Open care life insurance coverage value per thirty days varies considerably relying on quite a few components. Understanding these components is essential for making knowledgeable choices about your monetary safety. This exploration delves into the intricacies of figuring out premiums, inspecting completely different suppliers, and evaluating regional variations.

From age and well being to protection quantities and coverage phrases, varied components contribute to the ultimate month-to-month premium. An in depth evaluation of those components gives a transparent image of how these components have an effect on the price of your coverage.

Understanding Open Care Life Insurance coverage

Open care life insurance coverage is a quickly evolving kind of life insurance coverage product that distinguishes itself from conventional insurance policies by its versatile and complete strategy to protection. It typically emphasizes preventive care and wellness initiatives, offering a novel framework for people looking for a extra holistic strategy to monetary safety. This departure from standard life insurance coverage fashions presents each benefits and concerns for potential policyholders.Open care life insurance coverage is designed to supply greater than only a demise profit.

It integrates wellness and preventative care elements, typically encompassing a spread of providers to advertise a more healthy way of life. This strategy goals to scale back long-term healthcare prices and doubtlessly decrease the general danger profile of the insured. The underlying precept is to encourage proactive well being administration and well-being, alongside the usual life insurance coverage safety.

Definition of Open Care Life Insurance coverage

Open care life insurance coverage insurance policies usually mix life insurance coverage protection with advantages geared toward supporting the insured’s well being and well-being. These insurance policies regularly embrace provisions for wellness packages, preventive care providers, and doubtlessly even monetary help for health-related bills. Crucially, they typically transfer past the normal give attention to demise advantages to include components of proactive well being administration.

Key Options and Advantages

Open care life insurance coverage insurance policies usually embrace a mix of conventional life insurance coverage options and distinctive wellness advantages. Key options may embrace:

- Enhanced Dying Profit: A normal life insurance coverage demise profit stays a core part, making certain monetary safety for family members upon the insured’s passing.

- Wellness Applications: These packages could embrace entry to well being coaches, health trackers, diet plans, or reductions on gymnasium memberships to encourage a more healthy way of life.

- Preventive Care Protection: This may increasingly embody common check-ups, vaccinations, or screenings to proactively handle potential well being points.

- Monetary Help for Well being Bills: Insurance policies may present money advantages for medical therapies or preventive care providers, doubtlessly lowering monetary burdens.

- Entry to Healthcare Suppliers: Some insurance policies present entry to a community of healthcare suppliers for consultations and coverings.

These options collectively intention to enhance the insured’s well being, doubtlessly reducing healthcare prices over time. This holistic strategy units open care life insurance coverage other than conventional insurance policies, providing greater than only a monetary security web.

Comparability with Conventional Life Insurance coverage

Conventional life insurance coverage insurance policies primarily give attention to offering a demise profit. They typically lack the wellness and preventative care elements inherent in open care life insurance coverage. Open care life insurance coverage goals to deal with potential well being dangers by preventative measures, which might translate into long-term value financial savings for each the insured and the insurer. The desk under highlights these distinctions.

| Coverage Sort | Protection | Price | Options |

|---|---|---|---|

| Conventional Life Insurance coverage | Dying profit solely | Typically decrease premiums | Focuses on monetary safety within the occasion of demise |

| Open Care Life Insurance coverage | Dying profit + wellness packages, preventive care, and potential well being expense help | Probably larger premiums as a consequence of added advantages | Encourages proactive well being administration, aiming for decrease healthcare prices in the long term |

Appropriate Conditions for Open Care Life Insurance coverage

Open care life insurance coverage is perhaps an acceptable choice for people looking for a complete strategy to monetary safety and well-being. These insurance policies might attraction to people who:

- Prioritize proactive well being administration and preventive care.

- Need a holistic strategy that mixes life insurance coverage with wellness packages.

- Are on the lookout for long-term value financial savings on healthcare bills by preventative care.

- Need to improve their monetary safety whereas bettering their total well being and well-being.

For instance, a younger skilled who is worried about future healthcare prices may discover open care life insurance coverage engaging as a consequence of its wellness options. The long-term value financial savings on healthcare, mixed with the usual life insurance coverage safety, might show advantageous.

