Thrifty automotive rental insurance coverage value is a vital issue for any traveler planning a visit. Navigating the complexities of protection choices, hidden charges, and ranging charges can really feel overwhelming. This in-depth exploration will demystify the prices related to Thrifty automotive rental insurance coverage, equipping you with the information to make knowledgeable selections and lower your expenses in your subsequent journey.

From understanding the fundamentals of Thrifty’s insurance coverage insurance policies to evaluating them with different rental firms, this information covers every part it’s essential to know. We’ll break down the elements influencing costs, look at numerous protection choices, and current methods for minimizing prices. Put together to uncover the secrets and techniques behind securing the very best rental insurance coverage deal.

Understanding Thrifty Automotive Rental Insurance coverage

Thrifty automotive rental insurance coverage, an important part of any rental settlement, safeguards vacationers in opposition to monetary burdens stemming from unexpected occasions throughout their journey. It offers a security web, guaranteeing that any harm or accident is dealt with effectively and with out extreme private value. Comprehending the intricacies of this insurance coverage is essential for making knowledgeable selections and guaranteeing a clean rental expertise.

Definition of Thrifty Automotive Rental Insurance coverage

Thrifty automotive rental insurance coverage encompasses a set of protection choices designed to guard renters from liabilities related to automotive harm or accidents throughout their rental interval. It acts as a monetary buffer, shielding the renter from probably substantial out-of-pocket bills.

Key Options and Advantages

The first advantages of Thrifty automotive rental insurance coverage are safety in opposition to monetary losses arising from accidents, harm, or theft of the rental automobile. This insurance coverage usually covers numerous eventualities, equivalent to collision harm, legal responsibility, and private harm. It permits for a worry-free journey expertise, specializing in the journey quite than the potential for monetary repercussions.

Protection Choices

Thrifty automotive rental insurance coverage usually presents quite a lot of protection choices, every tailor-made to particular wants and circumstances. These embrace legal responsibility protection, defending the renter from claims by third events; collision protection, safeguarding the rental automobile in opposition to harm from collisions; and complete protection, offering safety in opposition to a wider vary of damages, equivalent to vandalism or theft. These numerous protection ranges deal with a spectrum of potential dangers.

Comparability with Different Automotive Rental Insurance coverage

Evaluating Thrifty automotive rental insurance coverage with different suppliers reveals nuanced variations in protection ranges and related prices. Whereas particular options and pricing constructions fluctuate between suppliers, Thrifty presents a complete vary of choices, aiming to offer satisfactory safety for numerous conditions. Evaluating the particular inclusions and exclusions of every choice is vital to creating an appropriate alternative.

Elements Influencing Price

A number of elements play a job in figuring out the price of Thrifty automotive rental insurance coverage. These embrace the period of the rental interval, the kind of automobile rented, and the chosen protection choices. Rental period is a big issue, as longer leases usually incur increased insurance coverage premiums. The kind of automobile, together with its worth and potential for harm, can also be a key determinant.

Moreover, the particular chosen protection ranges, together with the extent of legal responsibility safety and complete protection, straight affect the ultimate value.

Protection Choices and Prices

| Protection Kind | Description | Estimated Price (USD) |

|---|---|---|

| Legal responsibility Protection | Protects in opposition to claims by third events concerned in an accident. | $10-$30 per day |

| Collision Protection | Covers harm to the rental automobile from collisions. | $15-$40 per day |

| Complete Protection | Covers harm to the rental automobile from occasions aside from collisions, equivalent to vandalism or theft. | $10-$30 per day |

Observe: These are estimated prices and should fluctuate based mostly on particular rental situations and protection selections. All the time seek the advice of the Thrifty automotive rental insurance coverage coverage for exact particulars.

Elements Affecting Insurance coverage Prices

The price of automotive rental insurance coverage, like a fragile tapestry, is woven from numerous threads. Understanding these threads permits discerning vacationers to make knowledgeable selections, guaranteeing a clean and worry-free rental expertise. Elements starting from private traits to the specifics of the rental itself affect the ultimate worth. This complete look will illuminate the important thing parts impacting your Thrifty automotive rental insurance coverage premiums.

Age and Driving Historical past

Rental automotive insurance coverage premiums are sometimes affected by the renter’s age and driving historical past. Youthful drivers, usually, face increased premiums as a result of their statistically increased accident threat. A clear driving file, nonetheless, can mitigate these prices, demonstrating accountable driving habits. Skilled drivers with a historical past of secure operation, conversely, are sometimes granted decrease charges. This displays a diminished chance of incidents, aligning with the precept of threat evaluation in insurance coverage.

