South Dakota automobile insurance coverage charges are influenced by varied components, out of your driving historical past to your automobile kind. This information delves into the complexities of those charges, providing insights into protection choices, reductions, and claims processes. Understanding these components empowers you to make knowledgeable selections and safe the absolute best insurance coverage in your wants.

This complete information explores the important thing parts that form automobile insurance coverage prices in South Dakota. From the associated fee variations between insurers to regional variations in pricing, we cowl all of it. Uncover methods for locating inexpensive choices and maximizing financial savings.

Components Influencing Charges

South Dakota automobile insurance coverage charges, like these nationwide, are influenced by a posh interaction of things. Understanding these parts is essential for shoppers looking for inexpensive protection and knowledgeable decision-making. These variables aren’t static; they shift primarily based on varied financial and societal tendencies, impacting the price of insurance coverage insurance policies.

Variables Impacting Premiums

A number of key components considerably affect automobile insurance coverage premiums in South Dakota. These embrace driving historical past, automobile traits, location, and the chosen insurance coverage supplier. These components are interconnected, and a change in a single can result in a ripple impact on the general value of insurance coverage.

Driving Historical past and Insurance coverage Prices

Driving historical past performs a pivotal position in figuring out insurance coverage charges. A clear driving document, marked by an absence of accidents or violations, sometimes interprets to decrease premiums. Conversely, drivers with a historical past of accidents or visitors violations face larger premiums because of elevated danger. This can be a direct reflection of the insurer’s evaluation of the probability of future claims.

For example, a driver with a number of dashing tickets or at-fault accidents will probably see a big enhance of their premiums in comparison with a driver with no such historical past.

Automobile Kind and Utilization

The kind of automobile and its supposed utilization considerably affect insurance coverage premiums. Luxurious autos and high-performance sports activities vehicles typically include larger premiums in comparison with extra economical fashions. That is typically as a result of larger restore prices related to these autos. Equally, autos used for industrial functions, reminiscent of supply vehicles or taxis, sometimes have larger premiums as a result of elevated danger of accidents and potential legal responsibility.

Moreover, the frequency and nature of utilization (e.g., commuting vs. weekend use) can even affect the premium.

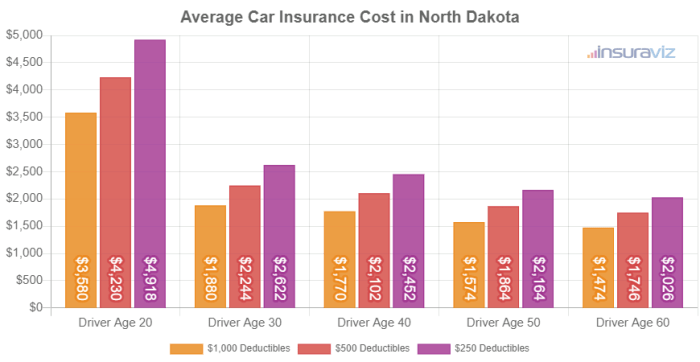

Location and Demographics in South Dakota

Geographic location in South Dakota and demographic components, reminiscent of age and gender, can have an effect on insurance coverage charges. Areas with a better focus of accidents or larger crime charges typically see larger insurance coverage premiums. This displays the perceived danger related to these areas. Moreover, age and gender have a demonstrable affect on charges, with youthful drivers incessantly going through larger premiums in comparison with older drivers.

Comparability of Insurance coverage Supplier Prices, South dakota automobile insurance coverage charges

The price of automobile insurance coverage in South Dakota varies amongst totally different insurance coverage suppliers. Some corporations would possibly provide decrease premiums than others, even for drivers with related danger profiles. This distinction stems from varied components, together with underwriting methods, claims dealing with processes, and funding returns. A comparability of quotes from totally different suppliers is important for figuring out essentially the most inexpensive protection whereas making certain enough safety.

