Michigan automobile insurance coverage improve 2024 is a big concern for drivers throughout the state. Rising premiums are impacting affordability and driving habits. Components like inflation, accident charges, and altering rules are all enjoying a task on this upward development. Understanding the nuances behind these will increase is essential for navigating the complexities of the insurance coverage market and mitigating potential monetary burdens.

This complete evaluation explores the multifaceted drivers behind the anticipated rise in Michigan automobile insurance coverage premiums for 2024. We’ll delve into the historic context, look at potential catalysts for elevated charges, and examine the precise components impacting varied demographics. Moreover, we’ll equip readers with methods to handle these rising prices and navigate the more and more complicated panorama of automobile insurance coverage in Michigan.

Overview of Michigan Automotive Insurance coverage Market

The Michigan automobile insurance coverage panorama has undergone important shifts in recent times, mirroring broader financial traits and evolving driving habits. Premiums have exhibited a posh sample, influenced by quite a lot of components. Understanding these components and evaluating Michigan’s charges to these in different states offers helpful context for deciphering the present market circumstances.Michigan’s automobile insurance coverage charges have demonstrated a fluctuating historical past, with durations of each will increase and reduces.

The state’s distinctive mixture of demographics, driving circumstances, and regulatory surroundings performs an important position in shaping these fluctuations. Understanding the historic context permits for a extra nuanced evaluation of present traits and future projections.

Historic Overview of Michigan Automotive Insurance coverage Premiums

Michigan’s automobile insurance coverage premiums have been topic to a variety of influences, from financial downturns to legislative adjustments. Analyzing historic knowledge offers insights into the components contributing to those fluctuations.

Components Influencing Michigan Automotive Insurance coverage Charges

A number of components have persistently influenced Michigan’s automobile insurance coverage premiums. These embrace:

- Frequency and Severity of Accidents: The quantity and severity of site visitors accidents instantly correlate with insurance coverage prices. Elevated accident charges result in larger claims payouts, consequently elevating premiums for all policyholders. For instance, elevated distracted driving incidents, as a result of cell phone utilization, have been proven to considerably affect accident charges.

- Financial Situations: The state’s general financial local weather has a direct bearing on insurance coverage charges. During times of financial prosperity, folks are likely to drive extra, rising demand for insurance coverage. Conversely, financial downturns can affect people’ capability to afford insurance coverage, resulting in potential adjustments in charges.

- Legislative Modifications: Modifications to state legal guidelines relating to insurance coverage necessities and protection can considerably affect charges. For instance, the introduction of latest security rules or adjustments to no-fault legal guidelines can instantly affect premium quantities.

- Claims Prices: The prices related to claims processing and payouts play a pivotal position in figuring out insurance coverage charges. Claims involving intensive damages or medical bills can drive up general prices.

- Driver Demographics: Components just like the age, driving historical past, and site of drivers may also have an effect on insurance coverage premiums. Youthful drivers, as an illustration, are likely to have larger accident charges and subsequently pay larger premiums.

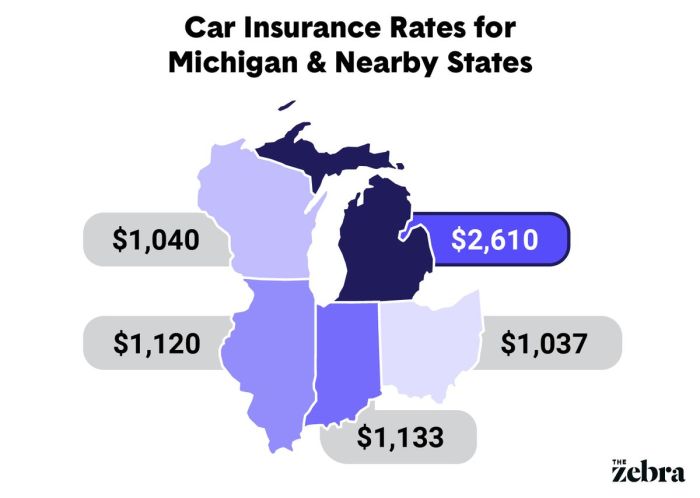

Comparability of Michigan Automotive Insurance coverage Charges to Different States

Michigan’s automobile insurance coverage charges are regularly in comparison with these in neighboring and different states. This comparative evaluation reveals each similarities and distinctions. Michigan’s charges will be affected by components like common annual miles pushed, state rules, and the price of healthcare, amongst others.