Rental Length, Thrifty automotive rental insurance coverage value

The period of the rental performs a big function in figuring out the insurance coverage value. Shorter leases typically command decrease premiums in comparison with prolonged durations. It is because the chance of an incident over a shorter interval is decrease. Longer leases, nonetheless, carry a better potential for harm or accidents, resulting in increased premiums. This precept is much like different forms of insurance coverage, the place the longer the protection interval, the upper the premium.

Protection Stage

The extent of protection chosen straight impacts the premium. Greater protection ranges, together with complete and collision insurance coverage, present wider safety in opposition to numerous potential damages. Consequently, these choices include the next price ticket. Conversely, primary protection offers extra restricted safety and usually results in decrease premiums. The number of protection straight displays the renter’s desired stage of safety and finances.

Deductibles

Deductibles are one other key issue influencing insurance coverage prices. A better deductible means a decrease premium. It is because the renter assumes a better monetary accountability in case of an accident. The renter ought to think about the trade-off between decrease premiums and potential out-of-pocket prices in case of harm. Deciding on the next deductible is a monetary choice balancing value financial savings with potential legal responsibility.

Rental Location

The situation of the rental performs a vital function in figuring out the insurance coverage value. Areas with increased accident charges or particular dangers, equivalent to areas with increased charges of theft, are inclined to have increased premiums. Insurance coverage firms analyze these elements to regulate pricing. This displays the variable threat profiles throughout completely different places, highlighting the significance of location-specific threat evaluation.

Rental Length vs. Price Comparability

| Rental Length (Days) | Estimated Insurance coverage Price (USD) |

|---|---|

| 3 | 50-75 |

| 7 | 100-150 |

| 14 | 150-250 |

| 21 | 200-300 |

This desk offers a normal illustration of how insurance coverage prices would possibly fluctuate with various rental durations. The precise figures will rely on different elements, together with the renter’s profile and the chosen protection stage. Observe that these figures are estimates and should fluctuate relying on particular circumstances.

Price Comparability and Options

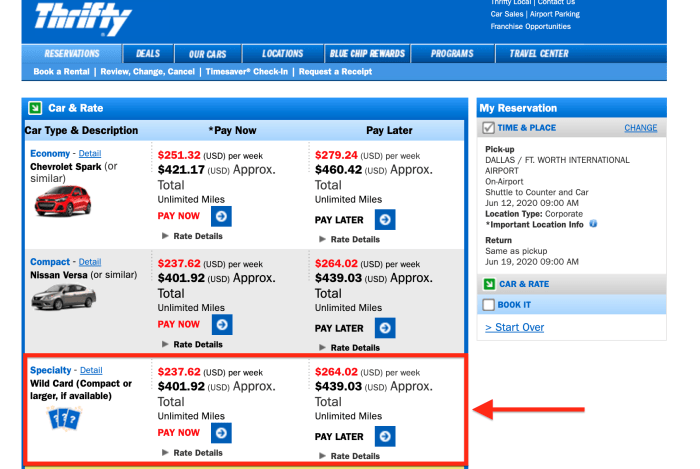

Evaluating the price of Thrifty automotive rental insurance coverage with different rental firms and understanding different choices is essential for vacationers looking for essentially the most economical and complete safety. A meticulous evaluation of various protection ranges and add-on choices will help make knowledgeable selections. Realizing the advantages of buying insurance coverage versus forgoing it, and methods to scale back prices, are important parts in planning a budget-friendly journey expertise.Understanding the elements influencing Thrifty’s insurance coverage prices, alongside evaluating costs with different rental firms, offers a clearer image of the obtainable selections.

This enables for a extra calculated decision-making course of, guaranteeing vacationers are well-prepared and guarded throughout their travels.

Price Comparability of Automotive Rental Insurance coverage

Rental firms, like Thrifty, usually supply a variety of insurance coverage packages. Evaluating the price of Thrifty’s insurance coverage with these of different main rental firms offers a complete understanding of pricing variations. This comparability considers elements equivalent to protection ranges, deductibles, and add-on choices. A radical comparability desk can illustrate these variations in pricing constructions.

| Rental Firm | Primary Insurance coverage Price (USD) | Average Insurance coverage Price (USD) | Complete Insurance coverage Price (USD) |

|---|---|---|---|

| Thrifty | 50-75 | 75-125 | 100-150 |

| Funds | 45-60 | 70-100 | 90-130 |

| Enterprise | 55-80 | 80-130 | 110-160 |

| Avis | 60-85 | 90-140 | 120-170 |

Observe: Costs are estimates and may fluctuate based mostly on elements equivalent to the kind of automobile, rental period, and particular add-on choices.

