Do I’ve to have insurance coverage to register my automobile? This can be a essential query for anybody trying to hit the street within the US. It is all about understanding the foundations, and we’ll break it down in an excellent chill method, so you’ll be able to navigate the registration course of like a professional. Completely different states have totally different guidelines, and the method can get a bit difficult, however we’ll make it straightforward to know.

From legal responsibility to collision, we’ll clarify the varied forms of insurance coverage and why they matter.

We’ll additionally take a look at exceptions, waivers, and even various insurance coverage choices. Plus, we’ll share an excellent helpful information on truly register your journey, step-by-step. Prepare to beat automobile registration with confidence!

Authorized Necessities for Automobile Registration

Navigating the intricate world of car registration within the US can really feel like deciphering a posh authorized code. Completely different states have various necessities, and understanding these nuances is essential for avoiding expensive errors. This part particulars the authorized panorama, emphasizing the need of insurance coverage and the potential penalties of non-compliance.

State-Particular Automobile Registration Necessities

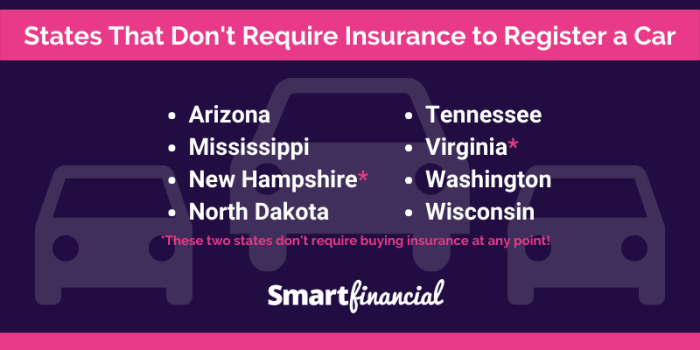

The authorized framework for automobile registration shouldn’t be uniform throughout the US. Every state establishes its personal algorithm, influencing elements comparable to insurance coverage requirements and penalties for violations. This variability underscores the significance of verifying particular laws within the state the place you plan to register your automobile.

Insurance coverage Necessities for Automobile Registration

Insurance coverage is regularly a compulsory element of car registration in most US states. The precise sorts and ranges of protection required differ primarily based on the state, and failure to fulfill these requirements can lead to vital repercussions.

Comparability of Insurance coverage Necessities in Key States

| State | Insurance coverage Requirement | Penalty for Non-Compliance | Further Notes |

|---|---|---|---|

| California | Proof of monetary duty, sometimes a minimal legal responsibility protection. Particular particulars are topic to alter. | Potential fines, suspension of car registration, and doable authorized motion. | California has particular necessities relating to uninsured/underinsured motorist protection, which can be factored into the registration course of. |

| Texas | Proof of monetary duty, usually requiring legal responsibility insurance coverage. Coverage particulars are topic to frequent updates. | Fines, potential suspension of driver’s license, and difficulties in acquiring future registrations. | Texas regulation mandates particular minimal legal responsibility insurance coverage protection, and failure to conform can lead to speedy penalties. |

| New York | Proof of monetary duty, often requiring legal responsibility insurance coverage with a specified minimal protection. | Fines, potential suspension of car registration, and the necessity to rectify the scenario to regain registration. | New York’s laws typically evolve, so all the time seek the advice of the newest official pointers for probably the most present info. |

Sorts of Insurance coverage

Choosing the proper automobile insurance coverage can really feel like navigating a maze, but it surely’s a vital step in defending your automobile and your self. Understanding the varied forms of protection out there empowers you to make an knowledgeable choice, making certain you are adequately shielded from potential monetary burdens. Completely different protection ranges have implications to your automobile registration course of, so understanding the specifics is vital.

Automobile Insurance coverage Protection Choices

Completely different insurance coverage insurance policies provide various levels of safety. The secret’s to know the nuances of every sort to tailor your protection to your wants and finances. This complete overview will spotlight the totally different choices out there, permitting you to make the only option to your automobile and your monetary well-being.