- Common Charges: Michigan’s common charges usually fall inside the nationwide vary, though particular charges can differ primarily based on particular person components.

- State Laws: Variations in state rules relating to insurance coverage protection and necessities can considerably affect the price of premiums throughout states. These rules usually differ enormously, impacting charges in several areas.

- Value of Healthcare: The price of healthcare can instantly affect insurance coverage charges, notably in states with larger medical prices. Greater medical bills in claims are a big think about general insurance coverage prices.

Financial Local weather in Michigan and its Potential Influence on Insurance coverage Prices

Michigan’s financial local weather, together with its employment charges, trade combine, and revenue ranges, can affect insurance coverage prices. Financial downturns can doubtlessly lower client spending, which might, in flip, affect the demand for insurance coverage. Conversely, durations of financial development could lead to elevated driving exercise, and therefore, larger insurance coverage premiums.

Key Traits Noticed in Michigan’s Automotive Insurance coverage Market

The Michigan automobile insurance coverage market has skilled a number of key traits:

- Shifting Demographics: The altering demographics of the state, together with the rising variety of younger drivers or drivers with particular danger components, have a direct affect on premiums.

- Technological Developments: Technological developments, comparable to telematics-based insurance coverage packages, are altering how insurance coverage is evaluated and priced, doubtlessly decreasing charges for protected drivers.

- Rising Consciousness of Insurance coverage Choices: Customers are more and more conscious of assorted insurance coverage choices, resulting in extra knowledgeable selections relating to protection and prices.

Potential Drivers of Elevated Charges in 2024

Michigan’s auto insurance coverage panorama is poised for a interval of potential premium changes in 2024. A number of components are converging to create a posh image, influencing the affordability and accessibility of protection for drivers. Understanding these dynamics is essential for each shoppers and insurance coverage suppliers.The present financial local weather, coupled with evolving rules and claims traits, is shaping the way forward for auto insurance coverage prices in Michigan.

Inflation’s relentless climb and its affect on restore prices, alongside an increase in accidents, are important issues. Additional complicating issues are adjustments in state legal guidelines and the shifting availability of insurance coverage suppliers, all of which contribute to the anticipated fluctuations in insurance coverage charges.

Inflation’s Influence on Insurance coverage Prices

Rising inflation instantly impacts the price of repairs and components wanted for autos broken in accidents. The elevated costs of supplies, labor, and alternative elements translate instantly into larger insurance coverage claims. This inflationary stress is just not distinctive to Michigan; comparable traits are noticed throughout varied US areas. For instance, the price of a normal restore job may improve by 15-20% year-over-year as a result of inflation.

This, in flip, forces insurance coverage corporations to regulate their premiums to keep up profitability.

Rising Accident Charges in Michigan

A discernible improve in accident charges in Michigan is one other potential driver of premium will increase. A number of contributing components could also be at play, together with altering driving habits, street circumstances, and driver habits. The frequency of accidents instantly influences the quantity of claims that insurance coverage corporations must settle. A sustained rise in accident charges will nearly definitely result in larger premiums to offset the price of elevated claims.

Information from the Michigan State Police or different comparable businesses might provide perception into these traits.

Modifications in State Laws and Legal guidelines

State rules and legal guidelines play an important position in shaping the panorama of Michigan’s auto insurance coverage market. Any changes in these areas, both in present rules or the introduction of latest ones, can affect premiums. For instance, new rules relating to distracted driving, or enhanced security options in autos, could introduce further prices for insurers. A complete assessment of not too long ago enacted or proposed laws, like necessary driver education schemes or enhanced inspection requirements, could be useful.

Modifications within the Availability of Insurance coverage Suppliers

The provision of insurance coverage suppliers in Michigan is one other key issue. A lower within the variety of insurers working within the state, or a discount in competitors, could lead to a discount of aggressive pricing, which in the end might drive premiums up. A shortage of suppliers may power the remaining corporations to regulate their charges with a view to stay financially viable.

