North Carolina minimal automotive insurance coverage: It is a must-know for any driver within the Tar Heel State. Navigating the principles and choices can really feel like making an attempt to determine the most recent TikTok development, nevertheless it would not need to be a headache. This information breaks down the necessities, from the naked minimal to additional protection choices, serving to you make knowledgeable choices about your safety.

Understanding your state’s minimal insurance coverage necessities is vital to staying on the proper aspect of the legislation. This is not nearly avoiding fines; it is about defending your self and others on the highway. Understanding the main points will provide help to make sensible selections when choosing your protection.

Minimal Necessities

Navigating the world of automotive insurance coverage can really feel overwhelming, particularly in the case of understanding the minimal necessities. Understanding the mandated protection ranges in North Carolina empowers you to make knowledgeable choices about your safety and monetary safety. This part clarifies the required protection quantities for varied automobile sorts, serving to you select the proper insurance coverage plan.North Carolina mandates a particular degree of legal responsibility insurance coverage to guard drivers and their autos in case of an accident.

The state-mandated minimums are designed to supply a baseline of monetary accountability. Understanding these necessities helps you keep away from penalties and guarantee your monetary obligations are met within the occasion of a declare.

Bodily Damage Legal responsibility

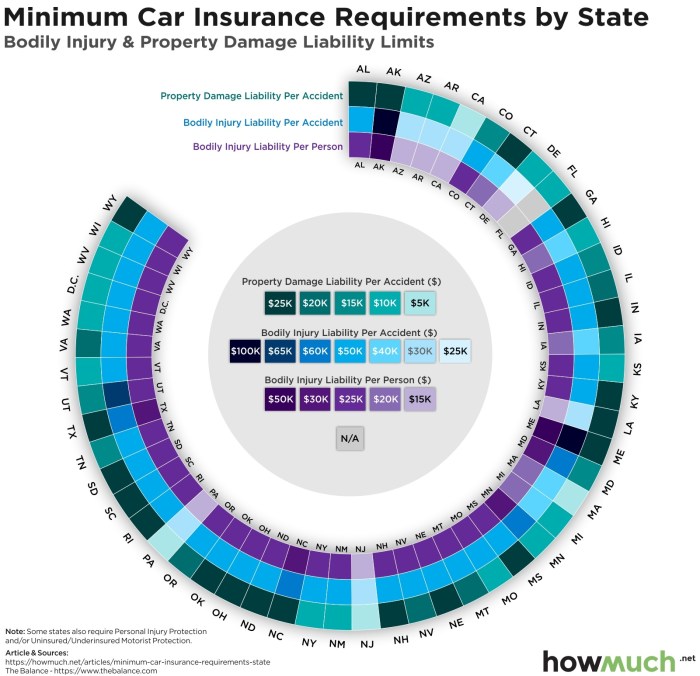

North Carolina requires a minimal of $30,000 per particular person and $60,000 per accident for bodily harm legal responsibility protection. Which means in case your actions end in accidents to others in an accident, your insurance coverage should cowl as much as $30,000 for every injured particular person and as much as $60,000 in complete for all injured events in a single accident. This quantity is essential, as medical bills and misplaced wages can rapidly exceed these minimums.

Subsequently, drivers ought to contemplate growing their protection to raised defend themselves and others.

Property Injury Legal responsibility

Property injury legal responsibility protection is one other essential element of North Carolina’s minimal necessities. The state mandates a minimal of $25,000 in protection for injury to a different particular person’s property. This implies your insurance coverage pays as much as $25,000 to restore or exchange the broken property of one other particular person if you’re at fault in an accident. Selecting greater limits for property injury legal responsibility is advisable, as automobile repairs and alternative prices can simply exceed the minimal protection quantity.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is a crucial addition to your coverage. This protection safeguards you and your automobile when you’re concerned in an accident with a driver who would not have insurance coverage or would not have sufficient insurance coverage to cowl the damages. North Carolina mandates this protection to supply monetary safety for you within the occasion of an accident involving an at-fault uninsured driver.

With out this protection, you could be left to pay for important damages your self.

Bike Insurance coverage

Bikes require comparable minimal protection ranges as different autos, although the specifics might differ based mostly on the insurance coverage supplier. It is essential to verify along with your supplier to make sure you have enough protection to fulfill the state’s necessities. Since bikes are sometimes extra susceptible in accidents, a better degree of protection is commonly beneficial.