Components Affecting Open Care Life Insurance coverage Prices

Open care life insurance coverage, designed for people with pre-existing circumstances, affords a vital security web. Nonetheless, understanding the components influencing its value is important for knowledgeable decision-making. The premiums aren’t static; they’re dynamically adjusted based mostly on varied standards.Open care insurance policies, whereas offering protection, typically include larger premiums in comparison with commonplace life insurance coverage. This premium disparity stems from the inherent danger related to pre-existing circumstances, necessitating the next degree of underwriting scrutiny and danger evaluation.

Age Influence on Premiums

Age is a major determinant in life insurance coverage pricing. Youthful people usually command decrease premiums as a consequence of their decrease likelihood of mortality and related well being dangers. Conversely, older people face larger premiums reflecting the elevated danger of demise or requiring in depth medical care. This age-related fluctuation in premium prices is a common phenomenon throughout varied life insurance coverage sorts.

Insurance coverage firms assess the mortality danger related to completely different age brackets, which straight influences the premium construction.

Well being Standing and Life-style Decisions

A person’s well being standing is a essential consider open care life insurance coverage pricing. Pre-existing circumstances, reminiscent of diabetes, coronary heart illness, or most cancers, straight affect the chance evaluation and, consequently, the premium. A more healthy way of life, marked by common train, a balanced food plan, and non-smoking habits, usually interprets to decrease premiums. Insurance coverage firms typically contemplate these way of life decisions as indicators of future well being prospects.

This permits them to raised estimate the chance related to the insured particular person.

Protection Quantities and Coverage Phrases

The quantity of protection and the coverage time period straight have an effect on the month-to-month premium. Larger protection quantities naturally result in larger premiums because the insurer assumes a higher monetary duty. Equally, longer coverage phrases usually end in larger premiums as a result of the insurer’s dedication extends over an extended interval. The insurer should contemplate the monetary implications of potential claims over an prolonged interval.

These components are essential within the danger evaluation course of.

Comparability of Open Care Life Insurance coverage Prices

| Age Vary | Premium Vary (USD) | Protection Choices | Threat Components |

|---|---|---|---|

| 18-30 | $50-$150 | Primary to complete | Decrease mortality danger, decrease pre-existing situation danger |

| 31-45 | $100-$250 | Primary to complete | Average mortality danger, potential pre-existing situation danger |

| 46-60 | $150-$400 | Restricted protection choices, could require larger premiums for complete protection | Larger mortality danger, elevated danger of pre-existing circumstances |

| 61-75 | $200-$600+ | Restricted protection choices | Excessive mortality danger, vital pre-existing situation danger |

This desk gives a normal comparability. Precise premiums will differ based mostly on particular person circumstances and particular coverage phrases. The danger components related to every age group play a pivotal function in figuring out the premium.

Comparability with Different Life Insurance coverage Choices

Open care life insurance coverage typically comes with larger premiums than commonplace life insurance coverage insurance policies as a result of larger danger evaluation for people with pre-existing circumstances. Time period life insurance coverage affords comparatively low premiums however covers just for a specified interval, not like everlasting life insurance coverage, which gives lifelong protection however with larger premiums. The selection is determined by particular person wants and danger tolerance.

Every choice affords distinct benefits and drawbacks, with the most suitable choice tailor-made to particular person circumstances.

Price Breakdown of Open Care Life Insurance coverage

Understanding the elements of an open care life insurance coverage premium is essential for making knowledgeable choices. Open care insurance policies, typically designed for flexibility and affordability, are structured in another way than conventional insurance policies. This breakdown clarifies the components contributing to the month-to-month value, serving to you anticipate potential variations.

Elements of the Month-to-month Premium

The month-to-month premium for open care life insurance coverage is not a monolithic determine. It is a composite of a number of components, every enjoying a definite function within the total value. These elements work collectively to replicate the chance related to the insured particular person and the executive overhead of the coverage.

Administrative Charges and Coverage Administration Prices

Administrative charges and coverage administration prices are inherent bills related to operating the insurance coverage firm. These prices cowl varied operational points, together with processing claims, sustaining coverage data, and dealing with buyer inquiries. The share allotted to those administrative prices varies considerably between insurance coverage suppliers. Larger administrative overhead usually interprets to the next premium. As an example, a supplier with a strong claims dealing with course of could have a barely larger administrative charge proportion than a supplier with a extra streamlined course of.