Legal responsibility Insurance coverage

Legal responsibility insurance coverage is probably the most fundamental sort of protection. It protects you in case you’re discovered at fault for an accident and are legally obligated to pay for damages to a different particular person’s automobile or accidents they maintain. The sort of protection sometimes solely pays for damages brought on to others, to not your individual automobile.

Collision Insurance coverage

Collision insurance coverage steps in in case your automobile is broken in an accident, no matter who’s at fault. This protection pays for repairs or alternative of your automobile. It is a crucial layer of safety, because it covers your individual automobile even in case you’re answerable for the accident. Contemplate this insurance coverage in case you worth the safety of your automobile and wish to keep away from monetary losses.

Complete Insurance coverage

Complete insurance coverage supplies broader safety than legal responsibility or collision insurance coverage. It covers damages to your automobile brought on by occasions aside from accidents, comparable to vandalism, theft, fireplace, hail, or climate harm. It is an necessary layer of safety towards unexpected circumstances. Having complete protection can considerably cut back the monetary pressure in case your automobile is broken by one thing past a typical collision.

Comparability of Protection Choices

| Insurance coverage Sort | Protection | Instance State of affairs | Impression on Registration |

|---|---|---|---|

| Legal responsibility | Pays for damages to different individuals’s property or accidents to others in an accident the place you might be at fault. | You rear-end one other automobile. Legal responsibility insurance coverage covers the opposite driver’s damages. | Registration could also be doable, however with situations. Some jurisdictions could require a minimal legal responsibility protection for registration. |

| Collision | Pays for damages to your automobile in an accident, no matter who’s at fault. | You might be concerned in a fender bender and your automobile sustains harm. Collision insurance coverage covers the repairs. | Registration is often in a roundabout way affected by collision protection, however it’s a precious element of a complete safety plan. |

| Complete | Covers damages to your automobile from occasions aside from accidents, like vandalism, theft, fireplace, or climate harm. | Your automobile is vandalized in a single day. Complete insurance coverage covers the harm. | Registration is often in a roundabout way affected by complete protection, but it surely’s a vital a part of an entire safety plan. |

Exceptions and Waivers

Navigating the world of car registration can really feel like deciphering a posh code. Whereas insurance coverage is usually a requirement, there are conditions the place exceptions or waivers may apply. Understanding these nuances can prevent time and trouble, making certain you are following the correct procedures to your particular circumstances.Exceptions to insurance coverage necessities for automobile registration aren’t frequent, however they exist.

They sometimes relate to automobiles used for particular functions, or conditions the place the automobile is not supposed for normal street use. These exceptions are sometimes ruled by state-specific legal guidelines, so consulting your native DMV is essential.

Circumstances Permitting Exceptions

Exceptions to insurance coverage necessities for automobile registration sometimes contain conditions the place the automobile shouldn’t be supposed for normal use on public roads. These can differ by jurisdiction, so it is important to analysis native legal guidelines.

Particular Examples of Exemptions

- Automobiles used for agricultural functions: Tractors, farm gear, and comparable automobiles used solely for farming may be exempt from necessary insurance coverage necessities for registration. The secret’s demonstrating the automobile’s major use is private street operation.

- Automobiles used for historic preservation: Basic or vintage vehicles that aren’t often pushed on public roads could also be exempt. This typically entails documentation proving the automobile’s historic significance and supposed use.

- Automobiles used for non-profit organizations: Some states permit for exemptions for automobiles used for particular non-profit actions that do not contain common public transportation. These organizations typically have to reveal the automobile’s unique use in a method that does not require insurance coverage protection.

- Automobiles utilized in a restricted capability: A automobile used occasionally, maybe just for occasional private transport inside a restricted space, may be excluded from the requirement for necessary insurance coverage. This often entails proving the automobile’s restricted use and lack of public street entry.

Procedures for Acquiring Waivers

Figuring out if an exception applies to your scenario requires cautious overview of native laws. Contact your native Division of Motor Automobiles (DMV) workplace. They’ll present particular details about the required documentation, types, and procedures. Usually, count on to supply documentation proving the automobile’s supposed use and compliance with particular native laws.