Business Automobile Insurance coverage

Business autos, similar to vehicles or supply vans, usually require greater minimal protection quantities than private autos. These autos pose a better threat in accidents, and due to this fact greater insurance coverage limits are mandatory. Companies should seek the advice of with insurance coverage suppliers to make sure compliance with North Carolina’s particular necessities for business autos.

Comparability Desk

| Protection Kind | Minimal Quantity |

|---|---|

| Bodily Damage Legal responsibility | $30,000 per particular person, $60,000 per accident |

| Property Injury Legal responsibility | $25,000 |

| Uninsured/Underinsured Motorist | North Carolina mandates this protection, particular quantities differ by coverage. |

Protection Choices Past Minimums

Whereas North Carolina’s minimal automotive insurance coverage necessities provide a primary degree of safety, they usually fall wanting totally safeguarding your monetary well-being and your automobile within the occasion of an accident. Selecting protection quantities greater than the minimums gives a considerable security internet, and understanding the varied choices out there can empower you to make knowledgeable choices that align along with your particular person wants and monetary state of affairs.

Advantages of Greater Protection Quantities

Choosing protection quantities exceeding the minimums in North Carolina considerably enhances your safety. Greater legal responsibility limits present extra monetary cushion when you’re accountable for damages or accidents in an accident. This may stop you from being held personally responsible for quantities exceeding your coverage limits.

Significance of Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is essential. It safeguards you and your automobile towards drivers missing enough insurance coverage or these with no insurance coverage in any respect. In these eventualities, your personal coverage steps in to cowl your losses, guaranteeing you are not left with substantial monetary burdens within the occasion of an accident brought on by a negligent or uninsured driver.

Legal responsibility Protection and Defending Towards Claims

Legal responsibility protection acts as a important defend towards claims from others concerned in accidents. It covers damages you trigger to a different particular person’s property or accidents you inflict on them. This protection is crucial for authorized safety and monetary accountability within the occasion of a mishap.

Comparability of Insurance coverage Choices

North Carolina gives varied insurance coverage choices past the minimums, permitting drivers to customise their safety based mostly on their particular person wants and funds. Understanding the nuances of every possibility is paramount to creating probably the most appropriate alternative.

Further Protection Choices

| Protection Choice | Description | Potential Advantages |

|---|---|---|

| Collision | Covers damages to your automobile no matter who triggered the accident. | Protects your funding in your automobile and minimizes out-of-pocket bills in case of an accident. This protection is particularly helpful when you’re concerned in an accident the place you’re at fault. |

| Complete | Covers injury to your automobile from occasions aside from collisions, similar to vandalism, hearth, or theft. | Gives peace of thoughts and monetary safety towards unexpected occasions that may injury your automobile. Complete protection will be particularly useful for autos parked in high-risk areas or these with a better worth. |

| Uninsured/Underinsured Motorist | Covers your damages if you’re concerned in an accident with a driver who has inadequate or no insurance coverage. | Gives essential safety towards monetary spoil if you’re injured or your automobile broken by a driver missing enough insurance coverage. It acts as a security internet in conditions the place the at-fault driver’s insurance coverage is insufficient to cowl your losses. |

Implications of Not Assembly Necessities

Failing to keep up enough automotive insurance coverage in North Carolina can result in a cascade of unfavourable penalties, starting from hefty fines to severe authorized bother. Understanding these implications is essential for accountable drivers to keep away from potential pitfalls. Understanding the repercussions helps you make knowledgeable choices about your insurance coverage protection.Ignoring the minimal insurance coverage necessities in North Carolina can have far-reaching results, impacting not solely your pockets but additionally your private security and freedom.

The monetary and authorized burdens will be important, making it important to know the potential penalties of driving with out correct protection.

Penalties for Driving With out Insurance coverage

North Carolina legislation mandates minimal insurance coverage protection to guard drivers and different highway customers. Failure to conform ends in substantial penalties. These penalties are designed to discourage uninsured driving and encourage accountable insurance coverage practices.

- Monetary Penalties: Fines for driving with out insurance coverage can differ relying on the particular violation and the circumstances. They will vary from a whole lot to 1000’s of {dollars}, escalating with repeated offenses. Along with fines, drivers may face suspension or revocation of their driving privileges. These monetary penalties can rapidly turn into overwhelming, particularly for people who’ve restricted monetary sources.