Threat Evaluation and its Influence

Threat evaluation is a essential issue influencing the price of open care life insurance coverage. The insurer evaluates varied components to find out the chance of a declare. These components embrace age, well being standing, way of life decisions, and pre-existing circumstances. People with larger perceived danger (e.g., people who smoke, these with pre-existing circumstances, or these in higher-risk occupations) usually face larger premiums.

It is because insurers should set premiums that account for the elevated likelihood of a declare.

Fluctuation of Prices Over Time

A number of components may cause the price of open care life insurance coverage to fluctuate over time. Adjustments in rates of interest, financial circumstances, and market developments can have an effect on the general value of insurance coverage merchandise. Additionally, enhancements in medical expertise and therapy strategies can influence the price of claims. Moreover, coverage modifications or changes by the insurance coverage supplier may result in adjustments in premium quantities.

For instance, a rise in the price of dwelling or inflation could influence administrative prices, subsequently influencing the premiums.

Pattern Price Breakdown

| Element | Description | Proportion | Influence |

|---|---|---|---|

| Administrative Charges | Prices related to operating the insurance coverage firm. | 15% | Straight impacts the premium, as larger administrative prices will result in the next month-to-month premium. |

| Coverage Administration Prices | Bills for processing insurance policies and claims. | 10% | These prices are inherent to the coverage and can influence the month-to-month premium. |

| Threat Evaluation | Analysis of the insured particular person’s danger profile. | 75% | A better perceived danger leads to a bigger portion of the premium. |

Comparability of Open Care Life Insurance coverage Suppliers

Navigating the panorama of open care life insurance coverage will be daunting. Understanding the assorted suppliers and their choices is essential for making an knowledgeable choice. Totally different firms cater to numerous wants and danger profiles, leading to a variety of pricing and protection choices. This part delves into the important thing components to contemplate when evaluating suppliers.Open care life insurance coverage suppliers differ considerably of their pricing, protection scope, and customer support.

A complete comparability permits people to decide on the most effective match for his or her particular monetary targets and danger tolerance.

Open Care Life Insurance coverage Supplier Record

A number of respected firms supply open care life insurance coverage. Figuring out appropriate suppliers is a major step within the insurance coverage choice course of. Selecting a supplier entails a cautious consideration of assorted points, together with pricing, protection particulars, and buyer evaluations.

- AIG

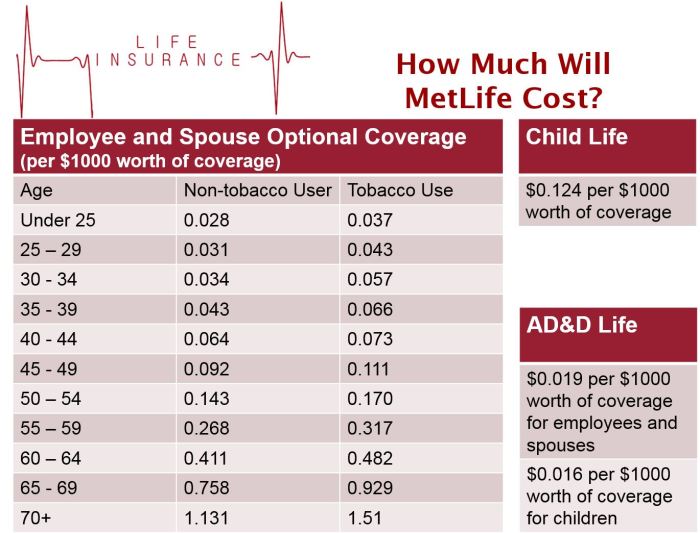

- MetLife

- Prudential

- State Farm

- John Hancock

Price Comparability of Suppliers

The price of open care life insurance coverage fluctuates based mostly on a number of components, together with age, well being standing, and protection quantity. Every supplier employs its personal pricing mannequin, and these fashions can differ considerably.

