Unum provident long run care insurance coverage affords essential safety in opposition to the monetary burden of future care wants. This complete information delves into the specifics of those insurance policies, from understanding protection choices to integrating them into your total monetary technique.

Navigating the complexities of long-term care insurance coverage could be daunting. This useful resource simplifies the method, empowering you to make knowledgeable selections about your future well-being and peace of thoughts. Uncover the benefits of Unum’s choices, evaluate them to different suppliers, and learn to seamlessly combine this important protection into your retirement planning.

Understanding Lengthy-Time period Care Insurance coverage Wants

Lengthy-term care insurance coverage is sort of a security web to your future well being wants. It isn’t simply in regards to the huge image, but in addition in regards to the day-to-day realities of growing older and potential well being points. It is a good transfer to start out excited about this now, similar to planning to your retirement or your youngsters’ training. It may show you how to preserve your independence and luxury in your golden years.

Kinds of Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is available in varied kinds, every with its personal set of options and advantages. Understanding the different sorts might help you select the best choice to your particular circumstances. Conventional insurance policies are the commonest, providing a hard and fast profit quantity for a set interval. Hybrid insurance policies mix components of conventional and different sorts of protection. These choices provide extra flexibility and customization.

Protection Choices in Lengthy-Time period Care Insurance policies

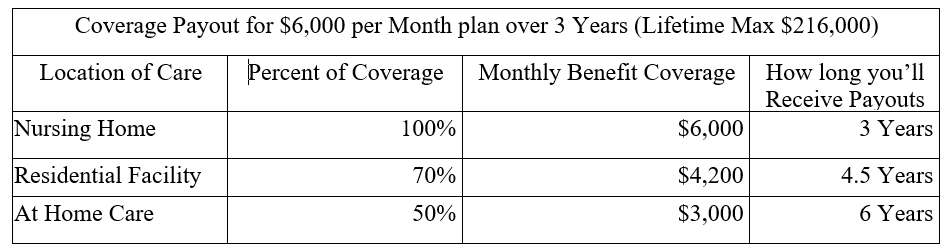

Completely different insurance policies provide various protection choices, from fundamental care to extra complete help. Some insurance policies cowl expert nursing services, whereas others could embody residence well being aides and assisted dwelling. This flexibility means that you can tailor the coverage to your wants and finances.

Evaluating Coverage Varieties

| Coverage Sort | Description | Advantages | Drawbacks |

|---|---|---|---|

| Conventional | Fastened profit quantity for a set interval. | Predictable payouts, straightforward to know. | Might not cowl all care wants, rigid. |

| Hybrid | Combines components of conventional and different sorts of protection. | Larger flexibility in protection, potential for personalisation. | May be extra complicated to know, potential for increased premiums. |

| Catastrophic | Covers care solely after a major interval of decline. | Decrease premiums, higher for many who anticipate minor wants. | Restricted protection, doubtlessly inadequate for main wants. |

This desk gives a fundamental overview. At all times seek the advice of with a monetary advisor to get a personalised comparability of choices.

Prices of Lengthy-Time period Care Wants

The price of long-term care varies considerably by area. In main cities like Jakarta, prices are usually increased as a result of increased dwelling bills and specialised care choices. Rural areas typically have decrease prices, however entry to particular care companies is perhaps extra restricted.

Components Influencing Lengthy-Time period Care Insurance coverage Prices

A number of elements have an effect on the value of a long-term care insurance coverage coverage. These embody your age, well being standing, the kind of care you want, and the protection quantity you select. In case you have pre-existing circumstances, premiums could also be increased. Additionally, the size of the protection interval can influence the full price. Think about these elements when evaluating insurance policies.

Unum Lengthy-Time period Care Insurance coverage Overview

Hey Jakarta South fam! Unum’s long-term care insurance coverage is a reasonably stable possibility if you happen to’re searching for a plan to assist with future care prices. It is designed to cowl bills for issues like nursing residence stays, in-home care, and different long-term care wants. Let’s dive into what Unum affords!Unum’s long-term care insurance policies intention to supply monetary help throughout occasions of want, serving to you or your family members handle the prices of prolonged care.

They perceive the significance of planning forward for potential long-term care bills, and their merchandise are designed to be versatile and adaptable to particular person wants.

Unum’s Coverage Choices

Unum affords a variety of long-term care insurance coverage tailor-made to completely different budgets and wishes. They perceive that one-size-fits-all would not work, in order that they’ve created varied choices to accommodate completely different conditions.