Components Impacting South Dakota Automobile Insurance coverage Charges

| Issue | Description | Instance | Impression on Charges |

|---|---|---|---|

| Driving Historical past | Accidents, violations, claims | Driver with a number of dashing tickets | Greater premiums |

| Automobile Kind | Make, mannequin, and automobile kind | Excessive-performance sports activities automobile | Greater premiums |

| Automobile Utilization | Frequency and objective of use | Business use automobile | Greater premiums |

| Location | Particular space inside South Dakota | Excessive-accident space within the state | Greater premiums |

Kinds of Protection and Prices

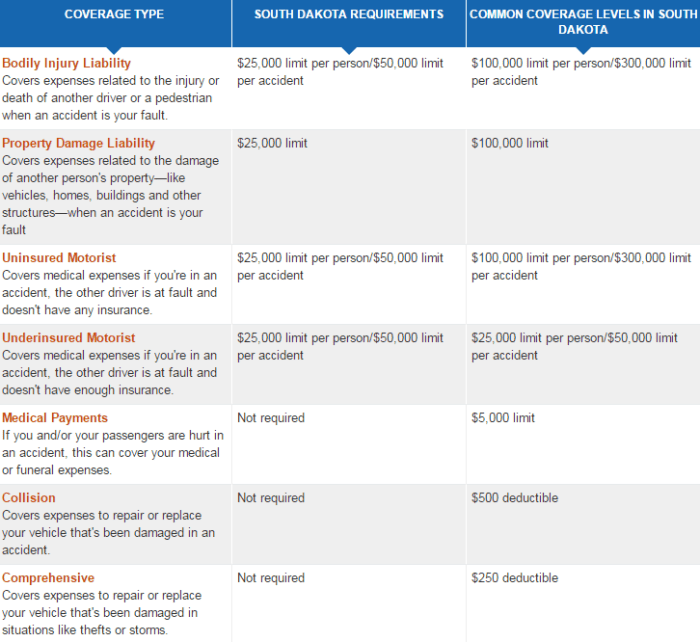

Navigating the varied panorama of automobile insurance coverage coverages in South Dakota can really feel overwhelming. Understanding the various kinds of safety obtainable and their related prices is essential for making knowledgeable selections. This part delves into the specifics of legal responsibility, collision, complete, and different coverages, highlighting the associated fee implications and demonstrating how these choices affect your total insurance coverage premium.Totally different ranges of protection instantly affect the premium you pay.

Selecting the best steadiness between complete safety and affordability is essential to securing appropriate automobile insurance coverage in South Dakota.

Legal responsibility Protection

Legal responsibility protection safeguards you towards monetary accountability for damages brought about to others in an accident. This can be a basic part of automobile insurance coverage, defending your belongings from doubtlessly important claims. South Dakota regulation mandates minimal legal responsibility protection, however larger limits provide larger peace of thoughts. The price of legal responsibility protection varies relying on the coverage limits you choose.

Greater limits sometimes translate to a better premium.

Collision Protection

Collision protection protects your automobile towards injury arising from a collision with one other object, no matter fault. Such a protection pays for repairs or alternative of your automobile. The price of collision protection is dependent upon the worth of your automobile and the protection limits you select. Having collision protection is important for preserving the worth of your automobile, because it helps mitigate the monetary affect of an accident.

Complete Protection

Complete protection protects your automobile from injury brought on by occasions aside from collisions, reminiscent of vandalism, fireplace, theft, or weather-related incidents. It gives a vital security internet in varied unexpected circumstances, stopping important monetary loss. Complete protection premiums sometimes correlate with components just like the automobile’s worth and the extent of safety you choose.

Different Coverages (Uninsured/Underinsured Motorist, Medical Funds, and Private Damage Safety)

Uninsured/Underinsured Motorist protection steps in in the event you’re concerned in an accident with a driver missing enough insurance coverage. Medical Funds protection addresses medical bills incurred in an accident, no matter fault. Private Damage Safety (PIP) gives protection for medical bills, misplaced wages, and different losses incurred by you or your passengers. The prices of those further coverages range primarily based on the particular coverage limits and the chosen degree of safety.

