quantity and severity of site visitors violations | Larger violations, larger premium |

| Automobile Kind | Efficiency, measurement, and worth | Excessive-performance automobiles, larger premiums |

| Location | Crime charges, accident frequency | Excessive-risk areas, larger premiums |

| Claims Historical past | Frequency and severity of previous claims | Larger claims, larger premiums |

| Credit score Rating | Monetary duty | Larger credit score rating, decrease premiums |

| Automobile Security Options | Presence of security gear | Superior security, decrease premiums |

Suggestions for Managing Automotive Insurance coverage Prices

Controlling your automotive insurance coverage premiums includes proactive steps to keep up a secure driving report, cut back accident dangers, and choose acceptable protection. Understanding the components influencing premiums and implementing methods to attenuate them can considerably decrease your total insurance coverage prices. This part particulars sensible strategies for reaching cost-effective automotive insurance coverage.

Sustaining a Good Driving Document

A clear driving report is paramount for reaching decrease insurance coverage charges. Constant adherence to site visitors legal guidelines and secure driving practices instantly impacts your insurance coverage premium. Avoiding site visitors violations, comparable to dashing, working pink lights, or reckless driving, is essential for sustaining a good driving report.

- Frequently assessment your driving habits and determine areas for enchancment. Pay shut consideration to your velocity, following distances, and lane adjustments.

- Search suggestions from passengers or make the most of driving apps to determine potential areas for enchancment.

- Make the most of know-how to assist in driving safely, comparable to superior driver-assistance techniques (ADAS).

- If potential, enroll in defensive driving programs to refine your expertise and enhance your driving report.

Lowering Automotive Insurance coverage Premiums

Reducing your automotive insurance coverage premiums includes a mix of methods. These methods embody each proactive measures and knowledgeable decisions about your protection.

- Evaluation your present coverage commonly to determine any pointless protection or outdated choices.

- Store round for aggressive charges from numerous insurance coverage suppliers. Examine quotes to seek out the perfect worth to your protection wants.

- Contemplate growing your deductible. Larger deductibles sometimes lead to decrease premiums, however be ready to pay a bigger quantity out-of-pocket in case you file a declare.

- Make the most of reductions which may be out there, comparable to reductions for good college students or for secure driving.

- Consider the necessity for complete protection and contemplate the prices of such choices, whereas making certain the automotive is sufficiently protected in opposition to potential damages.

Minimizing the Threat of Accidents

Proactive measures to scale back the chance of accidents are essential for minimizing insurance coverage prices.

- Keep a secure following distance to stop rear-end collisions. This permits for satisfactory response time in case of surprising conditions.

- Keep away from distractions whereas driving, comparable to utilizing a cellphone or consuming.

- Concentrate on your environment and anticipate potential hazards. Take note of the street situations and site visitors circulate.

- Drive cautiously in antagonistic climate situations, comparable to rain or snow. Scale back your velocity and enhance following distance.

- Be sure that your car is correctly maintained to keep away from mechanical points which will result in accidents.

Complete Protection Significance

Complete protection protects your car from non-collision damages. Understanding the worth of this protection and its significance is vital in managing insurance coverage prices successfully.

- Complete protection is significant for safeguarding your car in opposition to dangers like vandalism, fireplace, or hail harm.

- This protection supplies monetary safety for restore or alternative prices, avoiding vital out-of-pocket bills.

- Assess the potential dangers related along with your car and site to find out the need of complete protection.

Security-Targeted Driving Type Advantages

A security-conscious driving type is essential for lowering accident dangers and reducing insurance coverage premiums.

- Sustaining a secure driving type includes constantly following site visitors legal guidelines, driving at acceptable speeds, and avoiding distractions.

- Defensive driving strategies assist anticipate potential hazards and reply safely, minimizing the chance of accidents.

- Training defensive driving strategies can result in fewer accidents, which finally ends in decrease insurance coverage premiums.

Preventative Automotive Upkeep Examples

Common preventative upkeep is essential for stopping pricey repairs and minimizing insurance coverage claims.

- Common tire rotations and strain checks assist guarantee tire longevity and stop blowouts.

- Correct brake upkeep can keep away from brake failure, a big security hazard.

- Engine oil adjustments and filter replacements are important for sustaining optimum engine efficiency and lowering the chance of engine failure.

- Correct fluid checks (coolant, energy steering) are essential for avoiding mechanical breakdowns and potential accidents.

Automotive Insurance coverage Coverage Evaluation Guidelines

A guidelines for reviewing your present coverage ensures that you’ve got acceptable protection and aren’t overpaying.

- Evaluation your protection limits and deductibles to find out in the event that they align along with your present wants.

- Assess the necessity for extra protection choices, comparable to roadside help or rental automotive protection.

- Examine your present coverage with quotes from different suppliers to determine potential price financial savings.

- Confirm that your coverage contains all related reductions that you could be qualify for.

Evaluating and Adjusting Protection

Adapting your protection to match your evolving wants is crucial for optimum insurance coverage administration.

- Consider adjustments in your driving habits, comparable to elevated mileage or frequency of driving.

- Assess your monetary scenario to find out the suitable deductible stage.