- Protection Choices: Unum affords various kinds of protection, like every day profit quantities, most profit durations, and non-compulsory riders (like inflation safety). This lets you select a plan that aligns together with your anticipated care wants and monetary capability.

- Premiums and Prices: Unum’s premiums are depending on a number of elements, together with your age, well being, and the precise protection you select. It is essential to check quotes from varied suppliers to search out probably the most inexpensive and appropriate possibility.

- Coverage Options: Unum typically contains options like accelerated advantages, which could pay out a portion of your advantages early within the occasion of a crucial sickness or different qualifying circumstances. They may even have choices for inflation safety, making certain your advantages hold tempo with rising healthcare prices over time.

Key Options and Advantages

Unum’s insurance policies are designed to supply peace of thoughts and monetary safety throughout difficult occasions. They’re typically versatile sufficient to adapt to your evolving wants.

- Profit Fee Choices: The cost construction of Unum insurance policies means that you can select the way you need your advantages disbursed. This may contain every day funds for in-home care or nursing residence stays.

- Eligibility Necessities: Unum’s eligibility standards usually contemplate elements like age and well being standing. Which means that sure circumstances may have an effect on your eligibility for protection.

- Coverage Riders: Unum typically gives supplementary advantages by riders, including additional layers of safety or adjusting your protection. These might embody issues like inflation safety or accelerated advantages.

Coverage Choices Comparability

This desk gives a fast overview of Unum’s completely different coverage choices. This allows you to evaluate options and pricing to search out the most effective match.

| Coverage Sort | Day by day Profit Quantity | Most Profit Interval | Premium (Instance) |

|---|---|---|---|

| Primary Plan | $100 | 2 years | $150/month |

| Commonplace Plan | $200 | 5 years | $250/month |

| Premium Plan | $300 | 10 years | $400/month |

Protection Comparability to Different Suppliers

Unum’s protection needs to be in comparison with different suppliers available in the market. This can be certain that you are getting the most effective worth to your cash and deciding on a coverage that meets your wants and finances.

- Aggressive Pricing: Unum’s pricing needs to be in comparison with different suppliers within the long-term care insurance coverage market. This comparability helps to make sure you get probably the most aggressive charges for the protection you want.

- Complete Advantages: Consider the comprehensiveness of the advantages provided by Unum in opposition to different suppliers. Take a look at the vary of lined bills and any riders that is perhaps useful to your particular wants.

- Claims Course of: The claims strategy of Unum needs to be in comparison with these of different suppliers. Evaluate the effectivity and ease of submitting and receiving payouts.

Claims Course of

Unum’s claims course of is designed to be easy. The method typically entails documentation and verification to make sure accuracy.

“Unum’s claims course of is designed to be environment friendly and clear, with clear tips and procedures.”

Lengthy-Time period Care Insurance coverage and Monetary Planning

Planning to your future, particularly your golden years, is essential, and long-term care insurance coverage is a crucial a part of that plan. It is like having a security web for sudden well being points that would influence your independence and monetary stability. Consider it as a proactive technique to defend your belongings and preserve your way of life.Integrating long-term care insurance coverage into your total monetary technique ensures that you simply’re ready for the potential prices of care, whereas nonetheless having the monetary sources to get pleasure from retirement comfortably.

That is greater than only a plan; it is a peace of thoughts funding.

Integrating Lengthy-Time period Care Insurance coverage right into a Complete Monetary Plan

A complete monetary plan considers your present monetary state of affairs, targets, and threat tolerance. Integrating long-term care insurance coverage means aligning your protection together with your retirement financial savings and property planning. This holistic strategy ensures that your plan addresses your wants and your loved ones’s wants, too.

Significance of Lengthy-Time period Care Insurance coverage in Retirement Planning

Retirement planning is not nearly accumulating financial savings; it is about safeguarding your future way of life. Lengthy-term care insurance coverage protects your retirement nest egg from the substantial prices of care, making certain that your financial savings can be found for different monetary targets. It is like having a buffer to make sure you do not deplete your financial savings simply to pay for care.

Estimating Future Lengthy-Time period Care Prices

Estimating future long-term care prices requires cautious consideration of things like inflation, the kind of care wanted, and potential medical developments. Completely different ranges of care, like assisted dwelling or nursing residence services, can have various prices. Think about your particular person well being historical past and the projected wants for future care to get a extra correct estimate. For instance, somebody with a historical past of continual circumstances may want the next protection quantity than somebody with good well being.

It is good to get skilled recommendation to personalize your estimation.