Examples of Thrifty Automotive Rental Insurance coverage Insurance policies

Thrifty presents numerous insurance coverage insurance policies with various protection ranges. These insurance policies are designed to cater to completely different wants and budgets. Examples of those insurance policies are supplied under.

- Primary Coverage: This coverage offers the minimal required protection. It often covers legal responsibility, however the deductible is likely to be excessive. The good thing about this coverage is the decrease value.

- Average Coverage: This coverage presents a broader protection in comparison with the essential coverage. It’d embrace collision and complete protection with a barely increased deductible. That is usually an excellent stability between value and protection.

- Complete Coverage: This coverage presents essentially the most in depth protection. It covers damages to the rental automotive from nearly any incident, with a decrease deductible. This selection offers peace of thoughts for vacationers.

Add-on Protection Choices for Thrifty

Thrifty presents add-on protection choices, together with choices like extra driver protection, roadside help, and supplemental legal responsibility protection. These choices can enhance the associated fee however can even present extra complete safety.

- Extra Driver Protection: This selection covers the price of damages brought on by a further driver, defending the renter from monetary legal responsibility.

- Roadside Help: This add-on can present help in case of breakdowns or different emergencies on the highway. This can be a worthwhile choice for vacationers in unfamiliar places.

- Supplemental Legal responsibility Protection: This protection choice extends legal responsibility safety past the required minimal, offering the next stage of safety.

Advantages of Buying Thrifty Automotive Rental Insurance coverage

Buying Thrifty automotive rental insurance coverage offers vital advantages. It protects the renter from monetary accountability in case of accidents or damages to the rental automobile.

- Monetary Safety: Insurance coverage protects in opposition to monetary loss within the occasion of an accident or harm to the rental automobile. That is important for guaranteeing a stress-free journey expertise.

- Peace of Thoughts: Realizing that you’ve got satisfactory insurance coverage permits vacationers to deal with having fun with their journey with out worrying about potential monetary repercussions.

Methods to Probably Scale back Thrifty Automotive Rental Insurance coverage Prices

A number of methods might help scale back the price of Thrifty automotive rental insurance coverage.

- Decrease Protection Stage: Choosing a decrease protection stage can considerably scale back the price of insurance coverage. Assess the potential dangers and the necessity for complete protection.

- Evaluate Insurance policies: Evaluating insurance coverage insurance policies from completely different rental firms can result in higher offers.

- Think about Journey Insurance coverage: Some journey insurance coverage would possibly embrace automotive rental insurance coverage protection, probably offering a extra complete bundle.

Financial savings from Decrease Protection Ranges

Reducing the protection stage on Thrifty automotive rental insurance coverage can result in substantial financial savings. The desk under demonstrates potential financial savings based mostly on completely different protection ranges.

| Protection Stage | Estimated Price (USD) | Potential Financial savings (USD) |

|---|---|---|

| Primary | 75 | 0 |

| Average | 100 | 25 |

| Complete | 150 | 75 |

Protection Particulars and Choices

Understanding the varied protection choices inside Thrifty automotive rental insurance coverage is essential for making knowledgeable selections. Every choice presents completely different ranges of safety, and understanding the specifics will enable you to select the perfect match on your wants. This part will element the completely different protection choices, their phrases, and their exclusions, permitting you to pick essentially the most appropriate safety on your rental.The completely different insurance coverage choices obtainable from Thrifty automotive rental will usually embrace complete protection, collision protection, and legal responsibility protection.

Understanding the particular particulars of every protection sort, together with what’s and is not coated, is crucial for choosing the fitting plan.

Complete Protection

Complete protection, a vital part of Thrifty’s rental insurance coverage, protects in opposition to damages brought on by occasions past your management, equivalent to weather-related incidents, vandalism, or theft. It goes past the usual collision protection, offering an additional layer of safety. It is important to notice that this protection can fluctuate when it comes to what’s particularly excluded, so cautious evaluation of the wonderful print is important.