Potential Impacts of Pure Disasters on Michigan’s Automotive Insurance coverage Market

Whereas Michigan is just not a high-risk space for main pure disasters, the opportunity of extreme climate occasions, like heavy storms, floods, or hailstorms, exists. These occasions can result in a big spike in claims, particularly in areas liable to such incidents. The affect of those occasions on insurance coverage charges will depend on the frequency and severity of those occurrences.

For instance, hailstorms could cause widespread harm to autos, leading to a considerable improve in claims and, consequently, premiums.

Comparability with Comparable Traits in Different Areas

Comparable traits in different areas, such because the rising prices of repairs and components, or the rise in accident charges, are indicative of broader nationwide financial pressures. Analyzing these traits throughout varied areas permits for a extra nuanced understanding of the components contributing to rising premiums. A comparability of Michigan’s knowledge with these of neighboring states or different areas with comparable demographics would reveal helpful insights.

Particular Components Impacting Charges in 2024

Michigan’s automobile insurance coverage panorama is poised for shifts in 2024, pushed by a posh interaction of things. Modifications in driving habits, restore prices, technological developments, and claims traits are all contributing to the evolving pricing construction. Understanding these nuances is essential for each shoppers and insurance coverage suppliers.The dynamic nature of the trendy insurance coverage market necessitates a eager consciousness of those forces.

Adapting to those shifts will probably be important for sustaining affordability and making certain a strong and resilient insurance coverage ecosystem in Michigan.

Automobile Utilization Patterns and Their Influence

Shifting patterns in automobile utilization are considerably affecting insurance coverage premiums. The rise of distant work has led to a discount in every day commutes for a lot of, but elevated weekend driving and occasional longer journeys. This modification in utilization patterns is just not uniformly distributed, with various impacts throughout completely different demographics and areas. Whereas some areas may expertise a lower in premiums as a result of lowered commuting, others may see a rise as a result of elevated weekend driving or higher-risk longer journeys.

This variability underscores the significance of localized knowledge evaluation in figuring out the exact results on premiums.

Restore Prices and Availability

The provision and prices of auto repairs play a pivotal position in insurance coverage charges. Shortages of expert mechanics, components, and inflation-driven worth will increase for supplies are all contributing to larger restore prices. These escalating prices translate instantly into larger insurance coverage premiums, as insurers must issue within the potential for extra intensive and costly claims. Examples embrace the rise within the worth of components like catalytic converters and the elevated labor prices for repairs, necessitating elevated reserve funds for insurers.

Influence of New Automotive Applied sciences

The proliferation of latest automobile applied sciences, together with superior driver-assistance programs (ADAS), is having a posh impact on insurance coverage charges. Whereas ADAS options can scale back accidents, the elevated price of those options can result in an increase in insurance coverage premiums, relying on the precise know-how and protection. Moreover, the elevated complexity of recent autos could make repairs dearer and time-consuming, contributing to the general price of claims.

Claims Frequency and Severity

Claims frequency and severity are essential components in calculating insurance coverage charges. A rise in accidents, whether or not as a result of elevated driving or different components, will inevitably result in larger claims frequency, thus impacting the typical price of premiums. Accidents with larger severity, resulting in important property harm or private damage, can additional exacerbate this development, putting a better monetary burden on insurers and doubtlessly elevating premiums for all drivers.

Information evaluation on accident patterns and severity ranges is important to anticipate and deal with these traits.

Driver Habits Modifications

Driver habits is a key part in assessing danger and figuring out insurance coverage premiums. Modifications in driver habits, comparable to elevated distracted driving, aggressive driving, or the affect of alcohol, can contribute to an increase in accidents and claims frequency. These components are all taken into consideration by insurance coverage suppliers to regulate their danger assessments and doubtlessly improve premiums.

Rising Labor Prices and Their Influence

Rising labor prices instantly affect insurance coverage claims and repairs. Elevated wages for mechanics, technicians, and different restore personnel contribute to the general price of repairing autos. This added expense is mirrored within the insurance coverage premiums, as insurers must account for these price will increase of their pricing fashions. Examples embrace elevated labor charges for auto physique repairs and the prices related to specialised tools required for electrical automobile repairs.