| Supplier Title | Premium Vary (per thirty days) | Protection Highlights | Buyer Evaluations |

|---|---|---|---|

| AIG | $100 – $300+ | Complete protection choices, together with essential sickness, unintended demise, and incapacity. Typically sturdy monetary standing. | Combined evaluations, with some reporting good customer support and others experiencing difficulties with claims processing. |

| MetLife | $150 – $400+ | Big selection of coverage choices, tailor-made protection for particular wants. Sturdy popularity within the trade. | Typically constructive evaluations relating to coverage choices and claims processing. |

| Prudential | $120 – $350+ | Concentrate on reasonably priced plans, varied add-on options like long-term care. | Constructive evaluations relating to affordability and availability of add-on advantages. |

| State Farm | $100 – $250+ | Identified for customer support and broad attain, tailor-made protection for varied demographics. | Constructive evaluations on customer support and declare effectivity. |

| John Hancock | $180 – $450+ | Emphasis on particular wants reminiscent of household protection, wealth safety, and long-term monetary safety. | Constructive evaluations relating to monetary energy and long-term worth. |

Be aware that the premium ranges offered are estimations and might differ enormously based mostly on particular person circumstances.

Protection and Options Comparability

Totally different suppliers supply various ranges of protection and options. An in depth evaluation of the particular phrases and circumstances is important to make sure a coverage aligns with particular person wants. Components such because the kinds of lined occasions, payout quantities, and extra advantages needs to be completely examined.

- Protection Sorts: Some suppliers supply broader protection, together with unintended demise, essential sickness, and incapacity, whereas others give attention to particular areas like life insurance coverage.

- Coverage Add-ons: Add-ons like long-term care insurance coverage or supplemental advantages can enhance the general value however improve the coverage’s worth.

- Buyer Service: Sturdy customer support can considerably influence the general expertise. Evaluations and testimonials present insights into how successfully a supplier handles claims and buyer inquiries.

Acquiring Quotes from Totally different Suppliers

A number of strategies exist for acquiring quotes from completely different suppliers. These strategies enable people to match pricing and protection choices successfully.

- On-line Comparability Instruments: These instruments facilitate the comparability of a number of quotes from completely different suppliers in a single platform.

- Direct Contact: Contacting suppliers straight permits for personalised consultations and clarifications relating to particular wants.

- Insurance coverage Brokers: Insurance coverage brokers can act as intermediaries, providing complete comparisons of assorted suppliers and their merchandise.

Navigating Open Care Life Insurance coverage Quotes

Securing the fitting life insurance coverage protection requires cautious navigation of the quoting course of. Understanding the intricacies of quotes empowers you to make knowledgeable choices, making certain you get hold of the absolute best coverage to your wants and funds. Evaluating quotes from varied suppliers is essential for optimizing your monetary safety.

Acquiring Open Care Life Insurance coverage Quotes

The method of acquiring open care life insurance coverage quotes usually entails submitting an software kind. This way normally requests private particulars, well being info, and desired protection ranges. On-line portals and direct contact with insurance coverage suppliers are widespread avenues for initiating this course of. The preliminary software typically serves as a preliminary evaluation, permitting the supplier to gauge the suitability of your circumstances for protection.

Evaluating Quotes from A number of Suppliers

Evaluating quotes from a number of suppliers is paramount for securing essentially the most advantageous phrases. Totally different suppliers make use of various underwriting standards and pricing fashions. This range in strategy can result in substantial variations in premiums and protection choices. Thorough comparability ensures you safe a coverage tailor-made to your distinctive circumstances, optimizing monetary safety whereas minimizing prices.

Key Info to Search for in Quotes

When evaluating life insurance coverage quotes, key components reminiscent of protection quantity, premium prices, deductibles, and exclusions have to be fastidiously scrutinized. Understanding these points ensures a complete understanding of the coverage’s monetary implications.

Detailed Instance of Deciphering a Life Insurance coverage Quote

| Protection | Premium | Deductibles | Exclusions |

|---|---|---|---|

| $500,000 Life Insurance coverage Profit | $500 per thirty days | $1,000 for pre-existing circumstances, $2,000 for unintended demise | Suicide inside two years of coverage buy, demise from warfare or acts of terrorism |

This instance illustrates a typical quote construction. The protection quantity represents the payout in case of demise. The premium is the month-to-month value. Deductibles are particular monetary obligations related to specific circumstances. Exclusions element conditions the place the coverage is not going to present protection.

Understanding these components is essential for a well-informed choice.

Negotiating Premiums and Protection Choices

Insurance coverage suppliers typically enable for negotiation of premiums and protection choices. This course of entails discussions with the supplier to doubtlessly regulate the coverage to fulfill particular person wants and circumstances. By actively participating in negotiations, you might be able to safe a extra favorable coverage, doubtlessly lowering prices whereas enhancing protection. Bear in mind to completely analysis and examine insurance policies earlier than participating in negotiations to grasp the total scope of potential choices and their monetary implications.