- Contemplate any adjustments in your car, comparable to including security options or upgrading to a more moderen mannequin.

- Re-evaluate your protection periodically to make sure that your insurance coverage coverage adequately protects your monetary pursuits.

Assets for South Dakota Automotive Insurance coverage Info: Low cost South Dakota Automotive Insurance coverage

Navigating the South Dakota automotive insurance coverage panorama can really feel overwhelming. Nonetheless, with the proper assets, you may make knowledgeable choices and safe the absolute best protection at a good worth. Understanding your choices empowers you to safe inexpensive and dependable safety to your car.Realizing the place to seek out dependable info is essential. This part supplies a roadmap that can assist you discover the assets you’ll want to evaluate insurance policies, perceive your choices, and get probably the most worth out of your insurance coverage.

Respected Insurance coverage Corporations in South Dakota

South Dakota boasts a various vary of insurance coverage suppliers, every with its personal strengths and customer support approaches. Selecting a good firm ensures you are working with a financially steady group dedicated to buyer satisfaction. Components to think about embody their monetary power rankings, buyer critiques, and out there protection choices. Some distinguished corporations working in South Dakota embody State Farm, Geico, Allstate, Liberty Mutual, and Progressive.

State Authorities Web sites for Automotive Insurance coverage Info

The South Dakota Division of Insurance coverage supplies essential info on insurance coverage laws, client rights, and out there assets. The division’s web site serves as a central hub for understanding the state’s insurance coverage framework and its impression on policyholder rights. Accessing this info instantly from the supply ensures you are working with probably the most up-to-date and correct information.

Client Safety Businesses in South Dakota

Client safety businesses play a significant function in safeguarding policyholders’ rights and pursuits. These businesses examine complaints, mediate disputes, and guarantee insurers adjust to state laws. Realizing the place to show for help when points come up is crucial. The South Dakota Legal professional Common’s Workplace typically handles client safety inquiries associated to insurance coverage issues.

Unbiased Comparability Web sites for Automotive Insurance coverage Quotes

On-line comparability instruments are invaluable assets for acquiring a number of insurance coverage quotes from numerous suppliers. These websites assist you to enter your particular wants and obtain tailor-made quotes from a number of corporations, enabling a complete comparability of pricing and protection choices. This method is extremely environment friendly for locating probably the most aggressive charges. Websites like Insurify, Policygenius, and others are glorious examples.

Trusted Client Advocacy Teams in South Dakota

Client advocacy teams typically provide invaluable help and steerage to people navigating insurance coverage complexities. These teams present assets, info, and help to assist shoppers perceive their rights and make knowledgeable choices. Contacting such teams can assist tackle any issues or questions on particular insurance coverage conditions.

Studying the Fantastic Print of Insurance coverage Insurance policies

Insurance coverage insurance policies are detailed authorized paperwork, and understanding the fantastic print is crucial. Fastidiously reviewing coverage phrases and situations ensures you perceive what’s and is not coated. Reviewing exclusions, deductibles, and protection limits are paramount for making knowledgeable decisions.

Evaluating Completely different Insurance coverage Sorts and Protection

Understanding the nuances of various insurance coverage sorts and their related coverages is crucial. Legal responsibility protection protects you from monetary duty for accidents you trigger, whereas collision protection covers harm to your car no matter fault. Complete protection protects in opposition to harm attributable to issues like climate, vandalism, or theft. Examine the assorted coverages to determine the most suitable choice to your wants and funds.

Regularly Requested Questions on South Dakota Automotive Insurance coverage

| Query | Reply |

|---|---|

| What are the minimal insurance coverage necessities in South Dakota? | South Dakota mandates legal responsibility insurance coverage protection. Minimal protection necessities are Artikeld on the state’s Division of Insurance coverage web site. |

| How do I file a declare in South Dakota? | Submitting a declare is a structured course of Artikeld in your coverage paperwork. Contact your insurer to know the precise declare procedures. |

| What components have an effect on my insurance coverage premium? | Components comparable to your driving report, car sort, location, and age can affect your insurance coverage premium. |

Consequence Abstract

In conclusion, securing low-cost South Dakota automotive insurance coverage includes a multifaceted method. Understanding the market, exploring out there reductions, and actively managing your driving report and car upkeep are key steps. By diligently evaluating quotes, negotiating charges, and utilizing assets like comparability web sites, drivers can discover inexpensive insurance policies that align with their wants. Do not forget that cautious consideration and proactive measures are important for reaching cost-effective insurance coverage in South Dakota.

Query Financial institution

What are widespread components that have an effect on automotive insurance coverage charges in South Dakota?

Driving historical past (accidents, violations), car sort and worth, location, claims historical past, credit score rating, and security options all impression premiums.

How can I discover low-cost automotive insurance coverage in South Dakota?

Use comparability web sites, negotiate charges with insurers, contemplate bundling insurance policies, and discover totally different protection ranges.

What forms of reductions can be found for South Dakota automotive insurance coverage?

Reductions typically embody these for good driving data, a number of insurance policies, security options, and driver coaching.

What are the laws governing auto insurance coverage in South Dakota?

Particular laws relating to minimal protection necessities and coverage specifics may be discovered on the South Dakota Division of Insurance coverage web site.