Every further protection provides to the general premium.

Comparability of Protection Prices

| Protection Kind | Description | Typical Value Vary (South Dakota) | Impression on Total Price |

|---|---|---|---|

| Legal responsibility | Protects towards damages to others. | $100-$500+ per yr | Decrease limits value much less, however larger limits provide larger safety. |

| Collision | Covers injury to your automobile in a collision. | $100-$400+ per yr | Important for safeguarding your automobile’s worth. |

| Complete | Covers injury from occasions aside from collisions. | $50-$250+ per yr | Protects towards a variety of potential damages. |

| Uninsured/Underinsured Motorist | Covers damages from accidents with uninsured drivers. | $25-$100+ per yr | Important for safeguarding your self from financially irresponsible drivers. |

Be aware: The value ranges are estimations and might range primarily based on particular person circumstances. Components like your driving document, automobile kind, and placement all contribute to the ultimate premium.

Reductions and Financial savings

Securing advantageous automobile insurance coverage charges in South Dakota hinges considerably on maximizing obtainable reductions. Understanding these reductions and the way to qualify for them can translate to substantial financial savings in your annual premiums. Savvy shoppers who leverage these alternatives can typically cut back their insurance coverage prices significantly.

Frequent Reductions Provided by South Dakota Insurers

South Dakota automobile insurance coverage suppliers routinely provide varied reductions designed to incentivize protected driving habits and accountable conduct. These reductions mirror the insurer’s evaluation of danger and reward, the place decrease danger typically interprets to decrease premiums.

- Protected Driver Reductions: Insurance coverage corporations typically reward drivers with a confirmed historical past of protected driving, as evidenced by a clear driving document, low accident frequency, and no visitors violations. This demonstrates a decrease danger profile to the insurer, thus resulting in lowered premiums.

- Good Pupil Reductions: Encouraging accountable conduct amongst younger drivers, insurers typically provide reductions to college students sustaining a sure GPA. This displays a correlation between educational success and accountable conduct.

- Defensive Driving Course Reductions: Finishing a defensive driving course typically qualifies drivers for reductions. These programs equip drivers with methods to mitigate dangers and improve their consciousness, instantly translating to lowered danger for the insurer.

- Multi-Coverage Reductions: Insuring a number of autos or different insurance coverage merchandise with the identical firm typically leads to a reduction. This stems from the insurer’s lowered administrative prices related to managing a number of insurance policies for a similar buyer.

- Anti-theft Machine Reductions: Putting in anti-theft gadgets in your automobile can decrease your insurance coverage premiums. It is because the insurer can cut back the danger of auto theft, thus lowering the probability of a declare.

Qualifying for Reductions and Impression on Charges

To qualify for a reduction, particular standards have to be met. These standards range by insurer however typically contain offering verifiable documentation, reminiscent of proof of a clear driving document, proof of defensive driving course completion, or educational transcripts for scholar reductions. The extent of the low cost is dependent upon the insurer and the particular low cost program.

Instance Reductions and Necessities

| Low cost | Description | Necessities | Impression on Charges |

|---|---|---|---|

| Protected Driver Low cost | Reward for protected driving historical past | Clear driving document, low accident frequency, no visitors violations | Vital charge discount for qualifying drivers |

| Good Pupil Low cost | Incentivize accountable conduct in younger drivers | Keep a minimal GPA, sometimes for college students below a sure age | Decreased premiums for qualifying college students |

| Defensive Driving Course Low cost | Encourage protected driving practices | Completion of an accredited defensive driving course | Potential discount in premiums relying on the course and insurer |

| Multi-Coverage Low cost | Consolidating a number of insurance policies | Insuring a number of autos or different merchandise with the identical firm | Decrease total premium prices |

| Anti-theft Machine Low cost | Scale back automobile theft danger | Set up of an authorised anti-theft machine | Potential premium discount for added safety |

Methods to Save Cash on South Dakota Automobile Insurance coverage

A mix of methods can contribute to reducing your South Dakota automobile insurance coverage premiums. These methods embrace sustaining a clear driving document, taking defensive driving programs, and evaluating quotes from varied insurers. Insurers typically provide on-line instruments to check charges and perceive which low cost choices apply to your scenario.