Figuring out Applicability

To find out if an exception applies in a selected case, seek the advice of the precise legal guidelines of your state or jurisdiction. Evaluation the language of the legal guidelines rigorously, on the lookout for key phrases that outline eligible automobiles and circumstances. Immediately contacting your native DMV is extremely advisable. They’ll present customized steerage and ensure if the automobile meets the necessities for exemption.

The DMV’s experience in native legal guidelines will assist keep away from misunderstandings.

Registration Course of

Navigating the automobile registration course of can really feel like a maze, however understanding the steps and the position of insurance coverage could make it a lot smoother. It is a essential a part of proudly owning a automobile legally, and getting it proper the primary time saves complications and potential penalties down the street. This part clarifies the usual process and highlights the important connection between insurance coverage and registration.The automobile registration course of is a sequence of steps that have to be adopted to legally function a automobile on public roads.

Appropriately finishing every step is crucial, particularly relating to insurance coverage documentation, which is usually a key requirement for registration.

Normal Registration Steps

The method sometimes entails gathering essential paperwork, finishing purposes, and paying charges. This cautious process ensures that the automobile is correctly documented and its possession is verified.

- Collect required paperwork: This step entails amassing important paperwork, which can embrace the automobile’s title, proof of insurance coverage, and any relevant registration types. It is necessary to verify along with your native Division of Motor Automobiles (DMV) for a whole checklist of required paperwork. This may differ by state.

- Full the appliance: The registration software kind would require details about the automobile, the proprietor, and the insurance coverage coverage. Fastidiously overview the shape to make sure all fields are precisely crammed out. Inaccurate info can delay and even stop registration.

- Pay relevant charges: Registration charges differ by state and the kind of automobile. Fee strategies, comparable to money, verify, or on-line fee, may even rely upon native laws.

- Submit paperwork and software: Submit the finished software kind, together with the required supporting paperwork, to the designated DMV workplace. Be sure that to double-check that every part is so as earlier than submitting to keep away from any issues.

Insurance coverage’s Function in Registration

Insurance coverage performs a pivotal position within the automobile registration course of. It is a basic requirement in most jurisdictions.

Proof of insurance coverage is a compulsory a part of the registration course of. This demonstrates that the automobile proprietor has legal responsibility protection in place, defending each themselves and others on the street.

Dealing with Insurance coverage Documentation

The precise dealing with of insurance coverage documentation throughout registration varies barely from state to state, however there are commonalities.

- Proof of Insurance coverage: Sometimes, the proof of insurance coverage is a certificates or a doc from the insurance coverage firm confirming the coverage particulars and protection. That is typically a bodily doc or an digital copy. It is important to make sure that is legitimate and updated.

- Coverage Particulars: The registration course of typically requires particulars in regards to the insurance coverage coverage, such because the policyholder’s identify, the coverage quantity, and the efficient dates. These particulars verify that protection is lively through the registration course of.

Step-by-Step Automobile Registration Process (Insurance coverage Focus)

This process Artikels the steps concerned in registering a automobile, emphasizing the position of insurance coverage.

- Collect essential paperwork: This contains the automobile’s title, proof of insurance coverage, registration software kind, and any extra documentation required by the DMV.

- Receive insurance coverage: Guarantee you might have a sound and lively insurance coverage coverage for the automobile. Contact your insurance coverage supplier to get a proof of insurance coverage doc or equal.

- Full the registration software: Fill out the appliance precisely and utterly. Embody the insurance coverage coverage particulars just like the coverage quantity and efficient dates.

- Pay relevant charges: Pay the registration charges and some other related prices. Fee strategies are sometimes detailed by the DMV.

- Submit the paperwork: Submit all required paperwork, together with the proof of insurance coverage, to the designated DMV workplace.

- Obtain the registration: As soon as the DMV approves the registration, you’ll obtain your automobile registration paperwork.

Insurance coverage Suppliers and Sources

Discovering the correct automobile insurance coverage can really feel like navigating a maze, but it surely does not should be daunting. With some research and sensible comparability methods, you will discover an inexpensive coverage that matches your wants. Figuring out the choices out there and evaluate them is vital to getting the very best deal.