- Suspension of Driving Privileges: One of the crucial extreme penalties for driving with out insurance coverage is the suspension of your driver’s license. This suspension can final for a time period, relying on the severity of the violation. This implies chances are you’ll lose the power to drive, which might considerably affect your every day life, work, and private commitments. The size of suspension can also be elevated with repeat offenses.

- Automobile Impoundment: In some instances, authorities might impound your automobile if you’re caught driving with out insurance coverage. This may end up in additional monetary burden as chances are you’ll be accountable for the price of storage and potential towing charges. You could possibly additionally face the lack of your automobile when you can not afford these further bills.

Monetary Implications of Uninsured Driving

Driving with out enough insurance coverage exposes you to important monetary dangers, particularly within the occasion of an accident. This may rapidly drain your funds and result in monetary hardship.

- Private Legal responsibility: If you’re concerned in an accident and don’t have insurance coverage, you’re solely accountable for all damages, together with medical bills, automobile repairs, and property injury. This may end up in an unlimited monetary burden, probably exceeding your monetary capability.

- Authorized Prices: You may face appreciable authorized prices if you’re concerned in an accident with out insurance coverage. Attorneys’ charges, court docket prices, and different authorized bills can rapidly mount up, including to the monetary pressure.

- Potential Chapter: The monetary repercussions of an uninsured accident will be catastrophic, probably main to private chapter. The sheer quantity of bills concerned, together with medical payments, automobile restore prices, and authorized charges, might surpass your monetary sources, leaving you with little alternative however to declare chapter.

Authorized Repercussions of Uninsured Driving

Driving with out automotive insurance coverage in North Carolina carries important authorized penalties, impacting your freedom and security. These repercussions are designed to guard the rights of others and keep the integrity of the authorized system.

- Legal Expenses: Driving with out insurance coverage may end up in felony expenses, resulting in fines, imprisonment, and a felony report. This felony report can considerably affect future alternatives and make it more durable to safe loans, hire an residence, and even receive a job. Repeated offenses can result in even harsher penalties.

- Civil Lawsuits: In case you trigger an accident with out insurance coverage, the injured events can file a civil lawsuit towards you, looking for compensation for damages. This may end up in hefty monetary settlements and authorized battles. In case you can not meet the settlement calls for, you could be compelled to give up belongings to cowl the damages.

Penalties for Drivers in Accidents With out Enough Insurance coverage

Being uninsured in an accident can result in devastating private and monetary penalties for the motive force and the victims. Uninsured accidents can depart people in a tough state of affairs, with no recourse for compensation.

- Victims’ Rights: Victims of accidents involving uninsured drivers usually face important challenges in recovering their losses. With out insurance coverage, they could not be capable of receive compensation for medical bills, misplaced wages, and property injury. This may result in a monetary burden and a protracted restoration interval for the victims concerned.

- Driver’s Accountability: The driving force who’s uninsured bears the total accountability for the results of the accident. They are going to be held accountable for the damages incurred by the injured events, together with monetary compensation, medical therapy, and property injury. They may even face authorized repercussions, probably together with felony expenses and fines.

Potential Authorized Ramifications of Driving With out Enough Insurance coverage in North Carolina

Driving with out the minimal required insurance coverage protection in North Carolina has extreme authorized penalties.

- Driver’s License Suspension or Revocation: Driving with out insurance coverage can result in a suspension or revocation of your driver’s license. This implies you’ll lose the power to drive, impacting your every day life, work, and different vital actions.

- Legal Expenses: Repeated or extreme violations of insurance coverage necessities may end up in felony expenses, with potential fines and even imprisonment.

- Civil Lawsuits: Within the occasion of an accident, injured events might file a civil lawsuit, looking for compensation for damages. With out insurance coverage, chances are you’ll be held personally accountable for all damages, resulting in monetary spoil.

Discovering Reasonably priced Insurance coverage

Determining your automotive insurance coverage in North Carolina can really feel like navigating a maze. However don’t be concerned, discovering reasonably priced protection is completely achievable with the proper methods. Armed with data and a bit of savvy, you may safe a coverage that matches your funds with out sacrificing important safety.Understanding the components influencing your premium is vital to discovering the absolute best deal.

This includes your driving report, the kind of automobile you personal, and even your location. Evaluating quotes from a number of suppliers is an important step within the course of, as costs can differ considerably between firms. Profiting from out there reductions may also considerably decrease your month-to-month funds.