Claims and Processes

Navigating the claims course of is usually a essential a part of securing compensation after an accident. Understanding the steps concerned and the documentation required can streamline the method and guarantee a smoother expertise. This part Artikels the South Dakota automobile insurance coverage claims course of, offering a transparent image of what to anticipate.South Dakota’s automobile insurance coverage claims course of, like many others, emphasizes transparency and effectivity.

The purpose is to pretty and promptly resolve claims, whereas adhering to established authorized and insurance coverage trade tips. Understanding these processes can empower policyholders to successfully handle their claims.

Claims Course of Overview

The South Dakota claims course of sometimes includes reporting the accident, gathering documentation, and submitting it to the insurer. Insurers are obligated to pretty consider the declare and supply well timed communication all through the method. This course of is designed to assist policyholders get the compensation they deserve.

Steps in Submitting a Automobile Insurance coverage Declare in South Dakota

To provoke a declare, policyholders should first report the accident to their insurance coverage firm. This normally includes contacting the insurance coverage firm instantly or utilizing their on-line portal. Immediate reporting is important to provoke the declare course of and doubtlessly protect proof.

Documentation Necessities

Complete documentation is paramount in a South Dakota automobile insurance coverage declare. This contains accident stories, medical information, restore estimates, and witness statements. The extra complete the documentation, the extra probably the declare can be processed easily and precisely. Correct and full documentation is essential for a profitable declare.

Typical Timeframe for Claims Processing

The timeframe for processing a automobile insurance coverage declare in South Dakota varies relying on the complexity of the declare and the supply of all obligatory paperwork. Easy claims could also be resolved rapidly, whereas extra advanced claims, involving a number of events or important damages, might take longer. The everyday timeframe normally ranges from just a few weeks to some months.

Desk: Steps for Submitting a Automobile Insurance coverage Declare in South Dakota

| Step | Motion | Documentation Wanted | Timeframe |

|---|---|---|---|

| 1 | Report the accident to the insurance coverage firm. | Automobile registration, driver’s license, police report (if relevant). | Instantly |

| 2 | Collect all related documentation. | Medical payments, restore estimates, witness statements, photographs of harm. | Inside just a few days |

| 3 | Submit the declare to the insurance coverage firm. | Full declare type, all gathered paperwork. | Inside just a few enterprise days. |

| 4 | Observe up with the insurance coverage firm. | Affirmation of receipt of declare, ongoing updates. | Ongoing |

Evaluating Insurance coverage Suppliers

Navigating the panorama of automobile insurance coverage suppliers can really feel overwhelming. Understanding the nuances of protection and pricing is essential for securing the absolute best deal. This part dives into the specifics of evaluating main insurance coverage suppliers in South Dakota, highlighting key components for knowledgeable decision-making.Selecting the best automobile insurance coverage supplier in South Dakota includes a multifaceted evaluation. Concerns prolong past merely evaluating charges; customer support, protection choices, and status play important roles within the total expertise.

This evaluation will current a comparative overview of distinguished insurance coverage corporations, enabling shoppers to make well-informed selections.

Main Automobile Insurance coverage Suppliers in South Dakota

South Dakota boasts a variety of insurance coverage suppliers, every with its personal strategy to pricing and protection. Recognizing these gamers is step one towards comparability. Key suppliers embrace State Farm, Geico, Progressive, Allstate, and Farmers Insurance coverage. These corporations are established in South Dakota and provide a wide range of insurance policies.