Frequent Insurance coverage Suppliers within the US

A number of main insurance coverage corporations dominate the market, every with its strengths and weaknesses. Components like your driving historical past, location, and automobile sort will affect which insurance policies are finest for you. Understanding the frequent gamers out there provides you a place to begin to your analysis.

- State Farm:

- Progressive:

- Allstate:

- Geico:

- Nationwide:

- Liberty Mutual:

A big, well-established firm recognized for its broad protection choices and intensive community. They provide a variety of plans for various wants.

Recognized for its revolutionary strategy to automobile insurance coverage and infrequently aggressive charges, particularly for good drivers. They typically use know-how to tailor plans to particular person conditions.

One other main participant providing varied protection choices, typically emphasizing customer support.

Typically famous for its decrease premiums, particularly for younger or secure drivers.

Recognized for its complete insurance policies and numerous merchandise, interesting to numerous driving profiles and wishes.

Providing quite a lot of plans, recognized for his or her dedication to customer support and a user-friendly on-line expertise.

Discovering Insurance coverage Choices

Many avenues exist for locating appropriate automobile insurance coverage. A radical search may help you establish a coverage that meets your finances and wishes. Figuring out your particular wants and necessities is essential to getting the most effective insurance coverage choice.

- On-line Comparability Instruments:

- Impartial Brokers:

- Insurance coverage Brokers:

- Direct from Insurance coverage Corporations:

Web sites devoted to evaluating insurance coverage quotes streamline the method. These instruments collect quotes from a number of suppliers, making the choice course of extra environment friendly and permitting for straightforward comparability of assorted choices.

Impartial brokers work with a number of insurance coverage corporations, permitting them to current a spread of choices tailor-made to particular person circumstances. They’ll present customized steerage and make sure you perceive the implications of various insurance policies.

Brokers are much like brokers, however typically focus on discovering probably the most inexpensive choices. They sometimes have entry to a wider community of insurers and might present an summary of assorted insurance policies.

Giant insurance coverage corporations typically have on-line portals the place you’ll be able to evaluate insurance policies and acquire quotes straight. This feature will be fast and handy, however understanding the intricacies of the varied insurance policies is crucial.

Sources for Evaluating Insurance coverage Quotes, Do i’ve to have insurance coverage to register my automobile

Evaluating insurance coverage quotes is essential for getting the very best deal. By utilizing varied sources, you will discover the optimum protection and value.

- Insurify:

- Policygenius:

- Insure.com:

- NerdWallet:

- ValuePenguin:

This well-liked comparability web site aggregates quotes from quite a few suppliers, making it straightforward to match varied choices and discover a appropriate coverage.

A user-friendly platform permitting you to match varied insurance policy and insurance policies with ease.

Offers a complete platform for evaluating automobile insurance coverage quotes from varied suppliers.

A trusted monetary useful resource providing instruments to match insurance coverage charges and insurance policies, serving to you to make knowledgeable choices.

One other comparability web site that assists find the most effective automobile insurance coverage choices by amassing quotes from a number of insurance coverage suppliers.

Web sites Offering Insurance coverage Quotes

A variety of internet sites provide the comfort of evaluating automobile insurance coverage quotes. These websites streamline the method and will let you simply get hold of varied quotes from a number of suppliers.

- Insurify.com:

- Policygenius.com:

- Insure.com:

- NerdWallet.com:

- ValuePenguin.com:

This web site gives complete insurance coverage comparability instruments.

Offers an intuitive platform to match quotes from varied insurers.

An internet site with a user-friendly interface for evaluating insurance coverage insurance policies.

Provides quite a lot of monetary instruments, together with automobile insurance coverage comparability instruments.

A comparability web site that assists find inexpensive automobile insurance coverage choices.

Current Adjustments and Updates

Navigating the ever-shifting panorama of car registration and insurance coverage can really feel like a relentless puzzle. Current legislative modifications are impacting the method, typically making it extra advanced. Understanding these updates is essential for easily registering your automobile and making certain compliance with the regulation.

Legislative Adjustments Affecting Automobile Insurance coverage Necessities

Current legislative modifications have launched new standards for automobile insurance coverage necessities. These modifications are designed to enhance street security and monetary safety for all drivers. These modifications can embrace stricter pointers on minimal protection quantities, new forms of necessary insurance coverage, or the addition of particular protection for sure circumstances.