Methods for Discovering Reasonably priced Choices

Understanding the place to begin is step one to getting a coverage that works for you. Evaluating quotes from a number of suppliers is a should. Insurance coverage charges differ enormously relying on the corporate. Do not accept the primary quote you see; discover choices from varied insurers to get the absolute best worth.

Insurance coverage Comparability Web sites and Instruments

A number of on-line sources make evaluating quotes a breeze. These web sites mixture quotes from a number of insurers, letting you see side-by-side comparisons. Some common examples embrace Insurify, Policygenius, and others. These instruments are designed to save lots of you effort and time, permitting you to concentrate on the specifics of every coverage. Utilizing these instruments will provide help to discover one of the best deal rapidly.

Elements Impacting Insurance coverage Premiums

A number of components affect your insurance coverage prices. A clear driving report is a big benefit, as insurers view secure drivers as lower-risk clients. The kind of automobile you drive additionally performs a task. Sports activities vehicles, for instance, are likely to have greater premiums on account of their perceived greater threat of harm or theft. Location issues too; some areas have greater accident charges or greater theft dangers.

The Significance of Evaluating Quotes, North carolina minimal automotive insurance coverage

Evaluating quotes from a number of suppliers is essential. Insurance coverage firms usually regulate their charges based mostly on varied components. By getting quotes from totally different suppliers, you may determine probably the most aggressive charges and make sure you’re getting the absolute best deal. This easy strategy will assure you get probably the most reasonably priced protection.

The Position of Reductions in Insurance coverage Pricing

Reductions can considerably affect your insurance coverage premium. Many insurers provide reductions for secure driving, good scholar standing, or anti-theft gadgets. Look into reductions provided by your insurer; these can translate to important financial savings over time. Some insurers additionally provide reductions based mostly in your automobile’s anti-theft options.

Suggestions for Discovering Reasonably priced Insurance coverage

- Evaluation your driving report: Guarantee your driving report is clear and freed from any violations. It is a key think about figuring out your insurance coverage premium.

- Evaluate quotes from a number of suppliers: Do not restrict your self to at least one or two insurance coverage firms. Evaluating quotes from a number of suppliers ensures you get probably the most aggressive charges.

- Make the most of reductions: Many insurers provide reductions for secure drivers, good college students, or these with anti-theft gadgets. Inquire about out there reductions to probably decrease your premiums.

- Take into account your automobile sort: The kind of automobile you drive impacts your insurance coverage premium. Take into account a inexpensive automobile in case your funds is tight.

- Store round throughout totally different occasions of the yr: Insurance coverage charges can fluctuate all year long. Take into account buying round throughout totally different occasions to probably discover higher charges.

Understanding Coverage Paperwork

Navigating automotive insurance coverage insurance policies can really feel like deciphering a secret code, nevertheless it’s essential to know the effective print earlier than you signal. Understanding what your coverage covers and would not cowl empowers you to make knowledgeable choices and keep away from disagreeable surprises down the highway. This part gives a roadmap for understanding your automotive insurance coverage coverage, from deciphering the jargon to figuring out important clauses.Understanding your coverage is greater than only a formality; it is a key to managing your monetary well-being and guaranteeing your automobile is satisfactorily protected.

A transparent understanding prevents misunderstandings along with your insurance coverage supplier and safeguards you towards surprising monetary burdens.

Decoding Coverage Language

Automotive insurance coverage insurance policies usually use technical phrases and authorized language. Do not be intimidated! Taking the time to totally learn and perceive the coverage is crucial. Search for clear definitions of phrases and situations, guaranteeing you grasp the precise meanings of phrases like “complete protection,” “collision protection,” or “uninsured/underinsured motorist protection.” By taking the time to decipher the particular language utilized in your coverage, you may keep away from any surprises or misinterpretations of the phrases.

Reviewing Coverage Particulars Earlier than Signing

Rigorously reviewing each side of your automotive insurance coverage coverage earlier than signing is essential. This includes extra than simply skimming the doc; it requires a radical and demanding evaluation of all its components. Take your time, ask questions if one thing is not clear, and make sure the coverage aligns along with your wants and expectations. This proactive strategy minimizes the danger of pricey errors or unexpected circumstances later.