Collision Protection

Collision protection particularly protects in opposition to harm to the rental automotive ensuing from a collision with one other automobile or an object. It covers repairs or substitute, even if you’re at fault within the accident. Collision protection is usually a big a part of Thrifty’s insurance coverage packages. This protection is necessary as a result of it mitigates the monetary burden of harm to the rental automobile.

Legal responsibility Protection

Legal responsibility protection is one other necessary part of rental insurance coverage. It protects you from monetary accountability in case you trigger an accident that leads to accidents or damages to a different individual or their property. Legal responsibility protection is required in lots of jurisdictions and is a elementary facet of accountable driving. This protection offers a security web for these unlucky circumstances.

Extra Safety Choices

Thrifty could supply extra choices like loss harm waivers (LDW) or supplemental safety for extra peace of thoughts. These choices usually add extra safety and may supply extra complete protection, however with elevated prices. Understanding these further choices can help make a call that aligns along with your finances and threat tolerance.

Protection Limits

| Protection Kind | Protection Restrict (Instance) |

|---|---|

| Complete | $50,000 USD |

| Collision | $50,000 USD |

| Legal responsibility | $100,000 USD per individual / $300,000 USD per incident |

This desk offers a pattern of protection limits. Precise limits could fluctuate relying on the particular rental settlement and the chosen protection choices. Reviewing the particular particulars of the insurance coverage coverage is essential to grasp the exact protection limits supplied.

Understanding Exclusions

“Exclusions are situations underneath which the insurance coverage coverage doesn’t apply.”

Fastidiously evaluation the exclusions listed in your Thrifty automotive rental insurance coverage coverage. These exclusions Artikel conditions the place the protection doesn’t apply, equivalent to pre-existing harm to the automobile or harm brought on by intentional acts. Understanding the exclusions will enable you to keep away from surprises in case of an incident. Examples of potential exclusions embrace damages brought on by put on and tear, pre-existing harm, or harm from sure forms of misuse.

The cautious evaluation of exclusions is paramount for understanding the true extent of protection.

Methods for Saving Cash

Securing reasonably priced automotive rental insurance coverage with Thrifty requires a strategic strategy. Understanding the elements influencing prices and exploring obtainable reductions can considerably scale back bills. This part Artikels numerous strategies for attaining cost-effective automotive rental insurance coverage.

Negotiating the Greatest Price

Efficient negotiation is essential for acquiring essentially the most favorable insurance coverage charges. Thorough analysis into the present market charges for related protection is crucial. Presenting this data to the Thrifty consultant demonstrates your understanding and permits for a extra knowledgeable dialogue. Flexibility in protection choices may also be a strong instrument in negotiations. For instance, lowering the surplus quantity for harm protection can yield a discount within the general premium.

Exploring Reductions

Thrifty, like many rental firms, presents numerous reductions. Understanding these can result in vital financial savings. These usually embrace reductions for loyalty packages, affiliations, or particular bookings. Often checking for promotional presents and bundled packages is necessary.

Evaluating Quotes

Evaluating quotes from a number of suppliers, together with Thrifty and different rental firms, is important for getting the very best fee. Web sites specializing in journey insurance coverage comparisons might help compile quotes from numerous suppliers, offering a complete overview of choices and charges. This empowers you to make a well-informed choice.

Understanding the Positive Print

Thorough examination of the wonderful print within the Thrifty automotive rental insurance coverage coverage is essential. Fastidiously reviewing all phrases, situations, and exclusions ensures a transparent understanding of what’s and is not coated. This detailed evaluation helps keep away from surprising prices or surprises throughout the rental interval. Paying shut consideration to the coverage’s deductible and extra quantities is crucial to understand the monetary implications of potential damages.

Desk of Reductions

| Low cost | Situations |

|---|---|

| Loyalty Program Low cost | Necessities fluctuate; usually contain membership and a sure variety of leases. |

| Scholar Low cost | Proof of scholar standing is often required. |

| Navy Low cost | Legitimate navy identification is required. |

| Company Low cost | Membership in a acknowledged company program. |

| Journey Agent Low cost | Reserving by means of a journey agent usually qualifies. |

Visible Illustration of Information: Thrifty Automotive Rental Insurance coverage Price

Presenting knowledge in a visually compelling method is essential for understanding complicated data like thrifty automotive rental insurance coverage prices. Visible aids, equivalent to infographics and charts, make it simpler to know patterns, developments, and comparisons. This part will discover completely different visible representations as an example the elements impacting thrifty automotive rental insurance coverage prices, permitting for a deeper comprehension of the topic.