Electrical Autos and Their Affect

The rising adoption of electrical autos (EVs) presents a novel set of challenges for the insurance coverage trade. Whereas EVs usually have fewer transferring components and subsequently doubtlessly fewer restore wants, their battery programs require specialised information and tools. The potential for harm to high-value batteries and the necessity for specialised restore procedures can considerably affect the price of claims, doubtlessly rising premiums.

The restricted variety of restore amenities geared up to deal with EVs is one other issue that contributes to this development.

Insurance coverage Firm Monetary Efficiency

Insurance coverage firm monetary efficiency instantly impacts premiums. Components like profitability, funding returns, and regulatory necessities affect the premiums charged. Robust monetary efficiency by insurance coverage corporations may translate to decrease premiums, whereas weaker monetary efficiency may end up in larger premiums to keep up solvency. The insurance coverage market in Michigan will probably be intently monitored, contemplating the monetary standing of main insurers within the state.

Influence on Customers

The approaching improve in Michigan automobile insurance coverage charges in 2024 presents a big problem for common drivers. This rise, fueled by a confluence of things, will undoubtedly affect the monetary well-being of many Michiganders, notably these in lower-income brackets. Understanding the potential ramifications is essential for proactive measures and knowledgeable decision-making.The monetary pressure of elevated insurance coverage premiums will doubtless be felt disproportionately throughout completely different demographics.

These with decrease incomes and restricted monetary buffers will face probably the most fast and extreme penalties. This might result in a domino impact, doubtlessly impacting their capability to keep up transportation, affecting their job alternatives, and impacting their general monetary stability.

Affordability for Completely different Demographics

The rising price of automobile insurance coverage will disproportionately affect these with decrease incomes, doubtlessly exacerbating present financial disparities. Decrease-income households, already stretched skinny, will battle to soak up the elevated premiums, doubtlessly resulting in delayed or forgone upkeep, lowered driving frequency, and elevated danger of accidents as a result of deferred repairs. For these reliant on their autos for employment, the associated fee improve might imply a lower in incomes potential and even job loss.

Conversely, higher-income people could also be higher geared up to handle the elevated prices, however the general burden on the state’s financial construction will nonetheless be important.

Potential Client Reactions

Customers dealing with larger insurance coverage premiums are prone to react in varied methods. Some could hunt down different transportation choices, comparable to public transportation or ride-sharing providers, to scale back the monetary burden. Others could go for cost-saving measures like lowering driving frequency or driving much less dangerous routes. A good portion of drivers may discover completely different insurance coverage suppliers to check quotes and discover extra inexpensive choices.

One other response could be a shift in the direction of buying inexpensive autos, however this could affect the protection of the driving force and different street customers.

Actions to Handle Insurance coverage Prices

Customers can take proactive steps to mitigate the affect of elevated insurance coverage prices. Evaluating quotes from a number of insurance coverage suppliers is essential, making certain they’re getting the very best charges. Sustaining a clear driving report is paramount, as accident historical past considerably impacts premiums. Taking defensive driving programs may also scale back premiums and enhance driving abilities. Guaranteeing autos are well-maintained and correctly insured may also assist in mitigating dangers.

Lastly, exploring reductions accessible, comparable to these for protected driving or for a number of autos, can provide important financial savings.

Mitigating Elevated Insurance coverage Prices

Insurance coverage corporations can make use of methods to mitigate the consequences of rising prices, comparable to investing in modern security applied sciences, selling defensive driving initiatives, and partnering with native organizations to enhance street security. The state authorities may also play a task in offering monetary help packages for these dealing with hardship as a result of elevated premiums. These initiatives might embrace subsidies, tax breaks, or different monetary aid choices.

Influence on the Michigan Economic system

The elevated price of automobile insurance coverage in Michigan will undoubtedly have an effect on the state’s financial system. Diminished disposable revenue for shoppers might result in decreased spending in varied sectors. Elevated reliance on public transportation or ride-sharing providers might have an effect on the profitability of car-related companies. The general affect on employment and financial development will rely upon the extent of the rise and the measures taken to mitigate the destructive penalties.

The potential financial fallout from elevated automobile insurance coverage charges might ripple all through the Michigan financial system, affecting every little thing from native companies to main industries.