Monetary Methods for Funding Lengthy-Time period Care Wants

A number of monetary methods might help you fund long-term care wants. You possibly can contemplate organising a devoted financial savings account, utilizing a portion of your retirement funds, or exploring long-term care insurance coverage choices. The precise technique relies on your particular person circumstances and monetary targets.

Position of Property Planning in Relation to Lengthy-Time period Care Insurance coverage

Property planning is essential along side long-term care insurance coverage. It helps to guard your belongings from potential claims whereas making certain your needs are carried out, even if you happen to’re unable to handle your affairs. A well-structured property plan minimizes the influence of long-term care bills in your beneficiaries. Knowledgeable property planning lawyer might help you craft a plan tailor-made to your particular wants and circumstances.

This can be a must-do to make sure your legacy is safe and that your family members are taken care of.

Coverage Choice and Resolution Making: Unum Provident Lengthy Time period Care Insurance coverage

Selecting the correct long-term care insurance coverage coverage is essential to your future. It is like selecting the right trip for a protracted journey—you need one thing dependable, inexpensive, and tailor-made to your particular wants. Do not simply leap on any coverage; perceive the nuances to make the only option.This part delves into the method of choosing a coverage, from understanding the assorted choices to working with a monetary advisor.

We’ll cowl important elements like premiums, advantages, riders, and why a certified advisor is your finest guess.

Understanding Coverage Premiums and Advantages

Coverage premiums and advantages are basic points of any long-term care coverage. Understanding the elements influencing these components helps you evaluate insurance policies successfully. Premiums rely upon elements like your age, well being, and the protection quantity you select. Greater protection often interprets to increased premiums. Advantages check with the monetary help offered in case of long-term care wants.

Completely different insurance policies provide varied profit quantities and every day cost schedules.

Evaluating Completely different Coverage Options

Insurance policies provide varied options, and selecting the best ones relies on particular person circumstances. Key options to contemplate embody the sorts of care lined (e.g., nursing residence, assisted dwelling), every day profit quantities, and the period of protection. Some insurance policies could have caps on whole advantages paid, which is a major consideration. Insurance policies additionally fluctuate of their ready durations earlier than advantages start.

Understanding these specifics is essential for matching the coverage to your anticipated wants.

Evaluating Coverage Riders and Add-ons

Riders and add-ons are non-compulsory options that may improve your coverage. These additions can prolong protection or tailor it to particular conditions. For instance, a rider may cowl inflation safety, permitting advantages to maintain tempo with rising care prices. One other widespread rider may cowl the next every day profit quantity. Cautious consideration of those add-ons is crucial for optimizing your protection.

Working with a Certified Monetary Advisor

A professional monetary advisor is a useful asset within the course of. They might help you consider your particular monetary state of affairs, perceive your long-term care wants, and suggest appropriate insurance policies. They’re going to additionally information you within the decision-making course of, factoring in premiums, advantages, and the full price of care. They’re your trusted accomplice, making certain your decisions align together with your targets.

They will additionally present insights into the monetary implications of various coverage choices, making certain you make the most effective determination to your future.

Lengthy-Time period Care Insurance coverage and the Unum Supplier

Selecting the correct long-term care insurance coverage is essential for peace of thoughts, particularly as we become old. Unum has been a distinguished participant on this house, providing choices that many people discover useful. Let’s dive into why Unum is perhaps a good selection for you.Unum stands out for its complete long-term care insurance coverage choices. They have a stable monitor report, and their companies are backed by a dedication to buyer satisfaction.

Understanding Unum’s strategy might help you make a good move.

Advantages of Selecting Unum

Unum gives a variety of advantages that may ease your worries about future care wants. They provide versatile protection choices to suit numerous wants and budgets, making it simpler to discover a plan that works for you.

- Versatile Protection Choices: Unum understands that everybody’s state of affairs is exclusive. Their plans provide decisions by way of every day dwelling help, healthcare companies, and extra. This implies you’ll be able to tailor your protection to your particular necessities, making certain you are well-prepared for varied eventualities.

- Aggressive Premiums: Unum typically gives aggressive premiums in comparison with different insurers. Whereas costs can fluctuate relying on elements like age, well being, and protection quantity, Unum usually strives to be inexpensive and accessible.