Price and Protection Comparability

A direct comparability of charges and protection choices is important. The next desk Artikels the approximate charges and key protection choices from a number of distinguished South Dakota insurance coverage suppliers. Understand that charges fluctuate primarily based on components reminiscent of driving historical past, automobile kind, and placement.

| Insurance coverage Supplier | Common Price (per yr) | Key Protection Choices | Buyer Service Score (out of 5 stars) |

|---|---|---|---|

| State Farm | $1,200 – $1,500 | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Private Damage Safety (PIP) | 4.2 |

| Geico | $1,000 – $1,300 | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Private Damage Safety (PIP) | 3.8 |

| Progressive | $1,100 – $1,400 | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Private Damage Safety (PIP) | 4.0 |

| Allstate | $1,250 – $1,600 | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Private Damage Safety (PIP) | 3.9 |

| Farmers Insurance coverage | $1,150 – $1,450 | Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist, Private Damage Safety (PIP) | 4.1 |

Supplier Strengths and Weaknesses

Buyer opinions and suggestions provide insights into the strengths and weaknesses of every supplier. State Farm typically receives reward for its in depth community of brokers and personalised service. Geico is incessantly famous for aggressive charges, however some clients report difficulties with on-line platforms. Progressive typically receives constructive suggestions for its cell app and buyer help. Allstate provides a variety of protection choices and has a big presence in South Dakota.

Farmers Insurance coverage, with its emphasis on agricultural communities, might have a localized benefit in sure areas.

Buyer Service Scores

Customer support rankings are an essential facet in choosing an insurance coverage supplier. Scores are sometimes sourced from unbiased evaluation platforms. These rankings, together with buyer suggestions, present worthwhile insights into the expertise shoppers have with totally different suppliers.

Price of Insurance coverage by Area: South Dakota Automobile Insurance coverage Charges

South Dakota’s automobile insurance coverage panorama presents various prices throughout its various areas. Components like inhabitants density, accident charges, and even the sorts of autos generally pushed in a specific space can considerably affect insurance coverage premiums. Understanding these regional variations is essential for anybody looking for inexpensive automobile insurance coverage within the state.Regional disparities in automobile insurance coverage premiums are sometimes substantial.

Components reminiscent of native driving circumstances, crime charges, and the focus of high-risk drivers can affect insurers’ pricing fashions. Because of this even inside a comparatively small geographic space, there may be noticeable variations in the price of protection.

Common Automobile Insurance coverage Prices Throughout South Dakota Areas

South Dakota’s insurance coverage charges are influenced by quite a few variables. This makes exact, standardized pricing troublesome to ascertain. Nonetheless, a basic overview of common prices throughout areas can present a useful benchmark. Knowledge for particular cities or ZIP codes will not be all the time available.

Regional Variations in Insurance coverage Premiums

A number of components contribute to the variance in automobile insurance coverage premiums throughout South Dakota’s areas. These components embrace, however should not restricted to, visitors density, the frequency of accidents, and the prevalence of high-risk drivers in particular areas. Insurers regulate their pricing primarily based on these native circumstances. Areas with larger accident charges are likely to have larger insurance coverage premiums.

Estimating Automobile Insurance coverage Prices in Particular Areas

Figuring out the exact value of automobile insurance coverage in a specific South Dakota location requires entry to particular knowledge. Probably the most dependable strategy is to contact a number of insurance coverage suppliers instantly. Requesting quotes from a number of insurers and evaluating them primarily based on related protection choices will yield a extra correct estimation. Evaluating insurance policies from totally different insurers in a selected space will assist pinpoint essentially the most inexpensive charges.

Desk of Estimated Automobile Insurance coverage Price Variations

| Area | Estimated Common Premium (per yr) | Components Influencing Price | Instance Protection |

|---|---|---|---|

| Black Hills Area (e.g., Speedy Metropolis, Custer) | $1,800 – $2,200 | Greater accident charges because of difficult driving circumstances; elevated danger of extreme climate occasions. | Legal responsibility, Collision, Complete |

| Central South Dakota (e.g., Sioux Falls, Mitchell) | $1,600 – $1,900 | Average accident charges; average driving circumstances; average inhabitants density. | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist |

| Jap South Dakota (e.g., Aberdeen, Brookings) | $1,500 – $1,800 | Decrease accident charges; comparatively good driving circumstances; decrease inhabitants density. | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist, Medical Funds |

| Western South Dakota (e.g., Pierre, Winner) | $1,700 – $2,000 | Barely larger accident charges than Jap South Dakota, however decrease than the Black Hills. Potential for distant driving circumstances. | Legal responsibility, Collision, Complete, Uninsured/Underinsured Motorist |

Be aware: These figures are estimates and will range primarily based on particular person driver profiles, automobile kind, and particular protection selections.