Methods for Navigating Charge Will increase

Navigating rising Michigan automobile insurance coverage charges requires proactive measures and a strategic method. Customers want to grasp the components driving these will increase and make use of efficient methods to seek out probably the most cost-effective protection. This proactive method empowers shoppers to make knowledgeable selections and safe the very best insurance coverage insurance policies.Understanding the nuances of the Michigan automobile insurance coverage market is vital to navigating the complexities of rising charges.

By using comparative evaluation and leveraging accessible assets, shoppers can successfully mitigate the affect of those will increase. This includes a complete understanding of assorted components, from coverage specifics to provider-specific choices.

Evaluating Insurance coverage Charges

A important step in mitigating rising charges is evaluating insurance coverage charges throughout completely different suppliers. This enables shoppers to establish probably the most aggressive pricing and tailor their protection to their particular wants and funds. By evaluating quotes from a number of corporations, shoppers can choose probably the most inexpensive choice. This comparability is just not merely about worth; it additionally encompasses the standard of protection and the popularity of the insurance coverage supplier.

Insurance coverage Supplier Comparability Desk (Instance)

| Insurance coverage Supplier | Base Charge (per yr) | Reductions Out there | Protection Choices | Buyer Service Ranking |

|---|---|---|---|---|

| Progressive | $1,200 | Multi-car, Good Pupil, Defensive Driving | Complete, Collision, Legal responsibility | 4.5 stars |

| State Farm | $1,350 | Multi-car, Good Pupil, Accident Forgiveness | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist | 4.7 stars |

| Allstate | $1,150 | Multi-car, Protected Driver, Bundled Providers | Complete, Collision, Legal responsibility | 4.3 stars |

Be aware: Charges are hypothetical examples and will differ primarily based on particular person components.

The Function of Reductions and Threat-Decreasing Measures, Michigan automobile insurance coverage improve 2024

Reductions play a big position in lowering insurance coverage premiums. By figuring out and using accessible reductions, shoppers can considerably decrease their prices. These reductions are sometimes tied to components like protected driving data, bundled providers, or the presence of a number of autos insured with the identical firm. Moreover, proactive risk-reducing measures, comparable to defensive driving programs or sustaining a clear driving report, can instantly affect premiums.

Detailed Comparability of Protection Choices

Completely different protection choices cater to various wants and danger tolerances. Understanding the precise elements of every protection kind is crucial. Legal responsibility protection protects in opposition to harm to others, whereas complete and collision protection protects the insured automobile. Uninsured/underinsured motorist protection is essential for cover in opposition to accidents involving at-fault drivers with inadequate protection.

Instance Desk of Out there Reductions in Michigan

| Low cost Kind | Description | Potential Financial savings |

|---|---|---|

| Good Pupil | For college students with good grades | 10-20% |

| Multi-Automotive | Insuring a number of autos with the identical firm | 5-15% |

| Protected Driver | For drivers with a clear driving report | 5-10% |

| Bundled Providers | Bundling insurance coverage with different providers like dwelling insurance coverage | 5-10% |

Tricks to Decrease Insurance coverage Premiums

A number of sensible steps might help shoppers scale back their insurance coverage premiums. These measures contain proactive steps to attenuate danger and optimize protection. Sustaining a clear driving report, putting in anti-theft gadgets, and making certain satisfactory safety measures can contribute to decrease premiums. Moreover, reviewing and adjusting protection ranges to align with particular person wants may also result in price financial savings.

- Keep a clear driving report: Keep away from accidents and site visitors violations to keep up a positive driving historical past, which is commonly mirrored in decrease premiums.

- Set up anti-theft gadgets: Safety measures can considerably scale back the chance of theft, doubtlessly resulting in decrease premiums.

- Evaluation and alter protection: Consider your protection wants and alter insurance policies to take away pointless protection and scale back premiums.

- Store round for quotes: Recurrently examine charges from completely different insurance coverage suppliers to make sure you’re getting probably the most aggressive pricing.

Visible Illustration of Information: Michigan Automotive Insurance coverage Improve 2024

Unveiling the intricate tapestry of Michigan’s automobile insurance coverage market requires a visible method. Graphs and charts remodel complicated knowledge into simply digestible insights, permitting us to know the historic traits, regional variations, and contributing components driving charge will increase. This part offers a visible illustration of the info, providing a transparent image of the present state and anticipated way forward for automobile insurance coverage premiums in Michigan.