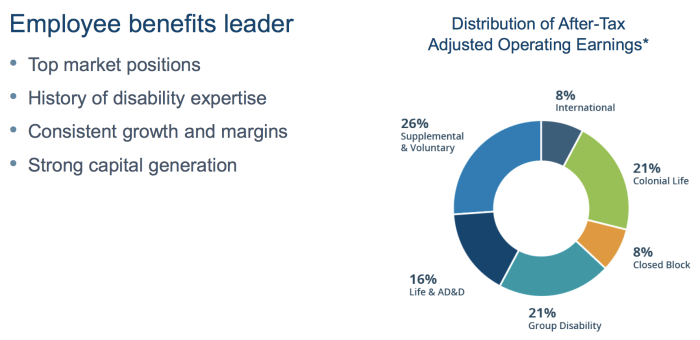

- Sturdy Monetary Stability: Unum’s monetary stability is a key issue. A financially sound firm is extra more likely to honor its commitments and supply long-term care advantages. This can be a essential side to contemplate when selecting a supplier.

Unum’s Buyer Service

Customer support is paramount. Unum’s dedication to buyer satisfaction shines by of their interactions with policyholders.

- Constructive Evaluations and Rankings: Many shoppers reward Unum’s responsiveness and helpfulness. Unum’s customer support receives excessive marks, constantly inserting them among the many higher gamers within the business.

- Accessible Help Channels: Unum usually gives varied methods to attach with their customer support staff. This may embody cellphone help, e mail, or on-line portals.

Unum’s Historical past and Fame

Unum’s historical past within the long-term care insurance coverage business is a major issue.

- Established Observe Report: Unum has a long-standing historical past of offering long-term care insurance coverage, constructing a status that displays their dedication to policyholders.

- Trade Recognition: Unum has earned recognition for its dedication to providing dependable and reliable protection.

Unum’s Dedication to Buyer Satisfaction

Unum actively demonstrates its dedication to buyer satisfaction.

- Buyer-Centered Method: Unum typically focuses on understanding and addressing the precise wants of its policyholders. This ensures a tailor-made strategy to protection and repair.

- Steady Enchancment: Unum constantly seems for methods to boost its companies and merchandise. They often incorporate suggestions to make their processes and choices higher for his or her clients.

Unum’s Monetary Stability

Unum’s monetary power is a crucial consideration.

- Sturdy Monetary Rankings: Unum usually receives favorable monetary scores from impartial score businesses. These scores replicate the corporate’s capacity to fulfill its monetary obligations and preserve its monetary stability. Dependable scores are a transparent indicator of the corporate’s capability to meet guarantees made to policyholders.

- Confirmed Skill to Meet Obligations: Unum’s historical past demonstrates a dedication to assembly its obligations. This constant monitor report assures policyholders of the corporate’s functionality to supply advantages as promised.

Illustrative Case Research

Hey, so that you’re trying to stage up your monetary recreation, proper? Lengthy-term care insurance coverage ain’t just a few random factor; it is a critical funding in your future, particularly as you become old. These case research will present you the way it can actually influence your pockets and peace of thoughts. Let’s dive in!

The Impression of Lengthy-Time period Care Insurance coverage on a Household’s Monetary Nicely-being

Think about a state of affairs: Budi, a profitable entrepreneur, is now in his 60s and requires help with every day actions. With out long-term care insurance coverage, his household would face a major monetary burden. The price of residence care, assisted dwelling, or nursing residence services can rapidly drain financial savings and influence the household’s total monetary stability. However with a well-structured coverage, Budi’s household might use the protection to assist pay for care, making certain they do not need to dip into their retirement funds or promote belongings.

This proactive strategy preserves household sources and maintains their monetary well-being.

Selecting the Proper Protection

Choosing the proper protection is vital to taking advantage of long-term care insurance coverage. Protection varies significantly, so understanding your wants is essential. Somebody who anticipates needing vital care could require a extra complete coverage than somebody who expects minimal help. For instance, if you happen to anticipate needing the next stage of care, you may want a bigger profit quantity.

Components like your present well being standing, way of life, and future plans all play a task in figuring out the best protection.

Defending In opposition to Monetary Dangers

Lengthy-term care insurance coverage acts as a vital defend in opposition to the monetary dangers related to growing older and potential care wants. It is like having a security web that helps cushion the blow of sudden bills. With out it, the prices of care might rapidly deplete your financial savings, doubtlessly jeopardizing your retirement plans. With long-term care insurance coverage, you’ll be able to safeguard your monetary future and preserve a cushty way of life, even throughout occasions of want.