Ideas for Discovering Inexpensive Insurance coverage

Securing inexpensive automobile insurance coverage in South Dakota requires a strategic strategy. Understanding the components influencing charges and proactively looking for methods to cut back premiums is essential. This part Artikels key methods for attaining cost-effective protection.

Comparability Purchasing for Quotes

Evaluating quotes from a number of insurance coverage suppliers is paramount. Totally different corporations provide various charges and protection choices, and a complete comparability can result in substantial financial savings. Using on-line comparability instruments is a extremely environment friendly methodology for evaluating a number of quotes. These instruments combination knowledge from varied insurers, permitting for fast and simple comparisons.

Common Coverage Evaluate and Price Monitoring

Usually reviewing your insurance coverage coverage and monitoring charge fluctuations is significant. Modifications in driving habits, automobile modifications, or private circumstances can affect your eligibility for reductions or have an effect on your total premium. By staying knowledgeable about potential charge changes, you can also make knowledgeable selections and keep cost-effective protection.

Negotiating Automobile Insurance coverage Premiums

Negotiating automobile insurance coverage premiums is usually a viable technique. Contacting your insurer instantly to debate potential reductions or charge changes primarily based in your driving historical past, automobile particulars, or different components can yield constructive outcomes. Insurers are sometimes prepared to contemplate these components when reviewing premiums.

Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, reminiscent of automobile insurance coverage with owners or renters insurance coverage, can yield important financial savings. Many insurers provide bundled reductions for patrons carrying a number of insurance policies. This strategy can result in a extra complete and cost-effective insurance coverage bundle.

Using On-line Instruments for Quote Comparisons

Leveraging on-line instruments for evaluating insurance coverage quotes is a extremely efficient strategy. Quite a few web sites and cell apps present complete quote comparability instruments. These assets enable customers to enter their automobile info, driving historical past, and different related particulars to obtain tailor-made quotes from a number of insurers. Examples of such on-line instruments embrace Insure.com, Policygenius, and others. By evaluating quotes from varied suppliers, shoppers could make well-informed selections.

Final Phrase

Navigating South Dakota automobile insurance coverage charges may be difficult, however this information gives a transparent and concise overview of the important thing components influencing premiums. Understanding your choices, evaluating suppliers, and looking for out obtainable reductions are essential steps in securing essentially the most inexpensive and complete protection. Bear in mind to commonly evaluation your coverage and regulate it as wanted to match your evolving circumstances.

FAQ Insights

What are the commonest reductions supplied by South Dakota insurance coverage suppliers?

Many suppliers provide reductions for protected drivers, good college students, and people collaborating in defensive driving programs. Bundling insurance coverage insurance policies can even result in financial savings. Particular necessities for every low cost range by supplier.

How do I examine quotes from a number of insurance coverage suppliers in South Dakota?

Make the most of on-line comparability instruments or contact a number of suppliers on to request quotes. Evaluating totally different insurance policies and protection choices is essential to discovering essentially the most appropriate plan.

What’s the typical timeframe for processing a automobile insurance coverage declare in South Dakota?

The timeframe for processing a declare in South Dakota can range relying on the complexity of the declare. Documentation is important to expedite the method.

How do location and demographics affect automobile insurance coverage pricing in South Dakota?

Areas with larger accident charges or larger crime statistics are likely to have larger insurance coverage premiums. Demographics, reminiscent of age and driving historical past, additionally play a big position in figuring out charges.