Historic Traits in Michigan Automotive Insurance coverage Premiums

Visualizing historic traits in Michigan automobile insurance coverage premiums is essential for understanding the present panorama. A line graph depicting premium adjustments over time (e.g., 2010-2023) would clearly illustrate the upward or downward trajectory. This graph ought to spotlight durations of serious fluctuation, doubtlessly linked to financial shifts, legislative adjustments, or main accident traits. For instance, a steep incline between 2020 and 2023 might be attributed to elevated accident charges following the pandemic, or a rising price of restore supplies.

This visible device would provide a helpful benchmark for evaluating the 2024 improve.

Comparability of Automotive Insurance coverage Charges Throughout Michigan Cities

A bar chart evaluating automobile insurance coverage charges throughout completely different Michigan cities would offer a geographically-focused view. Every bar would symbolize a particular metropolis, with the peak instantly correlating to the typical premium. This visible illustration would spotlight the discrepancies in charges between city and rural areas, doubtlessly revealing correlations with inhabitants density, accident frequency, or particular danger components distinctive to specific cities.

For instance, Detroit may present larger premiums in comparison with Traverse Metropolis as a result of various crime charges or accident statistics.

Components Contributing to Michigan Automotive Insurance coverage Will increase

A pie chart illustrating the components contributing to Michigan automobile insurance coverage will increase would break down the elements. Every slice would symbolize a contributing issue, comparable to rising restore prices, rising frequency of accidents, or adjustments in legal responsibility claims. The relative dimension of every slice would display the magnitude of every affect. For example, a big slice representing rising restore prices would point out that this issue performs a dominant position in premium will increase.

Predicted Improve in Charges for 2024

A line graph projecting the anticipated improve in charges for 2024 could be a helpful forecasting device. The graph would show the anticipated premium improve over time, doubtlessly illustrating completely different situations primarily based on varied assumptions. This might incorporate components like projected inflation charges, accident traits, or adjustments in laws. For instance, the graph may present a projected improve of 10-15% in charges for 2024, in comparison with 2023.

Influence of Threat Components on Premiums

A scatter plot illustrating the affect of various danger components on premiums would visually symbolize the connection between these components. This plot would characteristic every danger issue (e.g., driving report, age, automobile kind) as a degree on a graph. The x-axis might symbolize the chance issue, and the y-axis might symbolize the corresponding premium. This could visually illustrate the correlation between a driver’s danger profile and the ensuing premium, offering an simply understandable overview of the complicated relationship.

For instance, a driver with a poor driving report could be plotted with a considerably larger premium than a driver with a clear report.

Epilogue

In conclusion, the Michigan automobile insurance coverage improve in 2024 presents a posh and multifaceted problem for drivers. Understanding the interaction of financial forces, regulatory adjustments, and evolving driving behaviors is important for mitigating the affect on particular person budgets and the broader Michigan financial system. This evaluation has highlighted the important thing components behind the projected improve and offered actionable methods for shoppers to navigate these difficult instances.

FAQ Abstract

What are the most typical causes for the rise in automobile insurance coverage charges in Michigan in 2024?

A number of components contribute to the projected improve, together with inflation, rising accident charges, adjustments in state rules, and the affect of latest applied sciences on automobile utilization and restore prices. Moreover, the financial local weather in Michigan and the efficiency of insurance coverage corporations additionally play a big position.

How will this improve have an effect on completely different demographics in Michigan?

The affect will differ primarily based on components like location, driving historical past, and automobile kind. Decrease-income drivers and people in particular high-risk areas could expertise a disproportionately larger burden. Moreover, the affordability of assorted protection choices could develop into a important difficulty.

Are there any reductions accessible to assist mitigate the affect of rising automobile insurance coverage premiums in Michigan?

Sure, varied reductions can be found, comparable to these for protected driving, multi-car insurance policies, and anti-theft gadgets. Customers ought to actively discover these choices and examine charges from completely different suppliers to seek out probably the most inexpensive protection.

What are some steps I can take to decrease my automobile insurance coverage premiums in Michigan?

Sustaining a superb driving report, putting in anti-theft gadgets, and exploring reductions are key methods. Evaluating quotes from a number of insurance coverage suppliers and reviewing your present protection choices are additionally vital steps.