Figuring out Vital Clauses

Insurance coverage insurance policies comprise quite a few clauses that outline the phrases of the settlement. Understanding these clauses is vital to understanding your rights and tasks as an insured social gathering. Vital clauses usually tackle specifics just like the coverage’s efficient dates, exclusions, and limitations of protection. Rigorously learn and analyze these sections to know the precise scope of safety your coverage gives.

Examples of Widespread Insurance coverage Coverage Clauses

Widespread clauses in insurance coverage insurance policies usually embrace:

- Exclusions: These clauses specify what your coverage does

-not* cowl. As an example, a coverage may exclude injury brought on by struggle or intentional acts. Understanding these exclusions helps you anticipate potential gaps in protection. - Deductibles: This clause Artikels the quantity you may have to pay out-of-pocket earlier than your insurance coverage firm steps in. Understanding your deductible is crucial to budgeting for potential claims.

- Coverage Limits: These clauses set the utmost quantity your insurer pays for a declare. Understanding your coverage limits ensures you perceive the monetary safety afforded by your protection.

- Legal responsibility Protection: This clause particulars the extent to which your coverage covers damages chances are you’ll trigger to others in an accident. Understanding legal responsibility protection is crucial to understanding the extent of your safety in case of accidents involving third events.

Abstract of Key Clauses

The next desk summarizes key clauses and their implications in insurance coverage insurance policies:

| Clause | Rationalization | Implications |

|---|---|---|

| Exclusions | Particular occasions or circumstances that aren’t coated by the coverage. | Understanding exclusions helps you anticipate potential gaps in protection and keep away from surprising prices. |

| Deductibles | The quantity you pay out-of-pocket earlier than your insurance coverage firm pays. | Understanding your deductible helps you funds for potential claims and perceive the monetary accountability you bear. |

| Coverage Limits | The utmost quantity the insurance coverage firm pays for a declare. | Understanding coverage limits ensures you recognize the monetary safety afforded by your protection. |

| Legal responsibility Protection | The extent to which your coverage covers damages chances are you’ll trigger to others in an accident. | Understanding your legal responsibility protection is crucial for understanding the extent of your safety in case of accidents involving third events. |

Insurance coverage Claims Course of

Navigating the insurance coverage claims course of can really feel daunting, however understanding the steps concerned could make the entire expertise smoother. Understanding what paperwork are required and the timeline for decision empowers you to proactively handle your declare. This part Artikels the important facets of submitting a declare in North Carolina, from preliminary steps to last settlement.

Steps Concerned in Submitting a Declare

Submitting a declare in North Carolina sometimes includes a number of key steps. First, you may have to contact your insurance coverage firm and report the accident or injury. Be ready to supply particulars in regards to the incident, together with the date, time, location, and different related data. Subsequent, collect all mandatory documentation, which we’ll discover within the subsequent part. The insurance coverage firm will then examine the declare, which could contain contacting witnesses or inspecting the broken automobile.

Following the investigation, the insurance coverage firm will assess the declare and decide the suitable plan of action. This might contain negotiating a settlement, repairing the automobile, or paying for medical bills. Lastly, the declare can be resolved, with a cost issued or a denial letter defined.

Documentation Wanted for a Declare

Complete documentation is essential for a clean and environment friendly declare course of. This ensures the insurance coverage firm has all the required data to precisely assess the declare. Important paperwork embrace:

- An in depth report of the accident, together with the circumstances, accidents, and injury to property. This could embrace names and call data of witnesses.

- Police report, if relevant. A police report gives a proper report of the incident, outlining the main points of the accident, together with any citations or expenses filed.

- Medical data, if relevant. Medical data are important for proving accidents and bills incurred. This may increasingly embrace physician’s notes, payments, and receipts.

- Proof of auto possession, such because the automobile registration. That is very important for verifying your possession of the automobile and guaranteeing correct declare processing.

- Pictures or movies of the injury. Visible proof is essential in supporting your declare and offering a transparent report of the extent of the injury.

Timeframe for Submitting a Declare

North Carolina doesn’t have a particular timeframe for submitting a declare. Nevertheless, the earlier you file, the higher. The insurance coverage firm sometimes has a set timeframe to course of the declare, and you’ll expedite the method by offering all required documentation promptly.