Open Care Life Insurance coverage Price in Totally different Areas

Geographic location performs a major function in shaping the price of open care life insurance coverage. Variations in premiums replicate a posh interaction of things, together with native financial circumstances, societal danger profiles, and regulatory environments. Understanding these nuances is essential for potential policyholders to make knowledgeable choices.

Components Influencing Regional Price Variations

A number of key components contribute to the discrepancies in open care life insurance coverage premiums throughout completely different areas. These embrace the prevailing financial local weather, the incidence of particular well being dangers, and regulatory frameworks governing insurance coverage insurance policies. As an example, areas with larger incidences of sure illnesses or lifestyle-related illnesses may see larger premiums as a result of elevated danger pool.

Price Breakdown by Area

Regional variations in open care life insurance coverage prices stem from a mix of things. These components, which aren’t mutually unique, embrace the regional value of dwelling, the prevalence of particular well being dangers, and the regulatory panorama. The precise components and their weightings can differ from area to area, leading to a posh image of pricing dynamics.

| Area | Common Premium (USD/month) | Components Influencing Price | Protection Choices |

|---|---|---|---|

| North America (USA) | $150 – $300 | Larger value of dwelling, various well being dangers throughout states, stricter rules, and availability of healthcare | Complete protection, particular add-ons for pre-existing circumstances, and versatile choices for household plans |

| Europe (UK) | $100 – $250 | Stronger social security web, various rules by nation, and entry to high quality healthcare | Broad vary of coverages, together with essential sickness and incapacity advantages, and choices for worldwide journey |

| Asia (Japan) | $50 – $150 | Decrease value of dwelling, various ranges of entry to healthcare, and particular well being dangers | Primary protection, and choices for add-ons based mostly on particular wants |

| Latin America (Brazil) | $75 – $200 | Decrease value of dwelling in some areas, prevalence of particular illnesses, and evolving regulatory panorama | Primary protection, and growing choices for supplemental protection |

Strategies for Calculating Regional Prices

Insurance coverage suppliers make the most of actuarial fashions to calculate premiums for various areas. These fashions have in mind varied components, reminiscent of demographics, historic claims information, medical developments, and the price of healthcare in every area. The fashions contemplate the chance profile of people in particular areas, permitting for extra exact and correct premium calculations.

“Actuarial fashions mix statistical evaluation with monetary projections to estimate future insurance coverage prices.”

For instance, a area with a excessive incidence of coronary heart illness would have the next danger issue utilized to the actuarial mannequin, resulting in the next premium.

Open Care Life Insurance coverage and Particular Wants

Open care life insurance coverage, whereas providing complete protection, is especially related for people going through distinctive circumstances and particular monetary targets. Understanding how this kind of insurance coverage caters to numerous wants is essential for making knowledgeable choices. This part will delve into conditions the place open care life insurance coverage gives vital benefits over different monetary merchandise.

Conditions Benefiting from Open Care Life Insurance coverage

Open care life insurance coverage can show advantageous in varied eventualities. It is not a one-size-fits-all answer, and its effectiveness hinges on the particular wants and targets of the policyholder. This part Artikels circumstances the place open care life insurance coverage generally is a superior alternative.

- People with pre-existing well being circumstances: Open care insurance policies typically accommodate pre-existing well being circumstances, doubtlessly offering protection unavailable with conventional life insurance coverage. That is significantly helpful for these with persistent sicknesses or those that have undergone main surgical procedures. The price of such insurance policies, nonetheless, is perhaps larger than commonplace plans.

- Excessive-risk occupations: People in professions with inherent risks, reminiscent of firefighters or development staff, could discover open care insurance policies providing the next protection quantity and broader safety in comparison with commonplace life insurance coverage. This larger protection is commonly justified by the heightened danger profile of those professions. Premiums will usually be adjusted accordingly.

- Households with substantial healthcare bills: Open care life insurance coverage generally is a worthwhile part of a monetary plan for households with substantial medical bills. The insurance coverage payout may also help cowl ongoing medical care, long-term care prices, or different associated bills. This proactive strategy to overlaying future wants is vital for households going through potential excessive healthcare prices.