Impression on the Registration Course of

These changes to insurance coverage necessities straight have an effect on the automobile registration course of. The DMV or equal registration company now must confirm compliance with the up to date laws earlier than issuing a registration. This implies candidates should present proof of insurance coverage assembly the present requirements to finish the registration. Failure to fulfill the brand new necessities will result in delays or rejection of the registration software.

New Rules and Interpretations of Present Legal guidelines

A number of new laws have been launched, altering the interpretation of present legal guidelines relating to automobile insurance coverage. These could embrace stricter penalties for driving with out sufficient insurance coverage, modifications to the definition of “sufficient” protection, or extra detailed stipulations relating to the forms of protection required for various automobile sorts or driving conditions. There might also be new interpretations of pre-existing legal guidelines.

Abstract of Impression on Insurance coverage Wants for Automobile Registration

The latest legislative modifications considerably influence the insurance coverage wants for automobile registration. Drivers should now safe insurance coverage that exactly meets the up to date necessities, as this can be a essential issue within the registration course of. This may increasingly contain acquiring extra protection or reviewing present insurance policies to make sure they align with the newest laws. Understanding the specifics of those updates and the way they relate to your automobile is important.

A radical overview of your insurance coverage coverage is advisable to keep away from potential registration points.

Illustrative Situations: Do I Have To Have Insurance coverage To Register My Automobile

Navigating the world of car registration can really feel like a maze, particularly with regards to insurance coverage. This part will break down real-life conditions, highlighting when insurance coverage is essential for registration and when it is not, providing a sensible information to make sure you’re heading in the right direction. Understanding these situations will empower you to make knowledgeable choices about your automobile’s registration.

Insurance coverage Necessity for Registration

Insurance coverage is usually a prerequisite for registering a automobile. This can be a crucial security measure, making certain that within the occasion of an accident, the damages are coated. With out insurance coverage, registration authorities are unable to ensure the safety of different street customers.

- A driver causes an accident and damages one other automobile. With out insurance coverage, the motive force could be answerable for all the value of the harm. Registration with out insurance coverage wouldn’t defend the sufferer.

- A automobile is concerned in a collision. The proprietor’s legal responsibility insurance coverage covers damages to the opposite get together’s automobile, in addition to any accidents sustained. With out insurance coverage, the motive force might face extreme monetary repercussions.

- A driver’s automobile is stolen. Insurance coverage covers the price of changing the automobile, together with any potential damages to different property or people. This can be a essential facet of car possession and registration.

Conditions The place Insurance coverage May Not Be Required (Exceptions)

Whereas insurance coverage is often necessary, there are exceptions. These sometimes contain automobiles used for particular functions or that fall underneath explicit authorized frameworks.

- Vintage or Collectible Automobiles: Some jurisdictions could permit registration of vintage or collectible automobiles with out necessary insurance coverage if they aren’t pushed often. Nonetheless, particular laws differ by state and native legal guidelines. All the time confirm the laws.

- Automobiles Used Solely for Off-Street Actions: Automobiles primarily used for off-road actions may need totally different insurance coverage necessities, and even exemptions, relying on the jurisdiction. Examine native laws.

- Automobiles Registered for Particular Functions: Some automobiles, like these used solely for agricultural or farming functions, could have totally different insurance coverage necessities and even be exempt from commonplace insurance coverage necessities. Seek the advice of your native DMV.

Case Examine: Automobile Registration and Insurance coverage

A latest case concerned a younger driver, Sarah, who needed to register her new automobile. She was required to acquire legal responsibility insurance coverage to adjust to the state’s laws. Sarah’s insurance coverage firm offered her with a coverage, outlining the protection and phrases. With out this insurance coverage, Sarah’s automobile registration software wouldn’t be accepted by the Division of Motor Automobiles.