Course of for Acquiring a Settlement or Decision

The method for acquiring a settlement or decision varies relying on the complexity of the declare. Negotiations with the insurance coverage firm could also be mandatory. Insurance coverage adjusters consider the declare and suggest a settlement based mostly on the collected proof. In case you disagree with the settlement quantity, you may request a overview of the declare and even search various dispute decision choices.

If a settlement will not be reached, the declare may proceed to arbitration or litigation.

Examples of Documentation Wanted to Help an Insurance coverage Declare

Listed below are some examples of documentation that might be wanted to help an insurance coverage declare:

| Doc Kind | Instance |

|---|---|

| Police Report | A proper report documenting the accident particulars, together with contributing components, witness statements, and any citations issued. |

| Medical Data | Detailed data of medical therapy, together with diagnoses, therapy plans, and medical payments. |

| Automobile Restore Estimates | An in depth estimate of the prices required to restore the broken automobile from a good mechanic. |

| Witness Statements | Written statements from people who witnessed the accident, outlining their observations and offering supporting particulars. |

Current Adjustments in North Carolina Insurance coverage Legal guidelines

Navigating the ever-shifting panorama of automotive insurance coverage can really feel like a minefield. Happily, understanding the current modifications to North Carolina’s minimal necessities might help you make knowledgeable choices about your protection. Understanding these adjustments empowers you to decide on one of the best insurance coverage plan that aligns along with your wants and protects you from potential monetary burdens.Current updates to North Carolina’s minimal automotive insurance coverage legal guidelines have targeted totally on guaranteeing enough monetary accountability for drivers concerned in accidents.

These adjustments goal to safeguard each drivers and the general public by establishing extra strong protection requirements.

Particular Examples of Current Adjustments

Essentially the most important updates to North Carolina’s minimal insurance coverage necessities lately have targeted on growing the required bodily harm legal responsibility limits. Whereas property injury limits stay comparatively constant, the adjustments in bodily harm protection characterize a considerable shift within the state’s strategy to accident compensation.

Influence on Insurance coverage Prices

These changes in minimal necessities are prone to affect insurance coverage prices. Greater bodily harm limits usually translate to elevated premiums, notably for drivers looking for minimal protection. The elevated monetary accountability related to these greater limits might trigger insurance coverage firms to regulate their pricing methods to mirror the added monetary threat. Nevertheless, the precise value implications differ relying on particular person driving data, location, and chosen insurance coverage suppliers.

For instance, a driver with a clear report in a rural space may expertise a smaller enhance in comparison with a driver with a historical past of accidents in a high traffic city zone.

Key Variations from Earlier Necessities

The adjustments in North Carolina’s minimal insurance coverage necessities introduce noticeable distinctions from the earlier requirements. The important thing distinction lies within the enhanced monetary safety afforded to victims of accidents. Earlier necessities may need left victims with inadequate compensation, whereas the up to date rules goal to supply extra complete safety.

Potential Penalties of Not Assembly Up to date Necessities

Failure to stick to the revised minimal necessities might end in important penalties. These penalties might embrace monetary fines, the suspension of driving privileges, or the denial of insurance coverage protection, making it crucial for drivers to make sure they meet the present requirements. Understanding the specifics of those penalties, and the procedures for acquiring required insurance coverage, is essential to keep away from authorized problems.

Concluding Remarks

So, there you’ve it—a complete have a look at North Carolina’s minimal automotive insurance coverage necessities. From understanding the fundamentals to exploring additional protection choices and the results of not having sufficient, you are now geared up to make sensible choices about your automobile insurance coverage. Bear in mind, data is energy, and this information empowers you to guard your self and your experience.

Widespread Queries: North Carolina Minimal Automotive Insurance coverage

What are the minimal protection quantities for bodily harm legal responsibility in North Carolina?

The minimal bodily harm legal responsibility protection in North Carolina is $30,000 per particular person and $60,000 per accident.

What are some widespread components that have an effect on automotive insurance coverage premiums in North Carolina?

Your driving report, automobile sort, location, and age all play a task in figuring out your insurance coverage premiums.

What are the penalties for driving with out enough insurance coverage in North Carolina?

Penalties for driving with out enough insurance coverage in North Carolina can vary from fines to suspension of your driver’s license. Verify probably the most present rules.

How can I discover reasonably priced automotive insurance coverage choices in North Carolina?

Evaluating quotes from a number of insurance coverage suppliers, utilizing on-line comparability instruments, and benefiting from out there reductions might help you discover reasonably priced choices.