Elements Influencing Thrifty Automotive Rental Insurance coverage Prices

Visualizing the elements influencing thrifty automotive rental insurance coverage prices helps in understanding the complicated interaction of variables. An infographic, ideally a round diagram with interconnected sections, would clearly show these elements. The central hub may symbolize the bottom value of insurance coverage, radiating outwards to classes like driver profile (age, expertise, and driving file), automobile sort (make, mannequin, and 12 months), rental period, and optionally available add-ons (e.g., roadside help).

Every phase would symbolize a particular issue, and the dimensions or coloration depth of every phase would correspond to its relative impression on the general value. A legend would supply clear definitions for every issue.

Development of Thrifty Automotive Rental Insurance coverage Prices Over Time

As an instance the development of thrifty automotive rental insurance coverage prices over time, a line graph can be best suited. The x-axis would symbolize the time interval (e.g., years), and the y-axis would symbolize the associated fee. The graph would present the upward or downward development of insurance coverage premiums. For instance, a steadily rising line would recommend an growing development in insurance coverage prices over time.

Such a graph could be invaluable in figuring out any potential spikes or vital fluctuations. It might enable for a comparability of prices throughout completely different time durations.

Comparability of Thrifty Automotive Rental Insurance coverage Choices

A bar chart successfully compares the prices of various thrifty automotive rental insurance coverage choices. The x-axis would record the varied choices (e.g., primary, complete, and supplemental protection), and the y-axis would symbolize the corresponding value. Every bar’s peak would correspond to the insurance coverage value for that exact choice. This visible illustration permits for an instantaneous comparability of the associated fee variations between numerous protection ranges.

Setting up an Efficient Infographic

An efficient infographic requires a transparent understanding of the target market and the important thing message to be conveyed. First, establish the core knowledge factors. Then, choose a visually interesting structure. Think about using icons and illustrations to boost understanding. Preserve a constant coloration palette.

Use clear and concise labels for every aspect. The infographic needs to be straightforward to learn and perceive at a look.

Illustrating Totally different Ranges of Protection

A easy, visually partaking illustration showcasing the completely different ranges of protection is usually a collection of concentric circles. The innermost circle represents the essential protection, whereas the next circles symbolize growing ranges of protection. Every circle would symbolize a further stage of safety, equivalent to extra legal responsibility protection, collision harm waiver, or complete protection. A transparent legend explaining every stage of protection is important.

This visible illustration would allow a fast understanding of the completely different ranges of safety supplied.

Components of a Visually Partaking Graph

A visually partaking graph needs to be simply comprehensible at a look. Using acceptable colours and fonts is essential. Colours needs to be chosen to convey particular meanings and evoke the specified emotion. Clear and concise labels needs to be used for the axes and any knowledge factors. A compelling title will assist to seize the reader’s consideration.

Applicable legends will assist in deciphering the info factors successfully. A sexy and related background would additional improve the visualization.

Closure

In conclusion, understanding Thrifty automotive rental insurance coverage value empowers vacationers to make savvy selections. By analyzing the varied elements influencing premiums, evaluating choices, and adopting cost-saving methods, you may safe the best protection with out breaking the financial institution. Keep in mind, information is energy, and this information arms you with the instruments to navigate the world of automotive rental insurance coverage with confidence and lower your expenses in your subsequent journey.

Selecting the best protection ensures a clean and worry-free journey.

Query Financial institution

What are the everyday deductibles supplied with Thrifty automotive rental insurance coverage?

Thrifty usually presents a variety of deductibles, from low to excessive. The precise quantities fluctuate relying on the chosen protection stage.

How does the rental location have an effect on the insurance coverage value?

Rental places with increased dangers of harm or theft could have increased insurance coverage premiums. Thrifty’s pricing displays these localized elements.

Can I scale back the price of Thrifty automotive rental insurance coverage by negotiating the speed?

Sure, negotiating could also be doable, but it surely will depend on the particular circumstances and Thrifty’s insurance policies. It is price inquiring about doable reductions or particular presents.

What are some frequent reductions obtainable for Thrifty automotive rental insurance coverage?

Thrifty would possibly supply reductions for AAA members, loyalty packages, or different affiliations. Verify their web site for present promotions and reductions.