State of affairs: Insurance coverage Dispute and Registration

A house owner, Mark, had his automobile registered with out legal responsibility insurance coverage. Later, his automobile was concerned in an accident, inflicting harm to a different automobile. The opposite driver’s insurance coverage firm sought compensation from Mark for the damages. Mark was unable to supply protection, and the case went to court docket. The court docket dominated in favor of the opposite driver’s insurance coverage firm, emphasizing the necessary nature of legal responsibility insurance coverage for automobile registration.

Alternate options to Conventional Insurance coverage

Discovering the correct automobile insurance coverage can typically really feel like navigating a maze. However concern not, fashionable drivers! There are sometimes alternative routes to fulfill your automobile registration necessities past the standard insurance coverage insurance policies. These alternate options may contain totally different approaches, every with its personal algorithm and laws. Let’s discover a few of these choices.Past the acquainted insurance policies, varied alternate options exist for assembly insurance coverage wants when registering a automobile.

These alternate options typically include particular situations and should not all the time relevant in all circumstances. Understanding the nuances of every various is essential to make sure a clean and compliant registration course of.

Self-Insured Standing

Self-insurance, whereas not a typical alternative for automobile registration, can exist in sure conditions. This feature entails assuming the monetary duty for potential damages or claims. It is necessary to notice that self-insurance is usually coupled with a excessive stage of private monetary threat.

Bonding Choices

Surety bonds are monetary assurances, basically promising to pay for damages within the occasion of an accident. This strategy is usually a substitute for conventional insurance coverage. The surety bond quantity is often decided by the state and primarily based on the automobile’s worth and use. A good bonding firm handles the main points of this course of. For instance, companies typically make the most of bonds as a technique to guard themselves towards legal responsibility for potential harm.

Monetary Accountability Legal guidelines

Monetary duty legal guidelines, various by state, dictate the minimal monetary safety wanted to make sure compensation for accident-related damages. In some jurisdictions, assembly the necessities for monetary duty could contain offering a certificates of insurance coverage or a surety bond. This demonstrates a dedication to fulfilling potential liabilities. For example, if a driver causes harm, the monetary duty regulation ensures the accountable get together has the funds to cowl it.

State-Particular Waivers

Sure states could provide waivers or exceptions to the usual insurance coverage necessities for automobile registration. These waivers are sometimes tailor-made to particular circumstances, like for classic or vintage automobiles. The precise situations and necessities for these waivers differ extensively.

Circumstances Requiring Alternate options

In some circumstances, people may select or be required to make use of alternate options to conventional insurance coverage. These conditions typically embrace particular forms of automobiles, comparable to classic vehicles, which might not be coated by commonplace insurance coverage insurance policies. Additional, sure conditions, like a short lived or restricted use automobile, may fall outdoors of conventional insurance coverage protection.

Authorized Implications

The authorized implications of utilizing various strategies to conventional insurance coverage are essential. Failure to adjust to the precise necessities of the choice chosen can lead to penalties. Reviewing and understanding the authorized necessities related to every various is paramount. For example, an incorrectly accomplished bond kind or a missed deadline might result in registration points. It is strongly recommended to seek the advice of with authorized professionals or state companies for detailed steerage.

Remaining Conclusion

So, do you want insurance coverage to register your automobile? The quick reply is usually sure, however the particulars differ by state. This information has given you a complete overview of the ins and outs of car insurance coverage and registration, overlaying every part from authorized necessities to the registration course of. Understanding the specifics in your state is vital, so all the time double-check along with your native DMV.

Now you are geared up to make knowledgeable choices and register your automobile easily. Joyful driving!

FAQ Overview

Is insurance coverage required for all sorts of automobiles?

Usually, sure, however there may be exceptions for sure automobiles, like vintage or traditional vehicles. All the time verify your state’s particular guidelines.

What occurs if I haven’t got insurance coverage when registering?

You may face penalties, like fines and even suspension of your registration. The severity is dependent upon the state and the specifics of the violation.

What are the variations in insurance coverage necessities between states?

Insurance coverage necessities differ considerably from state to state. Some states have stricter guidelines than others. The offered Artikel will show you how to get extra particulars on particular states.

Can I get a short lived registration with out insurance coverage?

In some instances, you may be capable of get a short lived registration, however this typically is dependent upon the precise circumstances and laws in your state. Examine along with your native DMV for extra info.