Monetary Penalties of Not Having Lengthy-Time period Care Insurance coverage, Unum provident long run care insurance coverage

Think about a state of affairs the place somebody wants vital care however lacks long-term care insurance coverage. The prices can rapidly pile up, doubtlessly depleting financial savings and different belongings. This will result in monetary pressure on relations who might need to shoulder the burden of care bills. The emotional toll could be immense as effectively, with relations having to navigate the challenges of offering care.

This monetary stress can create immense emotional and sensible issues.

Using Unum Lengthy-Time period Care Insurance coverage to Deal with Particular Wants

Unum Lengthy-Time period Care Insurance coverage affords varied choices to deal with particular person wants. For instance, a single policyholder may select a particular profit quantity and kind of care they need to cowl. This permits people to tailor their protection to fulfill their distinctive circumstances. By working with a Unum advisor, you’ll be able to focus on your particular person wants and discover the coverage that most closely fits your necessities, making certain a tailor-made monetary resolution to your wants.

Key Concerns for Policyholders

Staying on prime of your Unum long-term care insurance coverage coverage is essential for a easy expertise. It is like having a dependable good friend in your nook, all the time there to assist while you want it. Common opinions and understanding the main points will hold your coverage working as arduous as you want it to.Understanding your coverage, widespread issues, and the way to deal with claims are important elements of a great policyholder expertise.

This helps make sure you’re not caught off guard when sudden occasions come up.

Common Coverage Evaluation

Recurrently reviewing your Unum long-term care insurance coverage coverage is important. Adjustments in your monetary state of affairs, household dynamics, and even simply normal life occasions can influence your wants. A yearly evaluate ensures your coverage stays aligned together with your present necessities. That is like checking your wardrobe—in case your wants change, your insurance coverage must adapt too.

Frequent Policyholder Issues

Some policyholders may fear about declare denials or the method itself. Others is perhaps involved about understanding the complicated language. Addressing these issues immediately is vital. Unum gives sources and help to assist navigate any hurdles. It is like having a useful concierge to reply your questions and resolve any points.

Incessantly Requested Questions (FAQs)

- Understanding Coverage Phrases: Policyholders ought to meticulously evaluate coverage phrases and circumstances. They outline the protection limits, exclusions, and your rights and tasks. These are the principles of the sport. Know them in and out.

- Declare Submitting Course of: Unum’s declare submitting course of is easy. Their web site and customer support channels provide clear steering and help. It is like a well-marked path, making the declare course of straightforward to observe.

- Coverage Updates: Insurance policies may want updates as a result of life modifications. Common communication and coverage changes are important. It is vital to remain knowledgeable about any modifications to your coverage.

- Price Concerns: Coverage prices can fluctuate based mostly in your chosen protection and advantages. Evaluating completely different choices and understanding the monetary implications is crucial. That is like selecting the most effective deal to your finances.

Understanding Coverage Phrases and Situations

Coverage phrases and circumstances are the fantastic print that Artikel your protection, exclusions, and limitations. They’re important for making knowledgeable selections. Understanding these components is essential to keep away from any surprises. This is sort of a detailed map of your insurance coverage coverage.

Submitting Claims with Unum

Unum gives a streamlined declare submitting course of, usually with on-line portals and devoted buyer help. A step-by-step course of is often Artikeld on their web site. Having a transparent course of in place ensures that claims are processed effectively. It is like having a well-oiled machine to your declare submission.

Remaining Conclusion

In conclusion, securing long-term care insurance coverage is a crucial step in defending your monetary future. Unum provident long run care insurance coverage affords a variety of choices, however cautious consideration of your particular wants and an intensive understanding of the coverage particulars are paramount. By integrating this important protection into your monetary plan and consulting with a certified advisor, you’ll be able to navigate the method with confidence and safeguard your future.

Questions Usually Requested

What are the various kinds of long-term care insurance coverage insurance policies?

Lengthy-term care insurance coverage insurance policies usually fall into conventional, hybrid, and structured settlement classes, every with various protection choices and premiums. Researching these choices will show you how to decide which most closely fits your wants.

How a lot does long-term care insurance coverage usually price?

Lengthy-term care insurance coverage premiums fluctuate based mostly on elements corresponding to age, well being, protection quantity, and the precise coverage chosen. Seek the advice of with a monetary advisor to estimate potential prices.

What’s the claims course of for Unum long-term care insurance coverage?

Unum’s claims course of usually entails submitting required documentation, adhering to particular timelines, and speaking with Unum’s claims division. Evaluation the coverage particulars for particular procedures.

How can I estimate future long-term care prices?

Think about present and projected inflation, potential care wants, and the typical prices for care in your area. Seek the advice of monetary advisors for extra personalised estimates.