- Entrepreneurs and enterprise homeowners: Open care life insurance coverage may also help companies handle danger and guarantee continued operations within the occasion of an unexpected demise. This insurance coverage can function a significant supply of funds to cowl enterprise money owed, worker salaries, and ongoing operations. The premiums are normally larger in such circumstances.

Evaluating Open Care Life Insurance coverage with Options

Evaluating open care life insurance coverage with different monetary merchandise is important for figuring out its worth. Open care typically differs considerably from conventional life insurance coverage by way of protection and price.

- Conventional Life Insurance coverage: Conventional life insurance coverage insurance policies usually supply easier protection with an outlined demise profit. Open care insurance coverage could embrace further protection, reminiscent of long-term care, essential sickness, and incapacity earnings, making it a extra complete answer. Nonetheless, the price of open care insurance policies typically displays these added advantages.

- Well being Financial savings Accounts (HSAs): HSAs are designed for medical bills, not demise advantages. Open care insurance coverage addresses the monetary implications of demise, which HSAs don’t. The main target of HSAs is financial savings and tax advantages associated to healthcare prices.

- Essential Sickness Insurance coverage: Essential sickness insurance coverage addresses particular medical occasions. Open care insurance policies may incorporate essential sickness riders, however the broader scope of open care protection distinguishes it. The price of open care will depend upon the particular protection and riders chosen.

Influence of Riders on Open Care Life Insurance coverage Prices

Including riders to open care life insurance coverage insurance policies can considerably affect the coverage’s value. Understanding the potential influence is essential for budgeting.

Riders are non-obligatory add-ons that increase the protection of a life insurance coverage coverage. Every rider comes with its personal premium.

- Essential Sickness Rider: A essential sickness rider gives a payout if the insured experiences a essential sickness. This will increase the price of the coverage.

- Lengthy-Time period Care Rider: A protracted-term care rider affords advantages for long-term care wants, which provides to the general value of the coverage.

- Unintentional Dying and Dismemberment (AD&D) Rider: This rider pays a profit if the insured dies or is dismembered in an accident. This extra protection provides to the premium.

Desk: Conditions Benefiting from Open Care Life Insurance coverage, Open care life insurance coverage value per thirty days

| Scenario | Insurance coverage Profit | Options | Price Issues |

|---|---|---|---|

| People with pre-existing circumstances | Protection doubtlessly unavailable with conventional life insurance coverage. | Conventional life insurance coverage, doubtlessly larger premiums. | Larger premiums than commonplace plans. |

| Excessive-risk occupations | Larger protection quantities and broader safety. | Conventional life insurance coverage, adjusted premiums. | Premiums adjusted for the upper danger profile. |

| Households with substantial healthcare bills | Covers ongoing medical care, long-term care prices, and associated bills. | Well being Financial savings Accounts (HSAs), however no demise profit. | Premiums will replicate the excellent protection. |

| Entrepreneurs and enterprise homeowners | Funds to cowl enterprise money owed, worker salaries, and ongoing operations. | Enterprise continuity plans, private financial savings. | Premiums are sometimes larger in comparison with commonplace insurance policies. |

Conclusion: Open Care Life Insurance coverage Price Per Month

In conclusion, the price of open care life insurance coverage is a posh interaction of particular person circumstances, supplier choices, and regional influences. By understanding the important thing components and evaluating choices, yow will discover the most effective protection to your wants at an acceptable value. This complete overview equips you with the information to navigate the world of open care life insurance coverage and make assured monetary choices.

Prime FAQs

What components affect the price of open care life insurance coverage?

Age, well being standing, way of life decisions, protection quantity, and coverage time period all influence the month-to-month premium. The precise coverage options additionally play a task.

How do I examine quotes from completely different suppliers?

Fastidiously evaluation protection particulars, premium quantities, deductibles, and exclusions for every quote. Evaluate the options and advantages supplied by completely different suppliers.

Are there regional variations in open care life insurance coverage prices?

Sure, geographic location impacts prices as a consequence of components like native danger evaluation, rules, and market competitors.

What’s the course of for acquiring quotes?

Contact a number of suppliers, present essential private info, and obtain tailor-made quotes based mostly in your particular circumstances. Evaluate the quotes to seek out the most effective match to your wants.